On Sunday morning, Valdosta, Georgia, recorded 28-degree temps. The extent of damage to South Georgia and North Florida growing regions is unknown. Young plants are in the ground for the upcoming Spring transition.

Winter storms in mid-March are rare and can wreak havoc on seedlings and tender transplants of the dry veg category (pepper, cucumbers, squash, eggplant, and beans). Other commodities, such as watermelon, may also be affected.

We are a week out from the first day of spring, but produce markets are already abuzz with new life. Winter growing regions are slowly winding down, and spring harvests are not quite ready. Over the next month, growing regions will begin their spring migration Northward.

On top of Spring transition pressure, increasing crude oil prices are threatening the margins of freight carriers and growers alike.

For example, before Russia invaded Ukraine, the average U.S. Retail Diesel price rose from $2.37 per gallon in November 2020 to $4.05 in February 2022. As of March 7th, diesel prices jumped to $4.85 and are expected to rise further.

In the short term, commodity markets, including freight markets, are priced based on the quantity of supply and demand rather than on costs. In other words, the driving factor in price is the availability of trucks compared to the amount of produce that needs to be moved, regardless of the cost of fuel.

However, in the long-term, high costs for fuel will lower both quantity supply (growers need higher prices) and demand (consumers have less discretionary spending) of fresh produce.

ProduceIQ Index: $0.99/pound, -1 percent over prior week

Week #10, ending March 11th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

The ProduceIQ dry-veg category is among the most active this week. Bell peppers, squash and cucumbers are seeing significant increases in response to waning supply in Mexico and little availability in Florida.

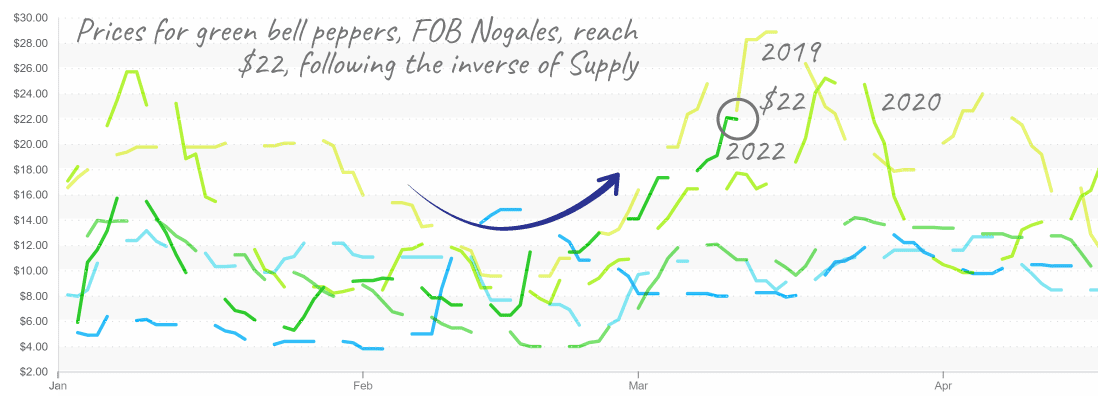

Green bell markets are particularly tight. At $22 in Nogales, prices are on the higher side of historical precedent. Florida production is cooling off, and current supply is insufficient to cover the gap left by Mexico’s dramatic drop in week-over-week export volume.

Growing methods for peppers in Mexico create seasonality to the supply curve. In Florida, growers have multiple plantings through the season, with each plant picked fewer times, causing a relatively steady harvest as each successive planting crowns.

In Culiacan Mexico, however, larger plants are grown, and the same plant is picked many times throughout the mid-winter season. This causes a rise and fall in quantity supply, typically flushing in mid-February and then winding down by late March. Fruit size also shrinks towards the end of a plant’s life.

The harvesting cycle of a green bell pepper plant can be seen as the inverse of prices.

Transition in Mexico is causing squash markets to tighten up. Yellow squash prices are up +32 percent over the previous week. Growers may start seeking $20 and $18 for fancy and medium this week. Due to cooler weather, this week’s Mexican squash volumes are being reported dramatically lower. Don’t expect that Spring acreage is overplanted as squash transitions northward. Prices should remain elevated over the next 7-10 days.

This year’s decline in Honduran cucumbers is lining up with a gap in Mexican production. Florida has started in a light way, but not enough to hold back rising prices. Strong demand and light supply from this cold snap will likely keep prices higher for another two weeks.

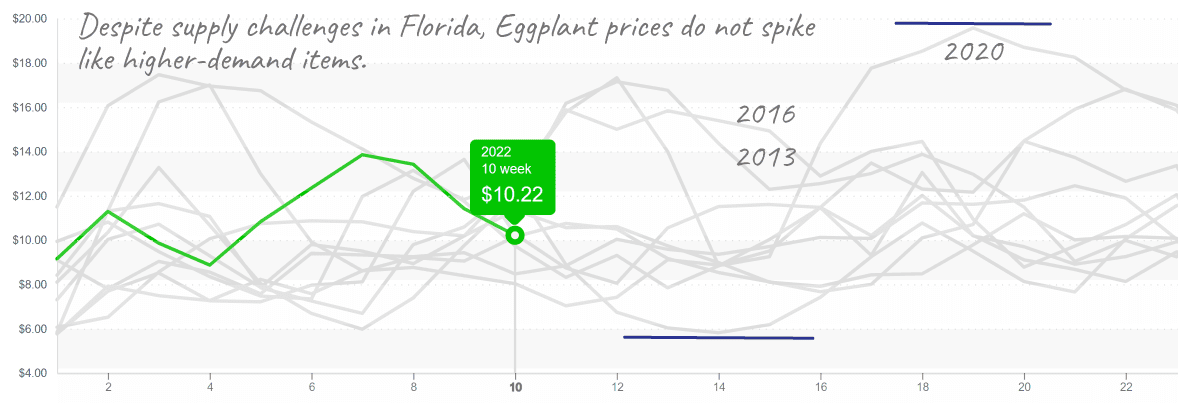

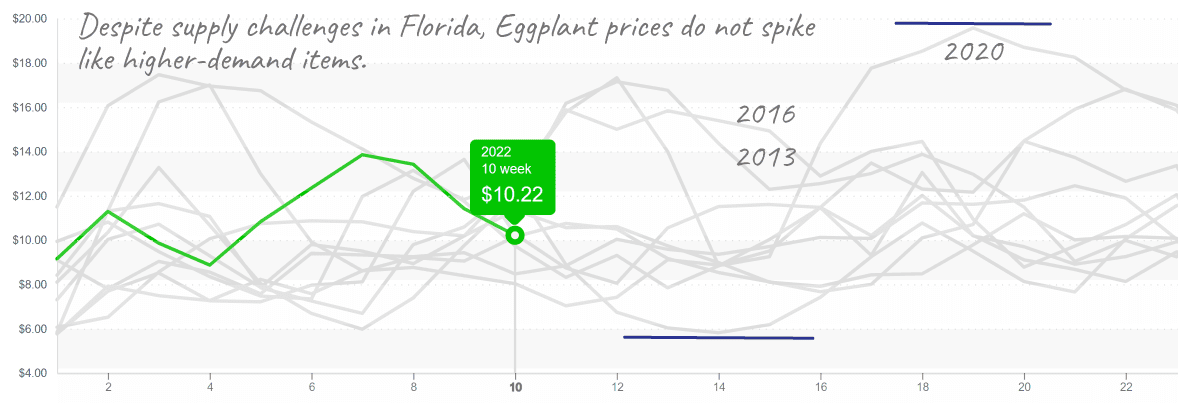

Eggplant markets are a bit of an anomaly. Despite a lack of supply and quality from Florida, prices have not risen and remain around $10 in Nogales. Eggplant is also sensitive to this weekend’s cold.

Mexican supply has been sufficient, and eggplant doesn’t typically realize very high price points. In economics, this is an example of a higher elasticity of demand. Meaning demand for eggplant drops off at higher price points. Eggplants are entirely unlike limes, which now exceed $75 per case.

Eggplant prices have remained at moderate levels throughout its history.

Cauliflower and Lettuce growers are returning to Southern California from the CA/AZ desert.

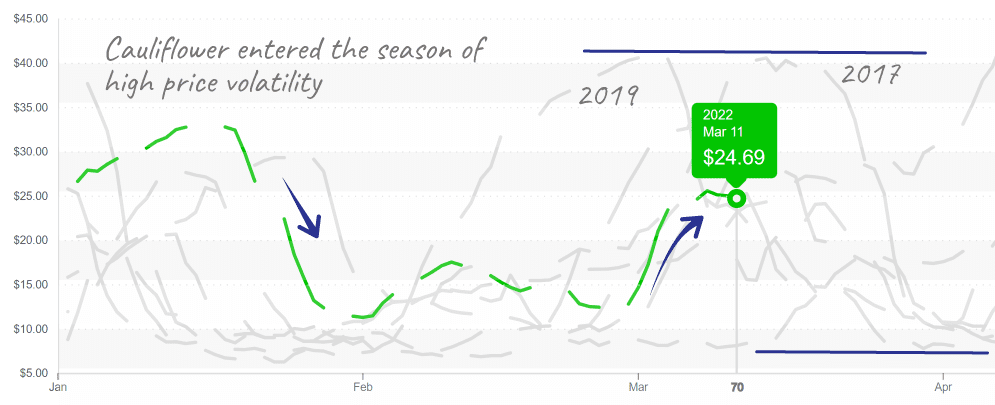

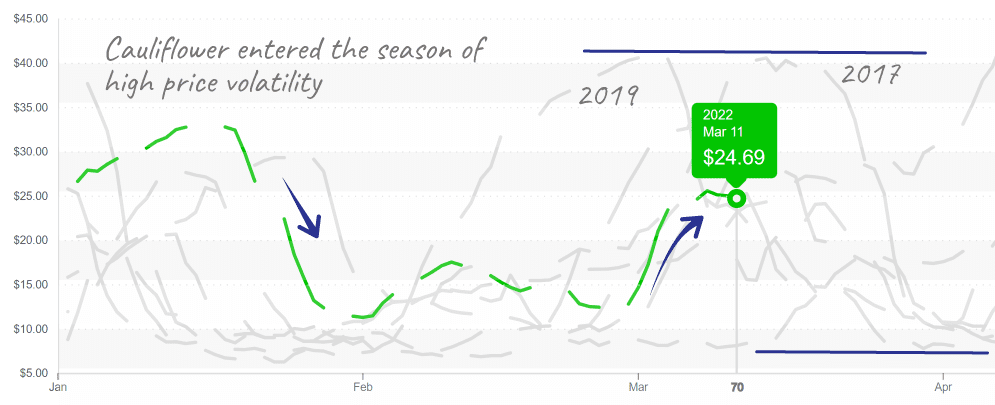

Cauliflower prices are up again, increasing +40 percent over the previous week to $25. Markets will be active for the next ten days as production winds down in AZ and picks up in California.

Cauliflower prices are unpredictable in advance of the season.

Lettuce markets are being hit with a double-whammy. Poor weather brought ice and wind damage to the AZ desert and is limiting an already slim transition supply. As a result, USDA Iceberg 24-count prices are up +83 percent over the previous week to a shocking $49, a historic high for week #10.

Romaine prices are also at a ten-year high and are trailing just a bit behind Iceberg at $42. Quality is improving, and markets should stabilize over the next couple of weeks. Of course, high freight costs will affect price disparity between the West and East Coast. Now is a great time for burgeoning indoor growers to break into the big box stores with locally-grown leaf alternatives.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.