November 14, 2023 CHICAGO–(BUSINESS WIRE)–dunnhumby, the global leader in customer data science, today released a special edition of the dunnhumby Retailer Preference Index (RPI), designed to determine which retailers in the $1 trillion U.S. grocery market personalize the shopping experience best for their customers.

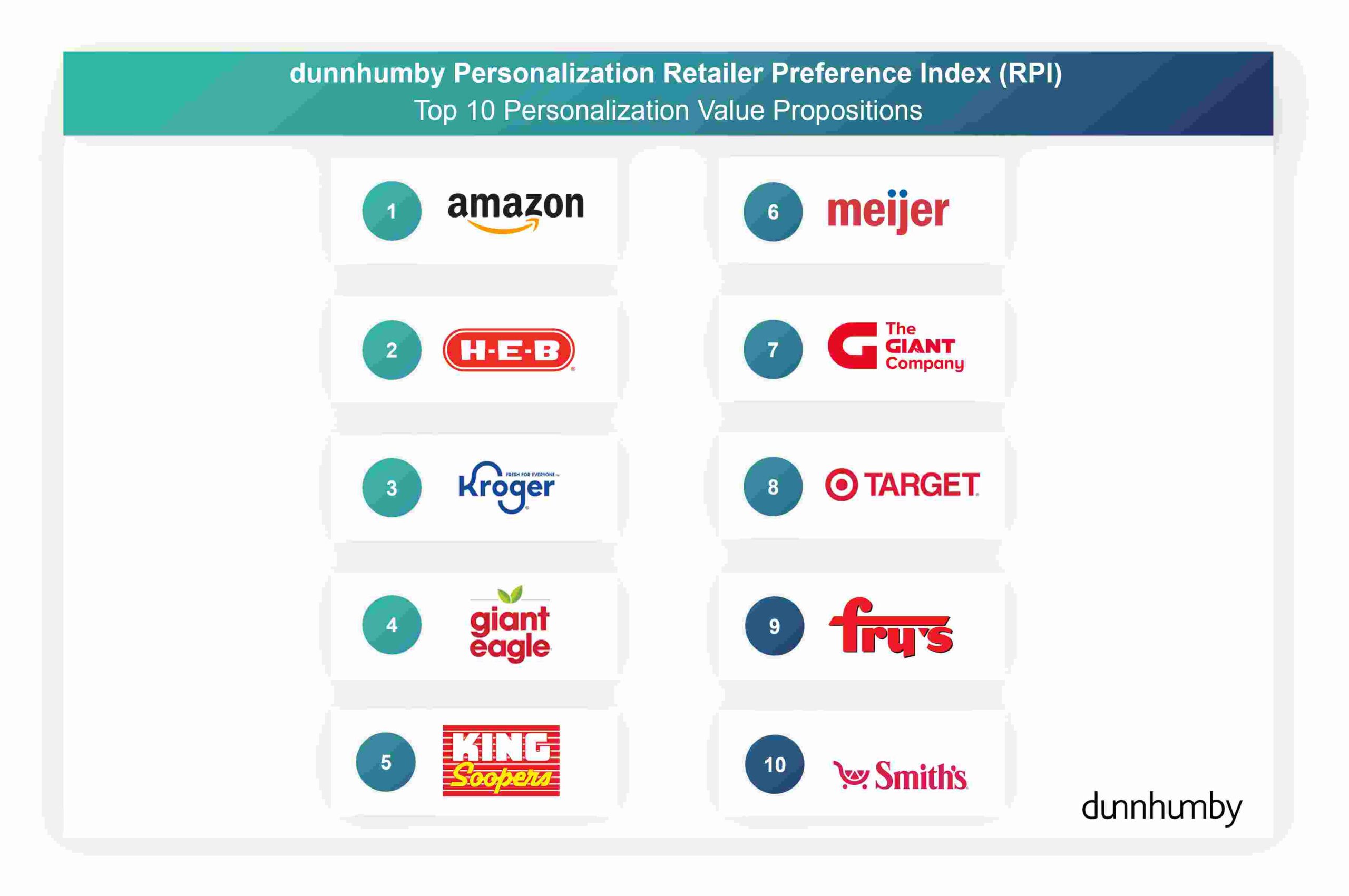

In this inaugural RPI for Leadership in Personalization, dunnhumby found that Amazon BB #:283186 stands apart from all other retailers followed by H-E-B BB #:106490 in second and Kroger BB #:100073 rounding out the top three. These three retailers are at the top of the rankings because they deliver targeted savings, a localized assortment, and a frictionless shopping experience best.

The seven retailers with the next highest overall customer preference index scores are: 4) Giant Eagle, 5) King Soopers, 6) Meijer, 7) The Giant Company, 8) Target, 9) Fry’s, 10) Smith’s.

Seventy percent of those in the top-quartile of the Personalization RPI (PRPI) ranking also are in the top quartile for Targeted Savings, the most important personalization driver.

“With the long-term trend of shoppers across all income brackets demanding lower prices, personalization is an opportunity for grocers to better retain and acquire customers,” said Matt O’Grady, President of dunnhumby for the Americas.

“The goal of this report is to help retailers improve personalization as a whole – the way customers define it. And because customers define personalization as targeted savings, local assortment and a frictionless shopping experience, understanding their preferences is key. The Personalization RPI provides a framework not only for grocery retailers looking to lead the market in personalization, but also for those who are in the earlier phases of their personalization journey who are trying to understand where to focus their resources.”

The dunnhumby RPI is the only approach to ranking grocers that combines financial results with customer perception. The PRPI includes 65 of the largest grocery retailers in the industry that sell everyday food and non-food household. For the Personalization RPI, the financial data and the customer perception data is sourced from dunnhumby’s survey of 10,000 American grocery shoppers.

dunnhumby analysts cross validate the model with financial data from Edge by Ascential, foot traffic data from Placer.ai, and web traffic data from Similarweb to ensure that grocery retailers who rank higher in our approach are driving a higher share of visits and bigger basket sizes.

Our personalization RPI model also identifies which dimensions of the personalization proposition matter the most for driving financial and emotional performance by grouping 30+ personalization Levers into three main personalization preference drivers: Targeted Savings, Frictionless Experience, and Localized Assortment.

Key findings from the study:

- Only Amazon, H-E-B, Target, and Shoprite who ranked in the top quartile in dunnhumby’s annual US Grocery RPI published in January 2023 were also ranked in the top quartile in the PRPI. Perennial top quartile performers Costco and Aldi as well as fast growing, hard discounters Dollar Stores, Lidl, and Grocery Outlet are absent from the top two quartiles of the report due to not relying on personalization to drive growth but instead relying on geographic expansion and cost-control measures to drive scale. If their ability to expand into new markets diminishes in the future, these grocery retailers will need to look to personalization to drive growth with current customers.

- Retailers in the top quartile outperform the rest of the retailers on benefits, costs, or both. For top quartile grocery retailers, this translates to a 14% increase in shoppers with a strong emotional connection, a 41% increase in share of wallet, a 34% increase in online visits per month per person, and a 131% increase in traffic share in a grocery retailer’s footprint compared to retailers in the third and fourth quartiles.

- By accepting that customers define what “personalization means to themselves, not the grocer,” retailers have the opportunity to compete with Amazon and every-day-low-price (EDLP) retailers with customer data. For grocery retailers, it’s about serving the customer according to their stated and implicit preferences.

- Smith’s, Winn-Dixie, Kroger, Fry’s, and Giant Eagle offer shoppers the best Targeted Savings. Forty-five percent of personalization-related grocery retailer outcomes are driven by Targeted Savings. Leaders in this driver do two to three times better than laggards at rewarding shoppers, helping them save money (via the loyalty program), and making it easy for them to do so (an easy-to-understand program and point redemption).

- H-E-B, Big Y, Wegmans, Food City, and Schnucks offer the best Localized Assortment, the second most important driver of personalization. Localized Assortment drives 28% of personalization-related grocery retailer outcomes. Leaders in this space perform 1.5-2 times better than laggards at providing shoppers with the right variety of products to meet their needs, local product variety (from local farmers or businesses) and a close connection to the local community. Localization and hyper-localization can help customers feel like a grocery retailer knows them personally.

- Amazon, Target, H-E-B, CVS, and Walgreens provide shoppers with the best Frictionless Experience, the third most important driver of personalization. A Frictionless Experience drives 27% of personalization-related outcomes. Amazon is peerless in Frictionless Experience ranking number one across all retailers in 10 out of the 11 frictionless experience levers.

- Target is the only retailer to beat Amazon in one lever – web and apps. Frictionless Experience Leaders perform roughly two times better than laggards at reminding shoppers (usual items, forgotten items, previously bought items, follow-ups), providing relevant products and topics, providing digital ease (making it easier to shop online or via the app), and personalizing both the online and in-store experience.

- Personalization matters most to shoppers in Baby Care (63%) – a category customers are particularly attached to, and that’s true across all three drivers. Personalization also matters in Health Care (53%), and Ready-to-Eat (52%) but their importance will vary by driver.

The full RPI report can be accessed today.

Retailers included in the RPI that are interested in receiving their individual banner profiles can speak with their dunnhumby account executive or contact dunnhumby at: https://www.go.dunnhumby.com/personalization-deep-dives.

About dunnhumby

dunnhumby is the global leader in Customer Data Science, empowering businesses everywhere to compete and thrive in the modern data-driven economy. We always put the Customer First.

Our mission: to enable businesses to grow and reimagine themselves by becoming advocates and champions for their Customers. With deep heritage and expertise in retail – one of the world’s most competitive markets, with a deluge of multi-dimensional data – dunnhumby today enables businesses all over the world, across industries, to be Customer First.

The dunnhumby Customer Data Science Platform is our unique mix of technology, software and consulting, enabling businesses to increase revenue and profits by delivering exceptional experiences for their Customers – in-store, offline and online. dunnhumby employs over 2,500 experts in offices throughout Europe, Asia, Africa, and the Americas working for transformative, iconic brands such as Tesco, Coca-Cola, Meijer, Procter & Gamble and Raley’s.

Contacts

Media Contact for dunnhumby

Theresa Smith

Silicon Valley Story Lab

theresa@siliconvalleystorylab.com

+1-818-681-6456