If it is true that “bad news is good news and no news is bad news,” then the avocado industry is doing just fine. Last week was quite a roller coaster for Avocados from Mexico.

A week after airing a multi-million-dollar Super Bowl marketing campaign and the suspension of Mexican avocados imports, the USDA announced the reopening of U.S. markets to avocados.

Given the uncertainty, many avocado shippers were in a wait-and-see mode, holding onto inventory that wasn’t committed. Sufficient inventory was on-hand last week, avoiding any significant impact on U.S. stores or restaurants.

Since the USDA did not report market prices on Hass, which would have been unreliable anyway, our ProduceIQ Index for the week is similarly distorted. This week, buyers will replenish inventory and return to the insanely high avocado prices that everyone is growing accustomed to.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: Prices are flat overall

Week #7, ending February 18th

An abundance of supply and a post-Valentine’s slowdown in demand is resulting in very favorable market conditions for berry buyers.

Blueberry prices are near the low side of their historical range. Thanks to strong Peruvian and Chilean imports, blueberry supply is “berry” high. Prices typically trend lower till mid-March and then rise towards the end of April, when growing regions transition back to the states. Prices should stay promotable for at least a couple more weeks.

Right on track with historical trends, strawberry prices are beginning a descent that typically lasts two to three weeks. California strawberry volume is lagging a bit behind pace due to cold weather; however, Mexico’s bumper crop is more than covering the gap. Prices fell -12 percent last week and are expected to continue to decrease. Quality remains high as California production ramps up.

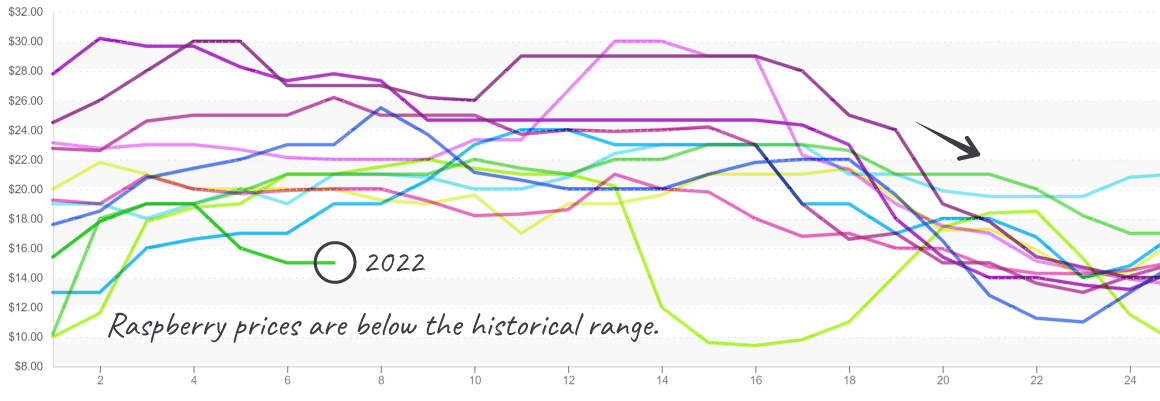

At a ten-year low, raspberries are testing the limbo! Parallel to strawberries markets, ample Mexican supply is driving raspberry prices lower. Domestic supply is nearly entirely reliant on Mexican growers this time of year. So enjoy the deals while they last. Prices could very well increase again before California ramps up production in the Spring.

Raspberry prices are low at $3.33/pound, $15 for 12/6oz clamshells.

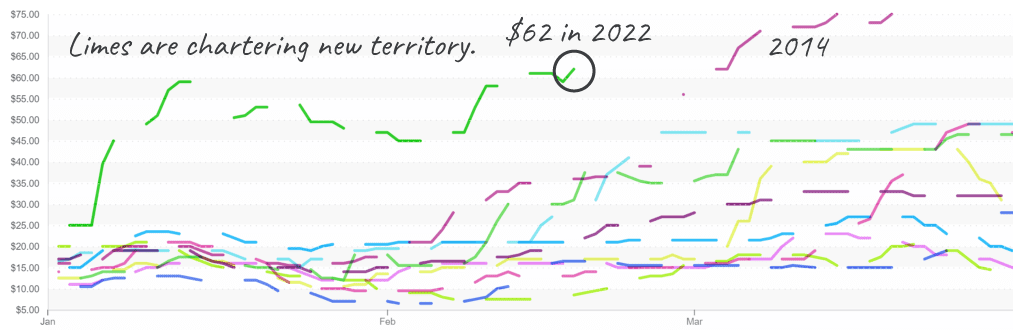

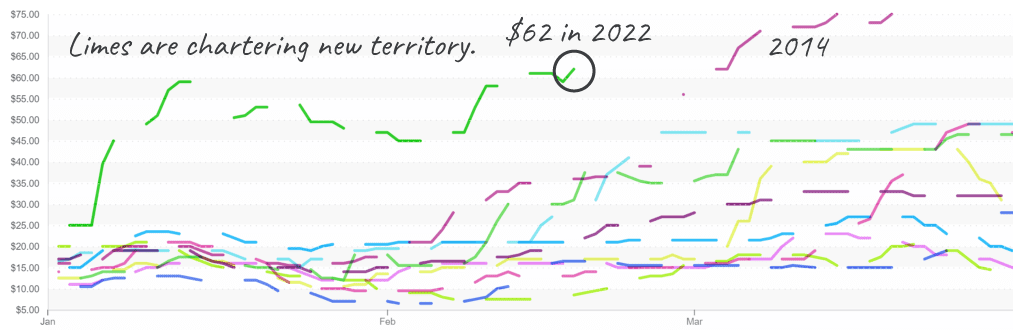

The post-holiday snooze isn’t soothing enough to calm restless lime markets. After a brief respite, prices are once again at a ten-year high, over $60 per case. Prices are high on all sizes, and relief is not yet in sight.

Limes will have opportunity to test the sky-high prices from 2014.

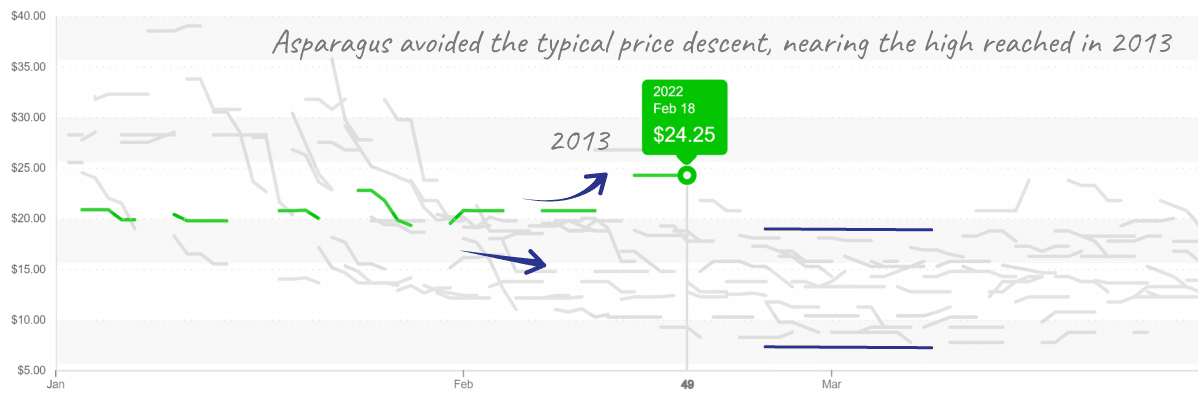

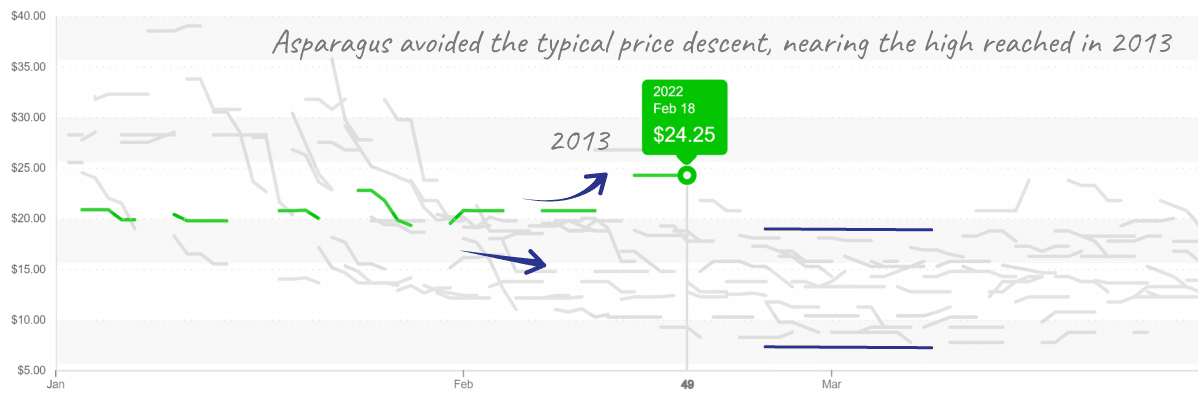

Asparagus markets are strengthening, above $20/case. Cooler weather in Mexico is affecting

“grass” yields. Import volume is down, and prices are up +20 percent over the previous week. Prices are forecasted to climb for the remainder of February.

Asparagus prices for 11 lb. case, large item size, exceed $24.

After hovering near the price floor for a few weeks, cucumber markets are on the rise. Mid-winter Mexican and Honduran production is waning, and Florida has yet to start. Current prices are well within the bounds of historical precedent but will probably climb higher over the next two weeks.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.