Mixed results across formats and services reveal how inflation is impacting online grocery buying behaviors

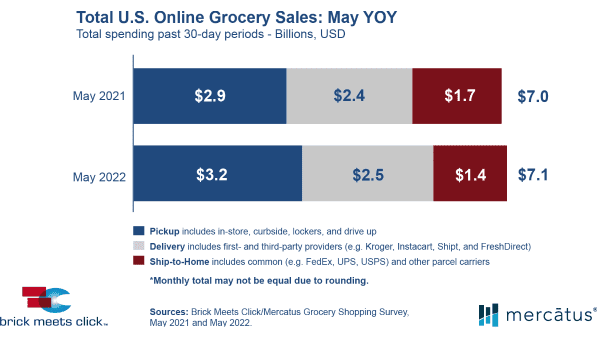

Barrington, Ill. – June 13, 2022 – Total online grocery sales finished the month of May at $7.1 billion, 1.7% higher versus a year ago, as inflation is motivating many customers to adapt where and how they shop online for groceries, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded May 28-29, 2022.

Pickup captured 45% of eGrocery sales during the month, rising 9% versus last year, driven largely by more than 10% growth in its monthly active user (MAU) base. A mid-single digit gain in its average order value (AOV) was offset by a nominal drop in order frequency.

Delivery, with a dollar share of 36%, climbed 5% versus the prior year, experiencing more modest gains in MAUs and AOV compared to those of Pickup and a decrease in order frequency of approximately 5%.

Ship-to-Home represented 19% of eGrocery sales in May and dropped 16% versus the prior year; a more than 10% pullback in AOV and similar rate of decline in order frequency was countered by an over 9% gain in its MAU base.

Beneath the top-line results, it’s evident that as price inflation erodes purchasing power customers are increasingly focused on finding ways to pay no more than necessary when shopping online. For Mass and Grocery customers using either Pickup or Delivery, the percentage who cited costs as the most important selection criteria rose 6 points, from 37% in August 2020, when customers first responded to this question, to 43% in May 2022.

What’s notable is that the share of Mass customers who cited costs as the top consideration remained relatively unchanged over this period, while the share of Grocery customers that cited costs as their top consideration jumped more than 10 percentage points.

“Less than one-quarter of online grocery customers who shop with Grocery or Mass online use both Pickup and Delivery services, so the increased cost consideration within this group may actually drive more demand toward Pickup,” said David Bishop, partner at Brick Meets Click.

“Interestingly, for Grocery customers, the importance of ‘getting the products you want’ has dropped from the top consideration to the bottom when ranked against the elements of cost and convenience, and this holds true for both Pickup and Delivery services.”

Although the Mass channel isn’t immune to the effects of inflation, Mass did see a surge of 20% in its MAU base versus last year. In contrast, Grocery contracted by more than 10%. A similar trend played out with order frequency.

Customers buying online from Mass placed nearly 2% more orders on average in May versus the prior year while Grocery experienced a 5% pullback in order frequency. And, while AOVs for both Grocery and Mass grew during the month versus May 2021, both trailed the general rate of grocery inflation, suggesting fewer items in the basket.

Another indication that inflation is influencing where and how customers shop online became apparent in the elevated cross-shopping rates. The share of Grocery’s MAU base that also shopped online with Mass for groceries during the month set a new record at 33%, nearly 4 percentage points higher than the previous high-water mark from December 2021. Even though this elevated rate may be temporary, Grocers are at a risk of losing customers to Mass.

“Customers appreciate the convenience of ordering online, but they are also becoming more cost conscious,” said Sylvain Perrier, president and CEO, Mercatus. “So, to defend the base business, Grocers can promote pickup to address both issues. Assuming the pickup experience aligns with customer expectations, showcasing the savings associated with pickup’s lower fees, no fuel surcharges, or zero tips can better protect your online customers and sales by highlighting a more affordable alternative to home delivery.”

The likelihood for an online grocery shopper to use the same service again within the next month remained unchanged at 63% in May versus the prior month and was up 10 points compared to a year ago. Analyzing month-over-month results showed that while Grocery narrowed the gap slightly in May, Mass still enjoyed an 8-point advantage over Grocery relative to repeat intent rates.

For information about access to the research and monthly eShopper/eMarket reports, go to brickmeetsclick.com.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on May 28-29, 2022, with 1,802 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com