More than four months after the big spikes in grocery sales at the start of the pandemic, CPG sales continue to track well ahead of the 2019 baseline.

More than half, 56%, were extremely concerned about COVID-19 this week, according to the IRI survey of primary grocery shoppers. This is the highest share among shoppers since the first week of May.

Additionally, more than one-third of Americans said they were more concerned now than they were last week, driven by residents of California (49%), Texas (46%) and Florida (42%). This heightened concern is further delaying the recovery of foodservice sales. Additionally, many shoppers are dealing with financial pressure. In IRI’s survey this past week, 30% of primary grocery shoppers say their financial situation is a little or a lot worse off than it was a year ago. 210 Analytics, IRI and PMA partnered to understand fresh produce sales at retail throughout the pandemic.

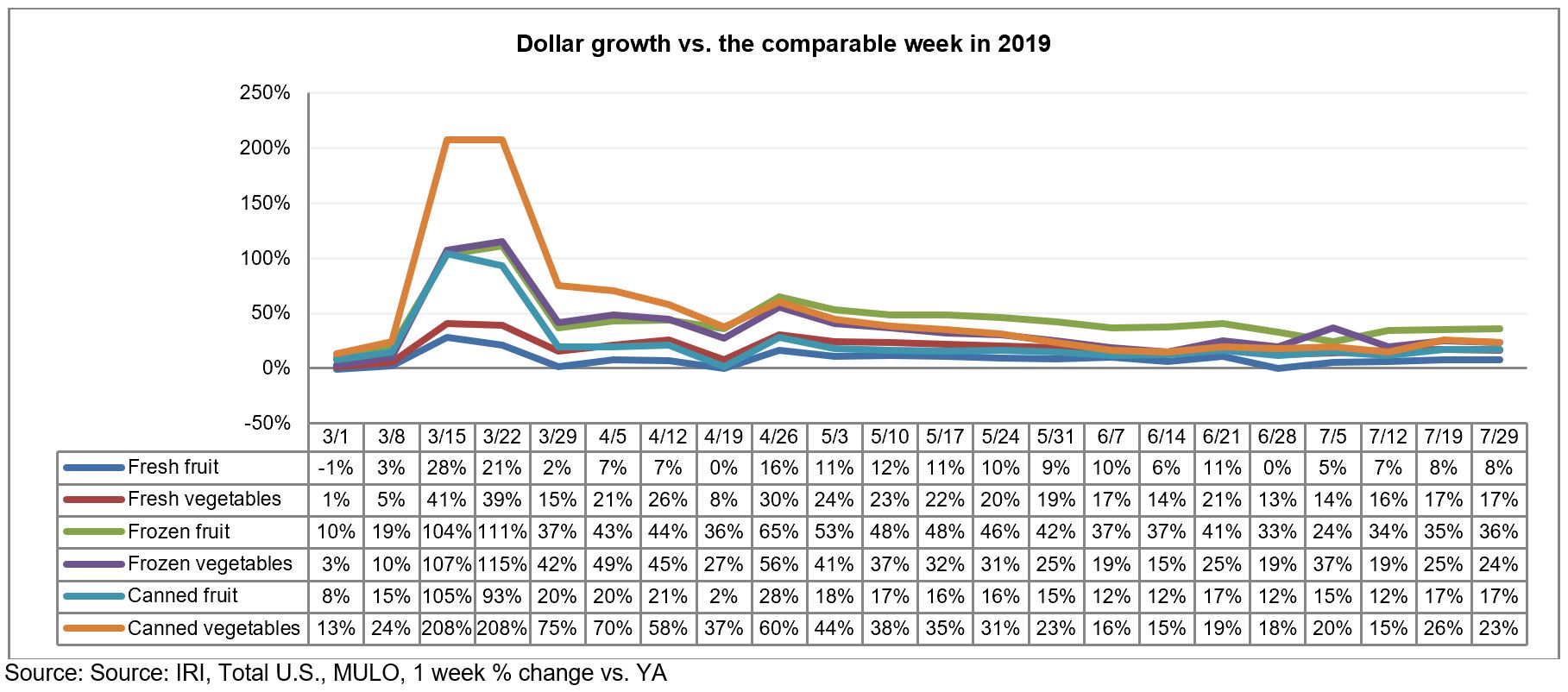

Elevated every day retail demand drove sales gains of +11.7% over year ago for fresh produce during the week ending July 26 — virtually unchanged versus the week prior. Frozen and shelf-stable fruits and vegetables had higher percentage gains but off a smaller base, with particular strength for frozen, at +25.9%. Year-to-date, fresh produce department sales are up 10.9% over the same time period in 2019. Frozen fruit and vegetables increased the most, up 27.8% year-to-date.

“The resurgence in COVID-19 cases along with economic pressure is shifting food dollars back to retail once more,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “The market is only growing more complex. The rising concern is likely to bring back some of the early pandemic behaviors, including stocking up for multiple weeks. But at the same time, consumers are struggling with meal planning after four months of preparing many more meals and snacks than they did pre-pandemic.”

Fresh Produce

Fresh produce generated $1.37 billion in sales the week ending July 26 — an additional $143 million in fresh produce sales over the prior year. Growth rates for vegetables and fruit were virtually unchanged from the week prior, with vegetables having a 9.2 growth percentage point lead over fruit. This points to the “new normal” in elevated produce demand at food retail.

“The virus is in clear control of produce demand for the foreseeable future,” said Jonna Parker, Team Lead, Fresh for IRI. “According to the latest wave of IRI primary shopper research, more Americans plan to further delay their return to normal activities, though in part this may be due to state mandates disabling them to engage in these activities. Up from 56% two weeks prior, 73% of consumers will wait at least four more weeks before going to a bar or club; 56% will wait this amount of time before dining out at a restaurant; and 45% before going to a coffee shop. As a result of rising concern to re-engage with foodservice, many fresh produce dollars will likely continue to flow to food retail.”

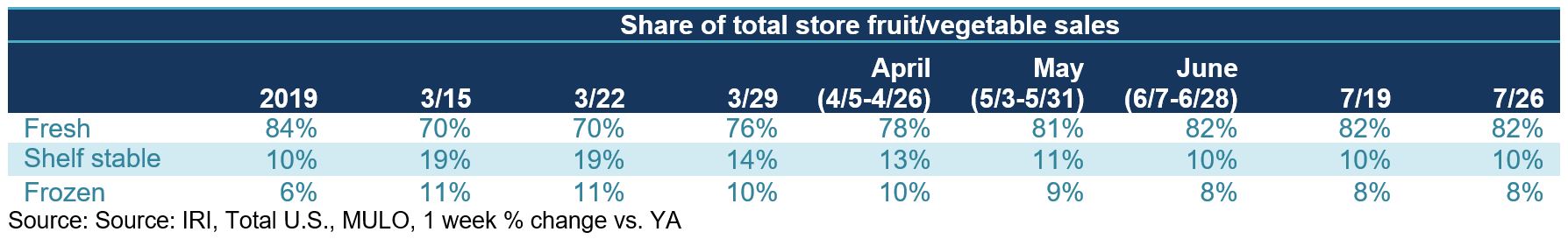

Fresh Share

During the height of the pandemic stock up purchasing, the fresh share of total fruit and vegetable sales fell to as low as 70%. Gaining back a few points every week, the fresh share returned to its 2019 level of 84% during Independence Day week, typically a big fresh produce holiday. However, as COVID-19 cases are rising, so is the share of frozen fruits and vegetables.

“With the upswing in the number of COVID-19 cases around the country, pantry loading is making a comeback” said Parker. “More than half of shoppers (54%) aim to buy enough food for their households to last them two to four weeks, according to the latest IRI shopper survey. As such, items with longer shelf life continue to do well, which favors frozen and canned sales. Optimizing and highlighting shelf life of fresh produce is increasingly important because of it.”

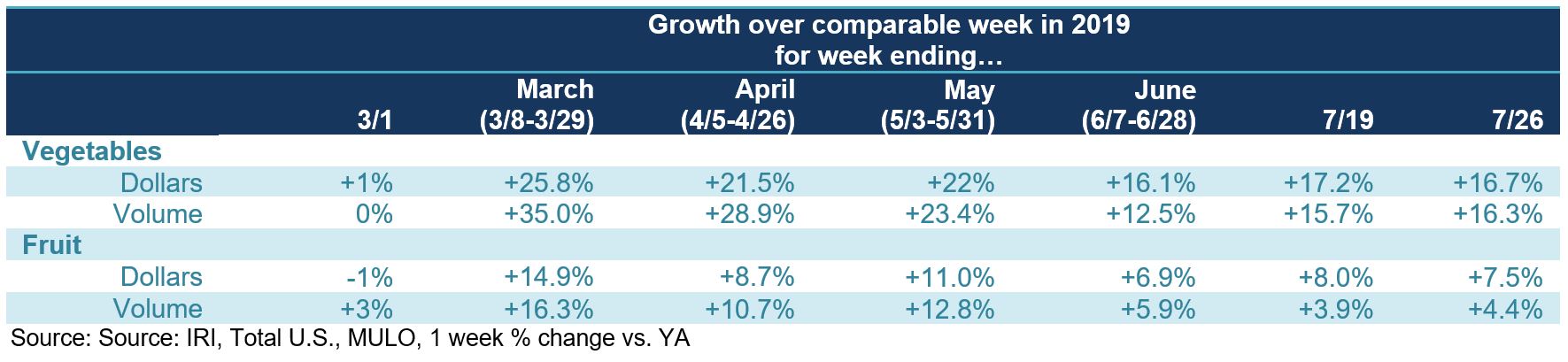

Fresh Produce Dollars versus Volume

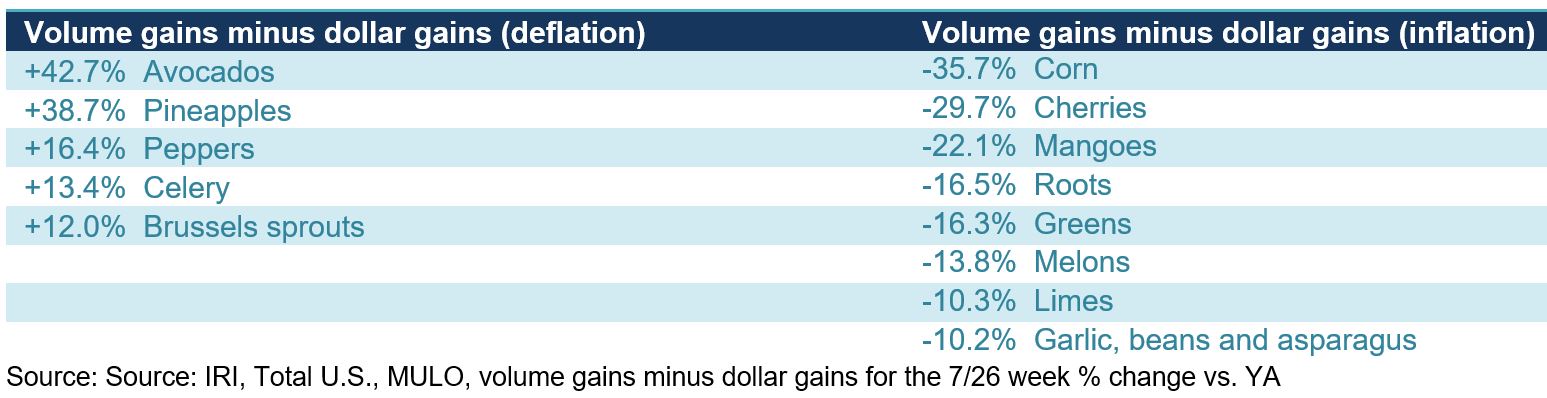

Dollar gains continued to track ahead of volume gains ever the week of May 24. However, the overall view is a bit misleading with many areas seeing double-digit inflation or deflation.

Both fruit and vegetables saw dollar sales gains track ahead of volume gains. Fruit volume gained 4.4% over the same week last year, showing demand is up but not quite keeping pace with other foods. In vegetables, dollar gains outpaced volume only very slightly, at +16.7% versus +16.3%. The overall volume/dollar gap remained small at just 2.7 percentage points.

However, moving from total fruit and vegetables to the individual categories show that supply and demand is still significantly out of balance for many areas. Ample supply is driving higher volume than dollar gains for items such as avocados, celery and peppers. On the other hand, dollar gains are far outpacing volume for items such as corn, cherries, asparagus and melons.

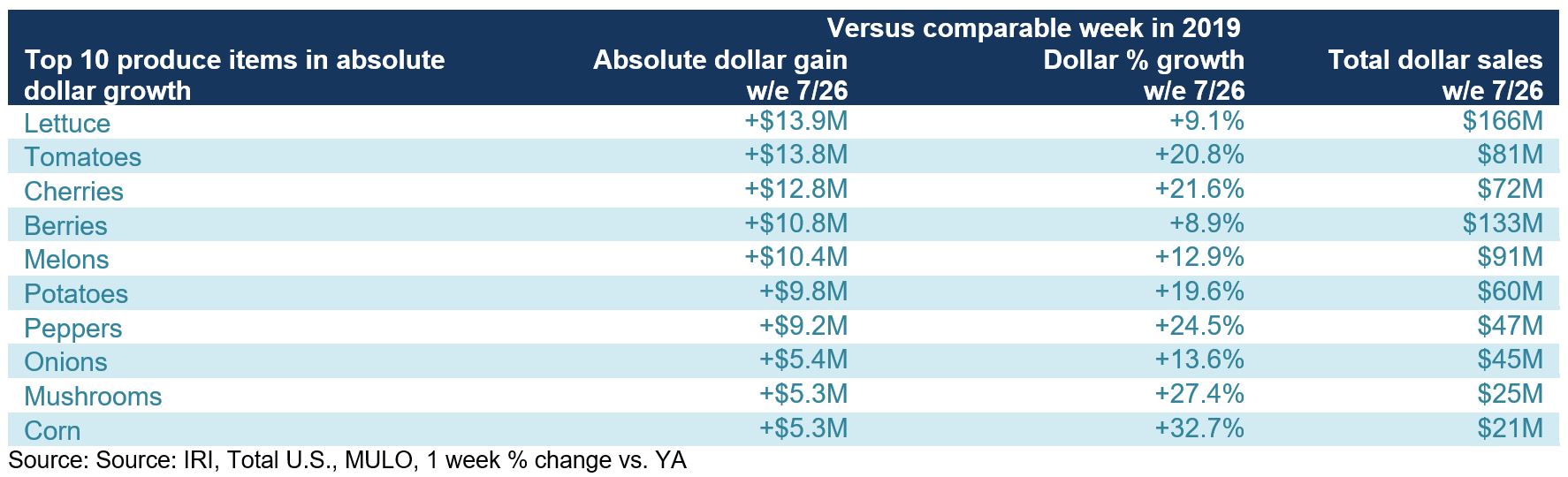

Absolute Dollar Gains

Lettuce contributed $13.9 million in new dollars the week of July 26 versus the comparable week in 2019. Tomatoes added another $13.8 million.

“Summer is in full swing with cherries, berries and melons in third, fourth and fifth place of items with the highest absolute dollar gains this week,” said Watson. “The top 10 for the week ending July 26 was a great mix of fruits and vegetables. Mushrooms were back in the top 10 and for the first time in many weeks and oranges dropped out of the top 10 in absolute dollar gains, despite being up 37.7% in dollars versus the same week year ago.”

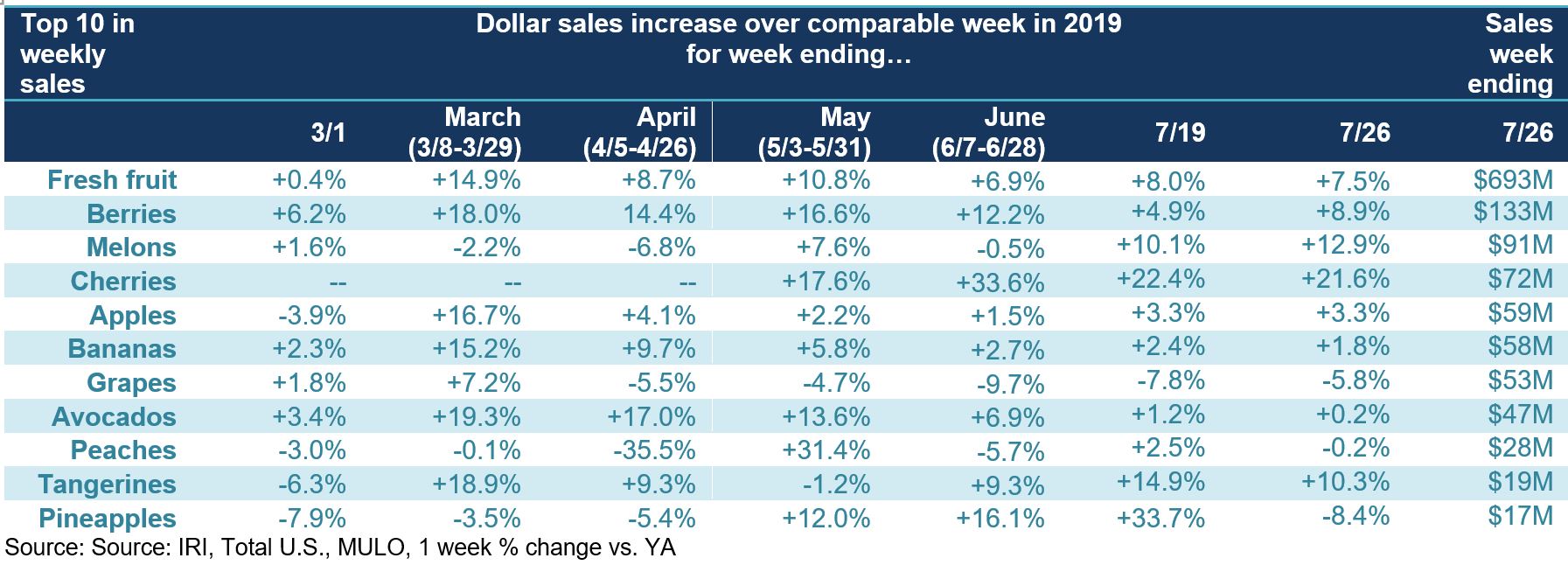

Fresh Fruit

“In fruit, berries, lemons and cherries also dominate total weekly sales,” said Watson. “Dollar gains are heavily impacted by deflation for some areas, such as avocados. With volume gains of 42.9% there is very strong demand, but lower prices barely put dollar gains above last year’s levels. Grape demand is not quite where we normally see it, but we have a lot of summer left and peaches are up in volume, though deflation is pulling dollar gains into the negative.”

During the week of July 26, double-digit gains in the top 10 sellers were reserved for melons, cherries and tangerines. Despite having the highest dollar gains of all fruits, at +37.7%, oranges fell out of the top 10 in absolute dollar gains and biggest sellers. Sales of grapes, peaches and pineapples tracked in negative territory versus year ago, driven by deflationary conditions.

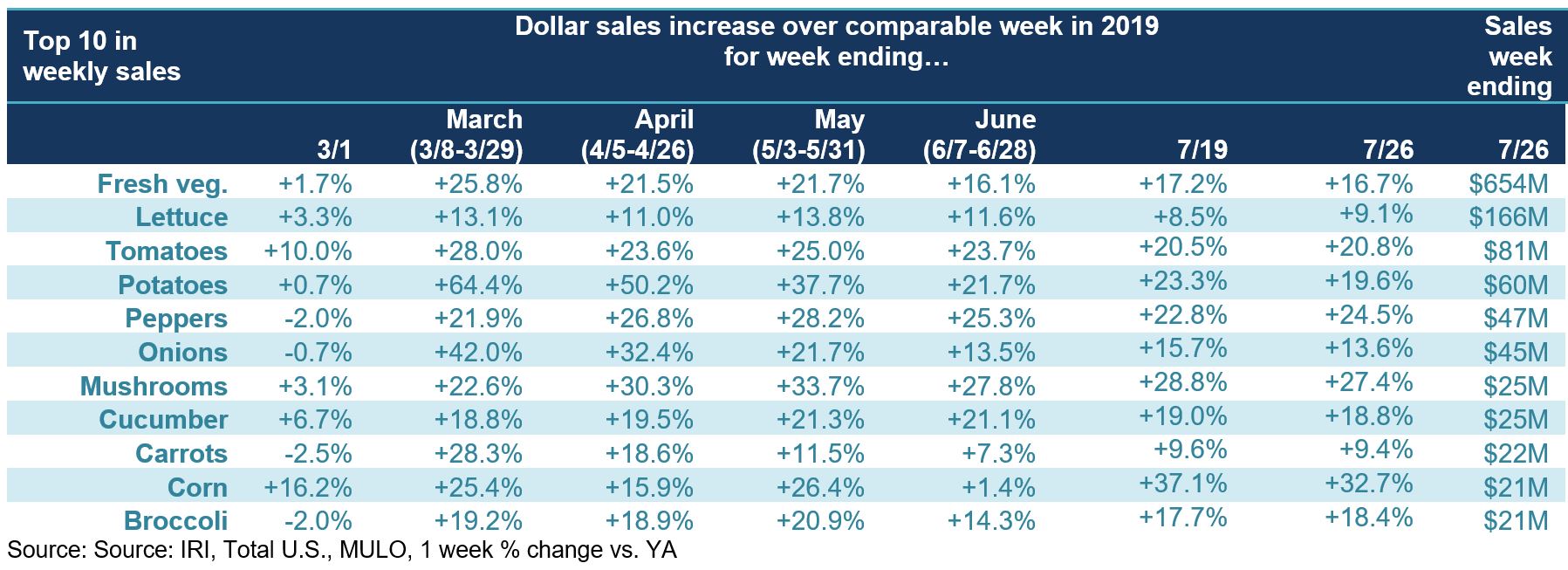

Fresh Vegetables

“In contrast to fruit, all top 10 vegetables increased in dollar sales versus year ago and eight in 10 did so with double-digit gains,” said Watson. “Whereas the order and items in the top 10 for fruit are very different each week, vegetables has virtually the same line up each week with just a few items shuffling up or down. Lettuce is the dominant seller, more than twice the size of number two, tomatoes, yet up 9.1% versus the same week year ago. The highest weekly gain percentage goes to corn, at +32.7%. This was fully driven by price increases, with volume down 3.1%.”

“Dollar gains for fresh cut salad remained in double digits, at +11.0%. Volume sales increased 6.2%. “Bagged salad is the perfect example of meeting consumers in their quest for nutritious fresh foods that are still fast and easy to prepare,” said Watson. “As consumers are focused on speed when shopping, do the thinking for them with reminders to combine fresh-cut salad with deli-prepared or frozen entrees for a quick lunch or dinner.”

Fresh Versus Frozen and Shelf-Stable Fruits and Vegetables

All temperature states of fruit and vegetables had double-digit gains during the week of July 26, with the exception of fresh fruit. Frozen fruit had particularly high gains this week, at +36%. The continued strength of frozen fruits and vegetables goes hand-in-hand with strong frozen foods performance overall.

Floral

Floral sales at retail had another strong week, up 6.2% over the same week last year. With the exception of the week of June 14, sales have been in positive territory since the third week of May.

Perimeter Performance

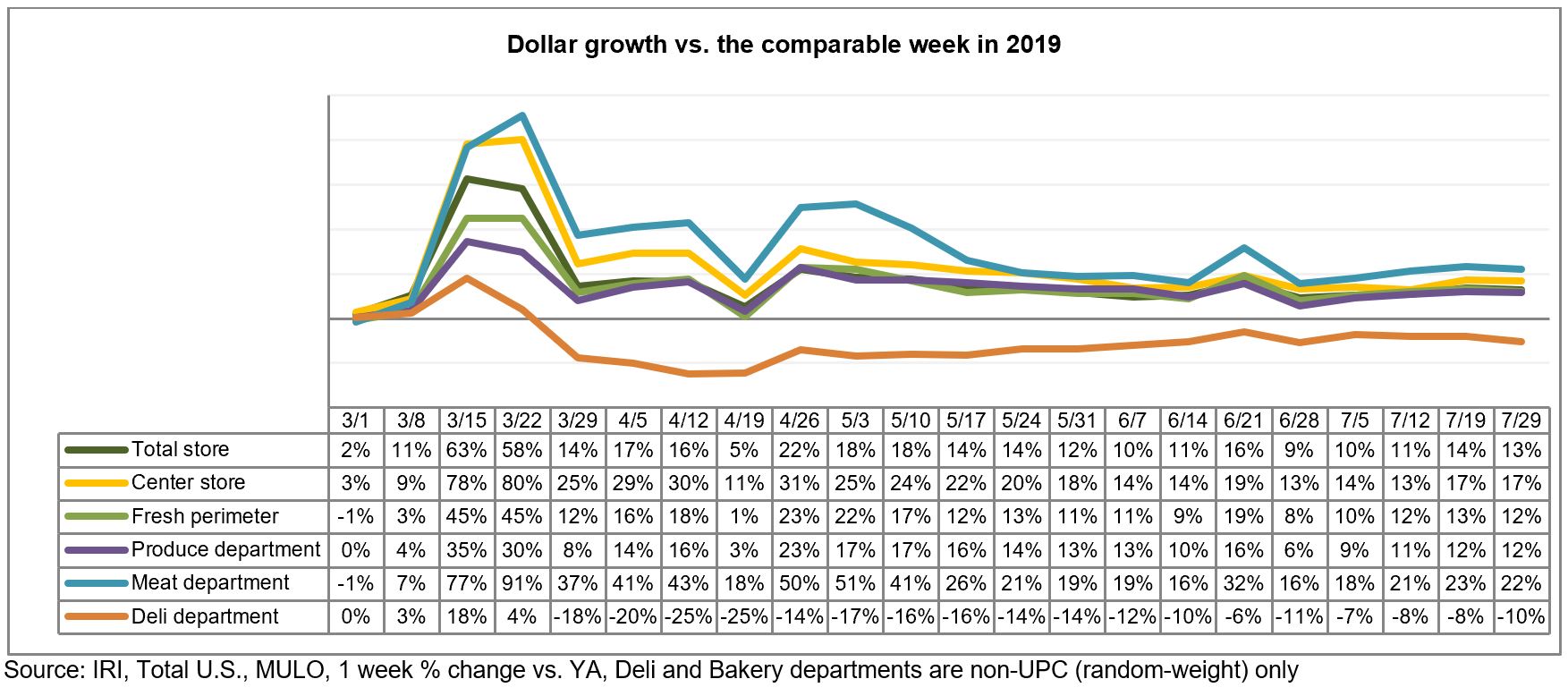

Center store food and beverages sales gains continued to outpace total store and total fresh, at +16.7% for the week of July 26. The fresh perimeter did well with total gains of +12.1% versus the same week last year, pulled up by very strong meat and seafood performances. Produce’s performance was just a little below the fresh average. Total deli, which encompasses deli cheese, meat and prepared foods, backslid somewhat to -10.4%, due to heightened pressure on the foodservice offering.

What’s Next?

This was the third of eight non-holiday weeks between Independence Day and Labor Day in which everyday demand alone has to drive growth. Between the rising consumer concern over COVID-19 and the mounting economic pressure, produce dollar sales at retail will continue to see gains versus year ago for a while to come.

Back-to-school season is also still up in the air. States and school districts are applying mixed systems of pushing back the starting date or are offering virtual education and hybrid virtual and face-to-face education models, which all impact year-over-year produce retail sales as many more school-aged children and teens will remain at home. In the IRI shopper survey this week, a third of parents said they do not know yet if and when their children will be in school in the fall. Fewer than one in five expect to have their child/children back at the school for a full schedule as of the late July survey. Almost half of parents who usually have a daycare/childcare provider for a child under six continue to say they will wait at least four more weeks to resume care.

Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times. #produce #joyoffresh #SupermarketSuperHeroes. 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns.