RaboResearch colleagues from the consumer foods team published a report recently on consumer behavior changes that persisted through the latest Covid-19 wave, signaling that they are lasting behaviors.

Highlights from the report:

• Foodservice demand is demonstrating excellent resilience with increased food traffic at dine-in establishments.

• Where consumers previously grabbed breakfast on-the-go, they now pop out for lunch while at home, and there are somewhat fewer evening dinners and drinks, so long as people are working from home.

• Consumption of food at home has sustained strong demand above pandemic levels, bolstered by higher average spend (inflation included), the return of in-person shopping (to 2019 levels), and structurally higher online grocery orders.

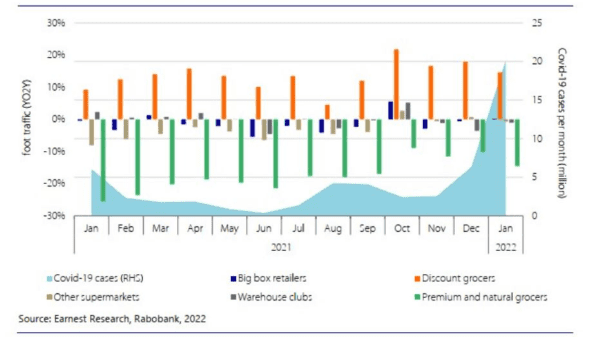

• Inflation is driving consumers to discount grocers, driving growth in share of traffic. On the opposite end, foot traffic at premium and natural stores remains far from the good old times.

• Online groceries seem to have reached a steady cap of 2.8 orders per month per active client, still significantly above pre-pandemic levels but below the levels of the initial months of hoarding. The average order amount is 16% higher than pre-pandemic, as clients add more items to their virtual carts.