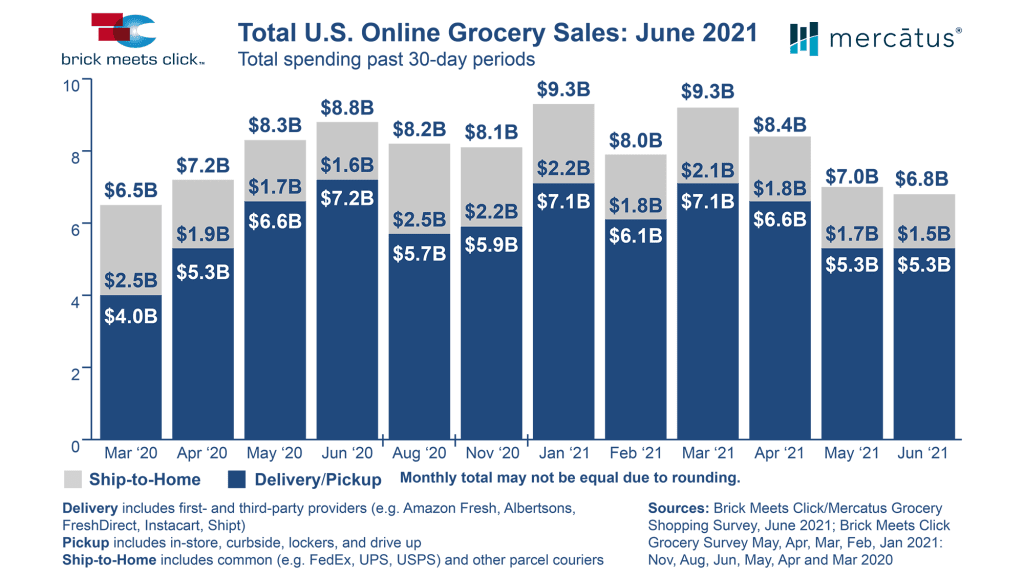

Barrington, Ill. – July 22, 2021 – The U.S. online grocery market generated $6.8 billion in sales during June, down 23% versus a year ago and 3% lower versus May, as ship-to-home sales totaled $1.5 billion and pickup/delivery reached $5.3 billion, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded June 27-28, 2021. The overall sales decline, much like in May, was driven by decreases in the number of monthly active users (MAUs), order frequency, and spending per order. While the total market contracted, pickup’s dominance continued to strengthen, and the degree of online grocery cross-shopping between grocery and mass retail services remained near all-time highs.

“We all know that the pandemic disrupted the way many U.S. households bought groceries, but it’s now becoming more evident how some retailers have more effectively changed the way they sell groceries,” said David Bishop, partner at Brick Meets Click. “When you look beyond online grocery’s monthly performance, the big picture shows which retail segments are winning market share by providing a more seamless shopping experience for their customers.”

The ongoing independent research initiative, created and conducted by Brick Meets Click and sponsored by Mercatus, found that 63.5 million U.S. households bought groceries online in June, a 12% decline from June 2020. Monthly active users declined across all age groups with the youngest (18-29 years old) and the oldest (>60 years old) each dropping by more than 15%. The core customers (30-44 years old) dropped only 6%. Pickup’s monthly average user base jumped by almost 16% on a year-over-year basis, while delivery’s base declined 1% and ship-to-home’s base experienced a drop of 6%.

During June 2021, monthly active users placed an average of 2.70 online orders, down 6% from 2.89 orders one year ago. The share of orders received via pickup grew nearly seven points on a year-over-year basis, capturing 42% of total order share as delivery and ship-to-home experienced two- and four-point drops in share, respectively.

via zip code into one of four market types based on population size. During June 2021, pickup regained the top share in large metro markets and once again became the dominant method across all four market types, growing monthly order share in all market types versus last year. In comparison, ship-to-home’s order share shrank across all market types, and delivery’s order share grew only slightly in the least populated markets on a year-over-year basis.

The June 2021 results also revealed that 33% of monthly active users received online grocery orders only via pickup; another 16% received online grocery orders only via delivery. From a broader perspective, pickup’s overall usage rate for June 2021 was nearly five percentage points higher versus last year and over 23 points higher compared to Aug. 2019. These results illustrate the importance of offering both services – but especially pickup – to remain relevant and to better support the total addressable market for online grocery services.

Spending per order shrank as the weighted average across all three receiving methods declined nearly 7% in June 2021 versus a year ago, mostly driven by a drop in delivery’s average order value (AOV) that exceeded 11%. Compared to pre-pandemic spending levels, June 2021’s AOVs remained elevated, with delivery up 6%, pickup up 12%, and ship-to-home up 14% versus Aug. 2019.

The repeat intent rate, which measures the likelihood that a monthly active user will order again in the next month with the same grocery service, jumped to 60%, up four points compared to a year ago. While this is a positive trend, there is a heads up for grocery retailers: The repeat intent rate for mass retailers, like Walmart and Target, was almost nine points higher on average compared to grocery’s repeat intent rate during June 2021.

“The cumulative effect of consistently executing a sound strategy that delivers against the brand’s promise has helped mass retailers outperform grocery on key metrics, including MAUs, order frequency and AOV in June 2021,” Bishop explained. “It’s vital for grocers to compete against mass, but it’s also essential that grocery retailers don’t try to operate like mass since that is an unsustainable strategy.”

The comparisons between grocery and mass remained extremely relevant as the share of online customers who used both a grocery service and a mass retail service to buy groceries during the month exceeded 28% for the second straight month. In fact, the ongoing research illustrates how a mass rival could now be a grocery retailer’s primary competitor when it comes to online grocery, as the cross-over shopping rate was only 15% pre-COVID (in Aug. 2019).

“Given June’s results, it’s hard to deny U.S. consumers’ clear preference for pickup services in all market types,” said Sylvain Perrier, president and CEO, Mercatus. “Regional grocers looking to solidify their sales gains also confront a more competitive environment. The mass merchants and third-party delivery services are all looking to protect their share of online wallet. One clear action grocers should take is to double-down on modeling your repeat online customers shopping preferences, and develop a re-engagement strategy that plays to your retail brand’s unique strengths. Second, invest both in the technology and re-alignment of your operating models so you can improve the overall customer pickup experience at a lower cost to your business.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on June 27-28, 2021, with 1,789 adults, 18 years and older, who participated in the household’s grocery shopping.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted May 28-30, 2021 (n=1,872), Apr. 26-28, 2021 (n=1,941), Mar. 26-28, 2021 (n=1,811), Feb. 26-28, 2021 (n= 1,812), Jan. 28-31, 2021 (n=1,776); throughout 2020, Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in Aug. 22-24, 2019 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final, Stater Bros. Markets and others. Mercatus is headquartered in Toronto, Canada.