This is the monthly GuestXM restaurant report from Black Box Intelligence:

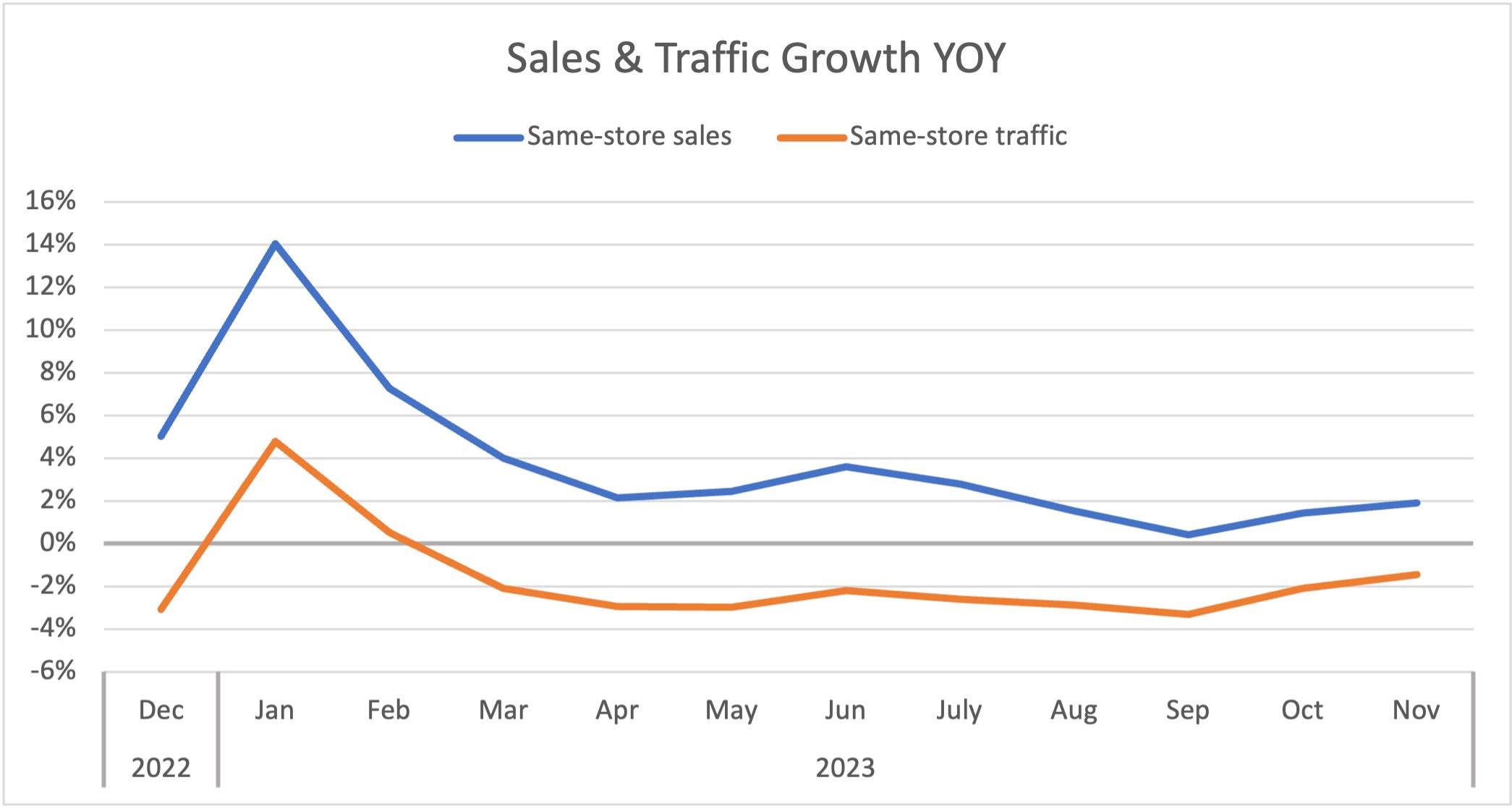

By several accounts, November was a pretty encouraging month for restaurants. For the second consecutive month, year-over-year (YoY) same-store sales and traffic growth accelerated, bringing much-needed optimism to the industry after September’s discouraging dip in performance.

Furthermore, November’s traffic growth was the third strongest achieved by the industry since February of 2022.

However, considering that the top two months (January and February of 2023) were outliers resulting from the easy Omicron laps from early 2022, it can be stated that November 2023 was the month with the strongest same-store traffic performance in almost two years for restaurants.

Same-store traffic growth was -1.5% during November, representing an acceleration of 0.7 percentage points relative to October’s YoY traffic growth.

Sales growth also improved for restaurants during November but at a slower pace than traffic. Same-store sales growth was 1.9% during the month, representing a 0.5 percentage-point improvement over October’s rate. November was the strongest month for restaurant sales growth since July’s growth of 2.8%.

A factor that has continued to provide some relief to consumers and has allowed restaurant traffic to experience some recovery in recent months has been the sustained moderation in average check growth, which persisted in November. Average check growth in comparable stores was only 3.5% in November, the lowest since December 2020. Furthermore, the industry has now experienced five consecutive months in which YoY growth in average checks has decreased relative to the previous month’s growth rate.

Another factor that is likely contributing to restaurants as a whole not shedding more dining occasions is the continued trade down toward lower-priced restaurant options. The segments with the best same-store traffic growth in November were fast casual and quick service. These segments have been the top performers during two of the last three months and were also in the top three during the last four consecutive months.

Perhaps most impressive is the fact that Fast Casual was able to post a small positive YoY traffic growth in November. Since April, the norm has been for all segments to experience negative traffic growth, with fine dining in October and fast casual in November as the only exceptions.

Improvement in Restaurant Average Star Rating Leads to More Visitors

In the age of social media, consumers turn to their phones and laptops when choosing anything from a dentist to a spouse and everything in between. The restaurant industry is no exception. A 2021 TripAdvisor study found that 70% of respondents say reviews are very or extremely important when choosing a restaurant.

Based on analysis by GuestXM earlier this year, full-service restaurants that improved their average star rating (ASR) from the previous year saw their traffic decline by only 2% YoY in 4Q 2022 (the norm, for years, has been declining same-store traffic YoY). Companies with a dip in their ASR saw a larger 4% decline in their traffic.

The contrast increases much more when we extend the time frame. Brands that improved their ASR watched their traffic increase by 3% compared with the same period three years ago, while those with a negative change saw a 1% decrease.

Most Limited-Service Restaurants Have a Rating of 3.7 Stars or Less; in Full Service the Majority Are Rated 4.0 Stars or More

According to GuestXM Reputation Management, which collects the customer-facing Google star rating of all its customers and their competitors’ units, 70% of limited-service restaurants are rated between 3.0 and 4.0 stars, while only 42% of full-service restaurants fall within this category. In contrast, nearly 60% of full-service restaurants have a 4.0-star rating or better, while only 26% of limited-service restaurants reach these levels.

It is important to note the distinction between a company’s ASR for one year and its customer-facing ASR (what potential guests see when searching for a restaurant). Google Ratings analysis allows restaurants to determine their overall star ratings in addition to their most recent ones. As a result, improvements may not have the expected impact on customer-facing star ratings after a year. Depending on a restaurant’s size and years in operation, changing a star rating is less like a sprint and more like changing course on an ocean liner. It takes time, patience, and the cooperation of the whole crew.