More wet Southeast weather is in the forecast this week—welcome news for drought-weary Florida, but not as joyful news for tomato lovers. Showers are forecasted to barrel through the state beginning Monday afternoon and continue through the week.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.21/pound, up -0.8 percent over prior week

Week #16, ending April 21st

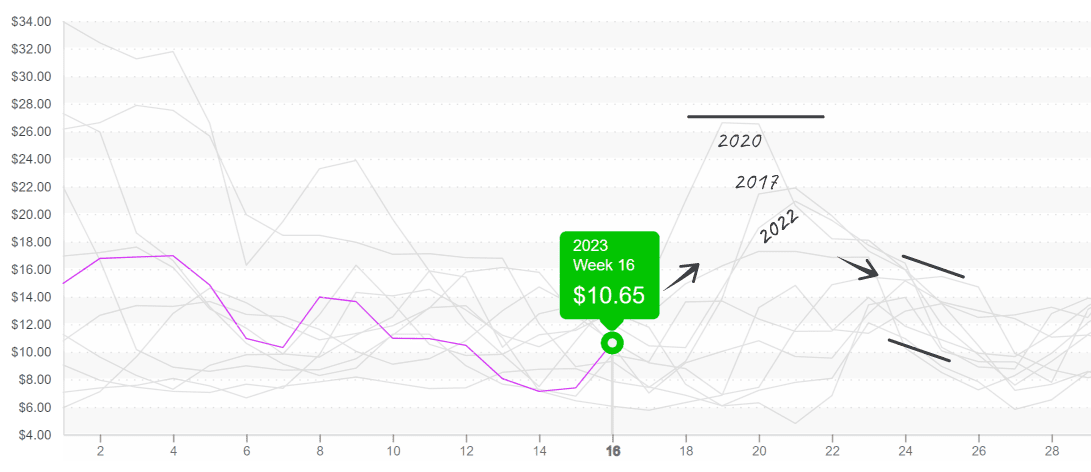

Rain in Florida and declining Mexican supply are spiking tomato prices. Round, plum, and grape-type tomatoes are all up an average of +20 percent over the previous week. Mexican supply is following its annual Spring decline in export volume.

Currently, tomato prices are on the lower end of the historical spectrum but could change rapidly as weather events intensify supply challenges. Supply for all varieties will likely remain tight over the next few weeks as California ramps up production in the West and more warm-weather local options pop up in the East.

Tomato (round) prices are heading northward from modest levels; prices typically rise for the next four weeks.

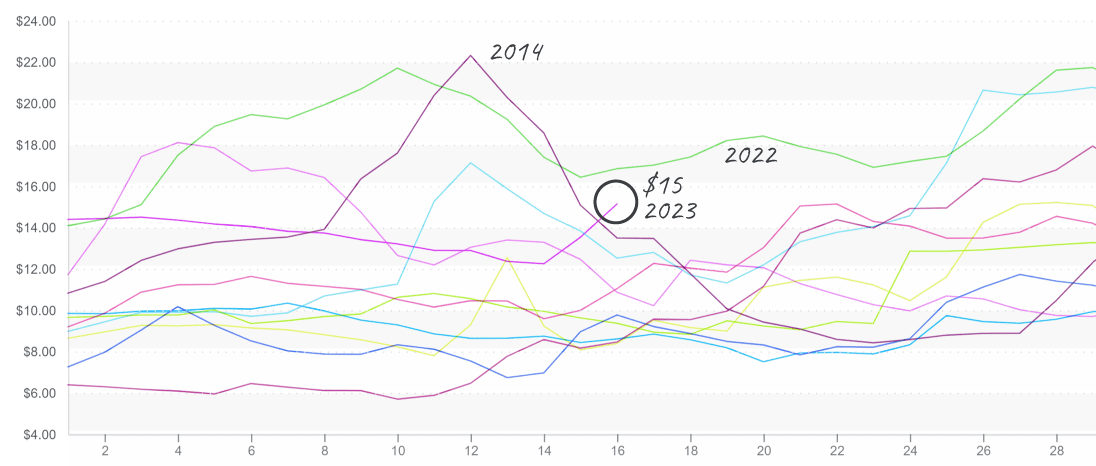

Up +13 percent over the previous week, dry onion markets are heating up. Due to rain, Texas supplies are lighter than usual, the Northwest season is winding down, and California production is still a week out.

Like Florida, more rain is in the forecast for Texas this week. Still, fortunately for onion buyers, it will probably only affect produce growers in East Texas (most onion growers in Texas are in the West and South.)

Yellow and White onions are each $15; white rose from $9 three weeks ago.

Broccoli and cauliflower buyers must feel like they’re raining coins. It must be the effects of climate “change.” Both commodities technically still increased in price week over week but are nearing a plateau.

Unfortunately for buyers, relief in the form of meaningful supply increases is still unforeseeable. Keep an eye on these commodities as growers in Salinas, CA, pick up production.

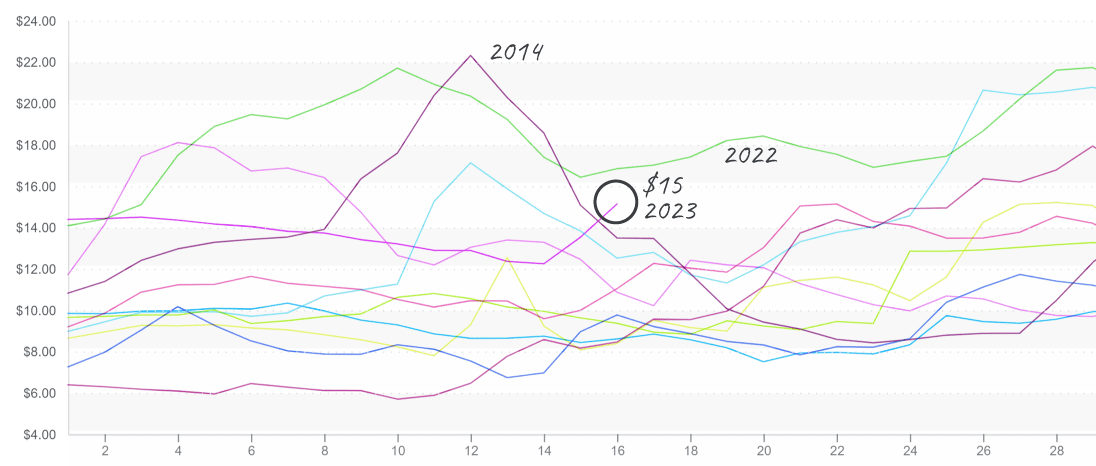

Yellow squash markets are also firming up due to rain in the sunshine state. Week #16 volume is significantly behind historical norms. Western squash markets are faring much better than their Eastern counterparts, with good supply/quality still coming out of Nogales.

Like other Florida-origin commodities, the week’s weather may do some damage in the short run but will undoubtedly benefit from the much-needed precipitation in the long term.

Yellow squash prices rise above $15, yet don’t stay high for long.

Strawberry prices are finally out of record-breaking territory. Prices are down -16 percent week over week due to gradually increasing volume out of Southern California—good news, as volume is still shockingly behind historical norms for week #16.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.