Pickup gains larger share of online grocery sales but faces challenges with first-time users

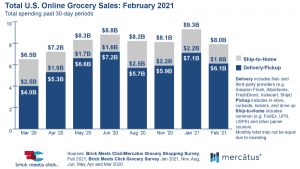

Barrington, Ill. – The total U.S. online grocery market posted $8.0 billion in sales during February, a 14% drop from January’s $9.3 billion, as fewer households went online for groceries and placed fewer orders than in January according to Brick Meets Click/Mercatus Grocery Shopping Survey fielded Feb. 26-28, 2021.

The survey is part of an ongoing and independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus.

“February’s overall sales contraction was expected,” explained David Bishop, partner, Brick Meets Click. “While January’s sales performance set a record high for online grocery sales, we also saw January’s shopper sentiment related to completing a grocery delivery or pickup order within the next month drop by approximately 10%, and that is what happened, albeit at a slightly higher rate, in February.”

The predominant driver of the February decline in sales was the smaller base of households buying groceries online; monthly active users dropped 12% from 69.7 million in January to 60.1 million in February. Much of the reduction (over 40%) came from the over 60 age group and may reflect growing confidence and/or personal preferences for in-store shopping as COVID-19 vaccinations rollout across the U.S.

Lower order frequency was also a factor in the sales decline with online grocery shoppers placing 6% fewer orders, averaging 2.7 orders during February compared to 2.8 during January. Most of the drop is attributable to the ship-to-home segment, which had a 12% decrease in order frequency.

The combined delivery/pickup segment, however, was only down 4% on a month-over-month basis. As households become more familiar with the range of online grocery shopping options, their experiences are altering their expectations and perceptions about the value of shopping this way.

A 4% increase in average order value (AOV) on a month-over-month basis helped to offset the February declines in shopper base and order frequency. This increase in AOV was boosted by two factors. First is the continuing shift toward pickup and delivery, which typically involve larger orders.

Households spent an average of $82 in February for orders received via delivery or pickup, which is 55% larger than orders shipped-to-home via common or contract carriers. The second factor is growth in both the respective AOVs for ship-to-home and delivery/pickup segments. The AOV for ship-to-home orders jumped nearly 11%, while the AOV for the delivery/pickup segment grew just over 1% in February vs. January.

As the market returned to the $8 billion level for February, the combined delivery/pickup segments captured $6.1 billion, accounting for more than three-quarters of the total online grocery market for the month. Within the combined segment, pickup’s share of online grocery sales grew once again, with share increasing over five percentage points in February versus January.

As a result, pickup captured nearly half of all online grocery sales in February and grows in importance as it continues to capture a larger share of sales.

The leading indicator, “likelihood to use a specific service again,” stabilized in February as 58% of households reported being extremely/very likely to place another order with the same delivery or pickup service within the next 30 days.

While the overall satisfaction metric scores were essentially equal for both the pickup and delivery segments, the first-time user scores for each segment differed significantly.

More than 40% of first-time delivery service users reported that they were extremely/very likely to use the same service again; in contrast, repeat intent scores for first-time pickup service users were more than 10 percentage points lower, landing below 30%.

“These scores are concerning as pickup is only becoming more vital to brick-and-mortar retailers for both strategic and economic reasons,” said Bishop.

“For many regional grocery chains, the online shopping battleground has shifted from delivery to curbside,” said Sylvain Perrier, president and CEO, Mercatus.

“Lower repeat intent rates for first-time pickup customers puts the spotlight squarely on customer service. Implementing a frictionless curbside fulfillment experience that wins the customer the first time, every time will help grocers defend against mass merchants’ low-price advantage. Enhanced pickup services combined with retailer branded marketing strategies to win-back lapsed and lost customers can help increase monthly order frequency, and contribute to a healthy contribution margin from online shopping.”

A more extensive summary of the February 2021 research insights is available from Brick Meets Click via subscription to the eGrocery Insights Program. To purchase a single-month or three-month subscription, please visit brickmeetsclick.com.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on Feb. 26-28, 2021 with 1,812 adults, 18 years and older, who participated in the household’s grocery shopping.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and were weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology in terms of design, timing, and sampling for each of the surveys conducted Jan. 28-31, 2021 (n=1,776) and throughout 2020: Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), June 24-25 (n=1,781), May 20-22 (n=1,724), April 22-24 (n= 1,651), and March 23-25 (n=1,601).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus is the authoritative voice for food retailers who want to strengthen their relationship with shoppers in a digital space. We help leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional branded omnichannel shopping experiences end-to-end, from store-to-door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we empower clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final and others. Mercatus is headquartered in Toronto, Canada.