Hurricane Agatha kicked off hurricane season as it battered Southern Mexico, and remnants of the storm drenched South Florida. A solid category 2 storm, Agatha is the strongest May hurricane to make landfall in the Eastern Pacific.

Remnants of the cyclone crossed the Gulf of Mexico. However, NOAA meteorologists, unable to define a clear storm center, declined to upgrade the tropical system into a named storm.

The drenching is a sobering reminder as diesel prices continue to soar and mother nature takes aim at major refineries in the Gulf. And let’s not forget the ways hurricanes upset produce supply chains in an ordinary year. NOAA’s forecast for this hurricane season is not optimistic, with the expectation of 3-6 major hurricanes among the 14-21 named storms.

If you think your last ticket at the gas pump was painful, be grateful, you could be driving a diesel engine. At $5.58/gallon, diesel prices reached a new national average in May. Prices are 70 percent higher than they were one year ago.

Truck drivers have a reason to lament the rising costs as market rates aren’t keeping pace. Last month, DAT reported average spot rates were approximately 20 cents lower than the prior year. However, the situation is not entirely hopeless. High-value grapes and cherries are competing for trucks and are forcing freight rates to increase.

Despite Hurricane Agatha’s best efforts, the storm had no impact on the major harvesting regions, mainly in Southern Georgia. Favorable growing conditions are improving supplies across commodity categories.

ProduceIQ Index: $1.39 /pound, -6.1 percent over prior week

Week #22, ending June 3rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

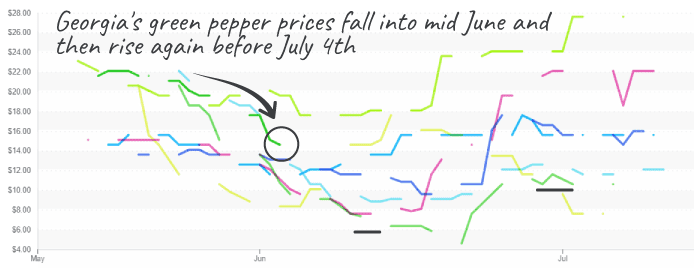

Bell pepper supplies are improving, and prices are falling. Pepper planted in Georgia after the freeze is ready for harvest. Georgia’s pepper production is overlapping with growers in California, North Florida, and even a small volume from Mexico. Current quotes are a weak $14 for XL and off-grades at $10 or less. Still, red and yellow supply remains short.

The West Coast’s pepper situation is the inverse of the East Coast. Red and yellow supply is strengthening, and green bells are expected to remain short for at least two weeks. Canadian colored pepper is ramping up, and Mexican greenhouse product is still crossing.

Green bell pepper prices are falling as Georgia’s volume accelerates.

Table grape prices continued their sharp decline, down -16 percent over the previous week. After a period of short supply due to the annual growing region transition, Mexican supply is in full swing and is providing relief for both red and green markets. This time of year, Nogales experiences an influx of grapes to help fill the coolers and offset fixed warehouse costs.

White table grape prices fall as production increases in the same historical pattern.

Tomato supply is still lean but is getting closer to completing the transition to Quincy, FL, on the East Coast and Baja, CA, on the West Coast. Even on thin supply, tomato prices are undergoing price drops across varieties.

Grape-type tomatoes are experiencing the most significant price decreases, -14 percent over the previous week. Markets are expected to remain unstable for the next couple of weeks until new growing regions find their swing.

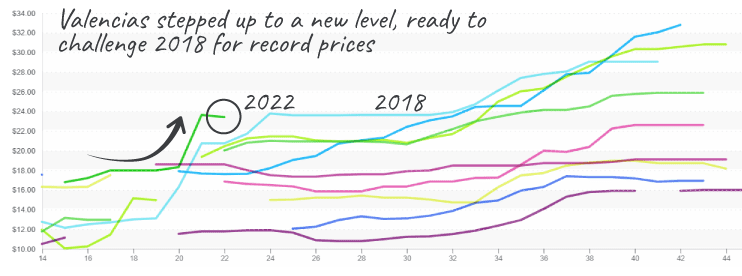

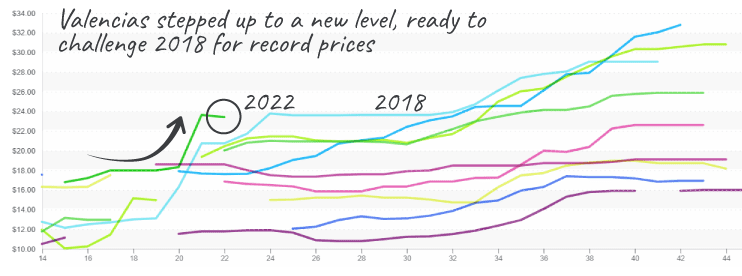

Countering general trends for the week, orange prices crept slightly upwards. 113ct/138ct are rising, and quality is good. The transition from navels to valencias is nearly complete. Prices are expected to stay elevated above average throughout the summer.

Valencia oranges, 113ct, are trending in the early season to exceed 2018 for the highest prices.

At $39, Brussel sprouts are skyrocketing past previous year’s week #22 prices. Heat in Mexico and a limited Californian supply continue to elevate markets on both coasts. For buyers’ sakes, let’s hope they don’t make it past the current ten-year record-holder, 2019.

Please visit our new grower stores, or our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.