The retail apocalypse, so much dreaded a year or two back, did not entirely materialize, but it was not completely illusory either, as we see from the closings of major flagship stores in downtowns like those of San Francisco and Chicago.

Yet on the whole, it did not prove true in any great detail for retail grocery.

Not long ago, some feared that the rise of e-grocery spelled doom for the brick-and-store supermarket. That no longer seems likely. There will of course be changes and consolidations in retail grocery, but it no longer looks like an endangered species.

Online grocery is, by contrast, declining.

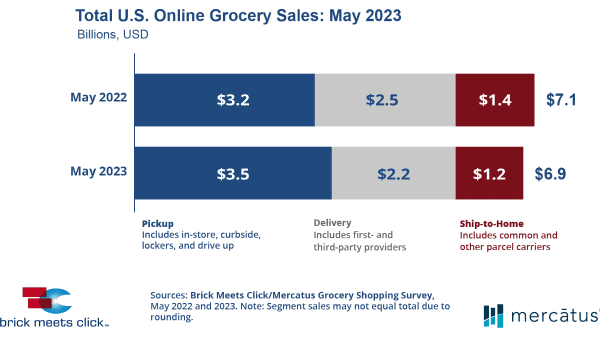

“The U.S. online grocery market finished May with $6.9 billion in total sales, down 3.4% compared to last year’s $7.2 billion, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded May 30-31, 2023. The dip in overall sales for May 2023 was driven by a combination of fewer households buying groceries online during the month than last year and a decline in the average number of orders placed by active shoppers,” says Brick Meets Click.

“Results were mixed across the three receiving segments,” the release continues. “Pickup recorded the only year-over-year growth and captured its largest share of sales to date, climbing 9.1% and contributing 50.7% of total eGrocery sales. Ship-to-Home fell 17.0% versus last year and accounted for 16.8% of eGrocery sales during the month, continuing to post weaker results each year since 2020. Delivery declined 11.7% compared to last year, and its dollar share dropped nearly two points to 32.5% for the month.”

We also learn that “online’s share of total grocery spending dropped in May, falling 270 basis points to 12.1% versus last year.”

The decline in online grocery was foreseeable. The category was greatly boosted by the pandemic, which led millions of shoppers to stay away from stores. Pandemic benefits also made many customers feel flush, so any added delivery costs were seen as minimal.

Today, with over a year of sharp inflation and an end to the pandemic, it makes sense that online grocery purchases are seeing a decline.

As I have said before in this column, e-grocery is ideal—even vital—for certain market segments, including the elderly and the disabled. The online option is clearly of great benefit to them.

To these, we can add people with agoraphobia, who avoid going out at all costs (and there are probably more of them than we may suppose), and hyperbusy affluents, who realize that online delivery costs are minimal compared to the hour or two they are losing with brick-and-mortar shopping.

These market segments will not go away, and neither will e-grocery. How much it will continue decline remains to be seen. At some point, the rate is likely to level out—probably as inflation comes more into line with historical levels.

Current yearly U.S. inflation rates are dropping: as of May, they were rising at an annual rate of 4 percent, compared to 7 percent in 2021 and 6.5 percent in 2022.

This trend away from online grocery probably benefits the produce industry, whose sales rely more heavily on visual and tactile appeal than for most sectors. After all, nobody has to worry about whether their laundry detergent is ripe or not.