Up for the third week, overall produce prices are still technically following typical week #14 trends. Although, the storms that drenched California and filled the Sierras with snow will likely unfold as higher-than-normal produce prices over the next few months.

Outstanding increases in the price of key commodities like lettuce and broccoli are setting markets up for a bumpy Spring transition.

ProduceIQ Index: $1.20/pound, up +4.35 percent over prior week

Week #14, ending April 7th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

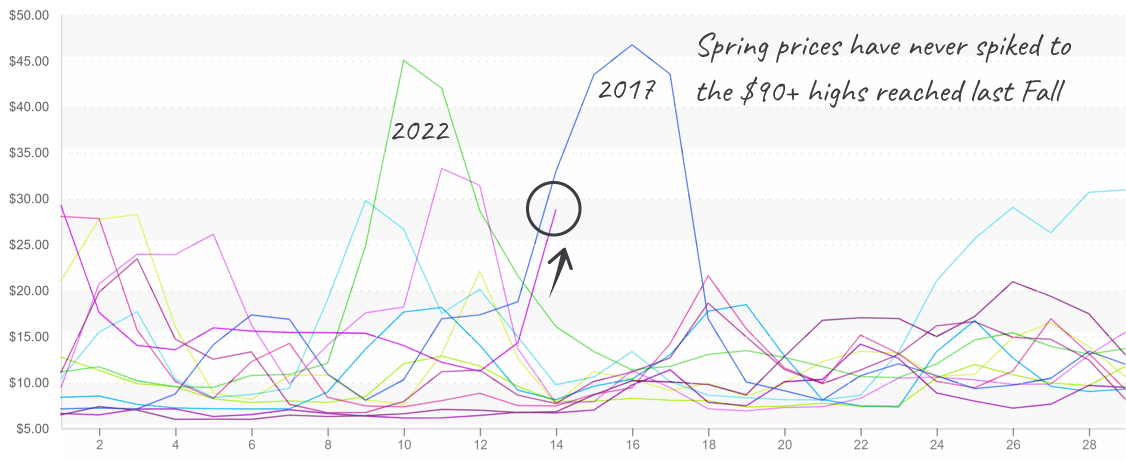

Cauliflower markets are so behind schedule that it’s starting to give us secondary anxiety. As a result, prices are up a draw-dropping +130 percent over the previous week to a staggering ten-year high of $55.

Warm weather in Yuma has ended most fields, and peak Salinas production is a few weeks behind schedule. Supplies are forecasted to remain tight for the next 4-5 weeks. Buyers, in a pinch, should look to growers in Mexico or Santa Maria, CA, to cover shorts.

Cauliflower prices launch vertically and will be interesting to watch.

Compared to cauliflower’s reaction, a broccoli price increase of +55 percent over the previous week seems mild. Like cauliflower markets, price stability is still a way off; however, growers are optimistic that warmer weather will improve yields sooner than anticipated.

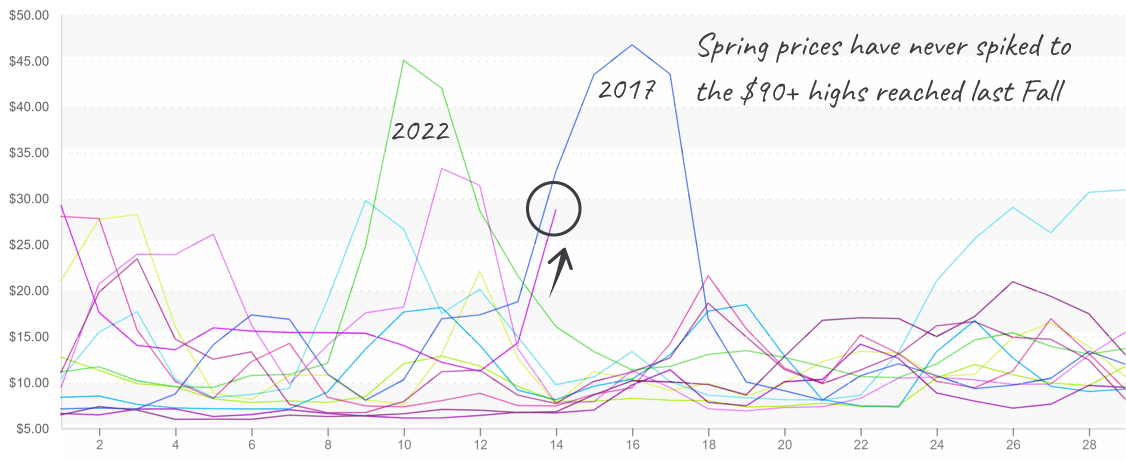

Lettuce prices are on the higher end of the historical spectrum but are still in line with seasonal trends. Iceberg and Romaine growers in Yuma are wrapping up production. It doesn’t help matters that the region responsible for growing almost half of the annual lettuce supply is severely behind schedule due to flood damage.

Growers in Yuma are also wrapping up a bit earlier than forecasted owing to a bout of warm weather.

Low supply and strong demand are setting lettuce markets up for a rocky transition out of the Arizona desert and into more Northern growing regions.

Iceberg prices are up +103 percent, and romaine is up +52 percent over the previous week. Prices are poised to climb higher over the next few weeks as Salinas growers fight against the clock.

Iceberg prices flex upward in a similar trajectory as in 2017

We hope you enjoyed those Easter holiday asparagus promotions while they lasted; Mexican supply is quickly fading, and domestic production is still a few weeks out. In the meantime, Peruvian growers will work to cover the gap. Though, unseasonably warm weather in Peru may further strain supply and raise prices.

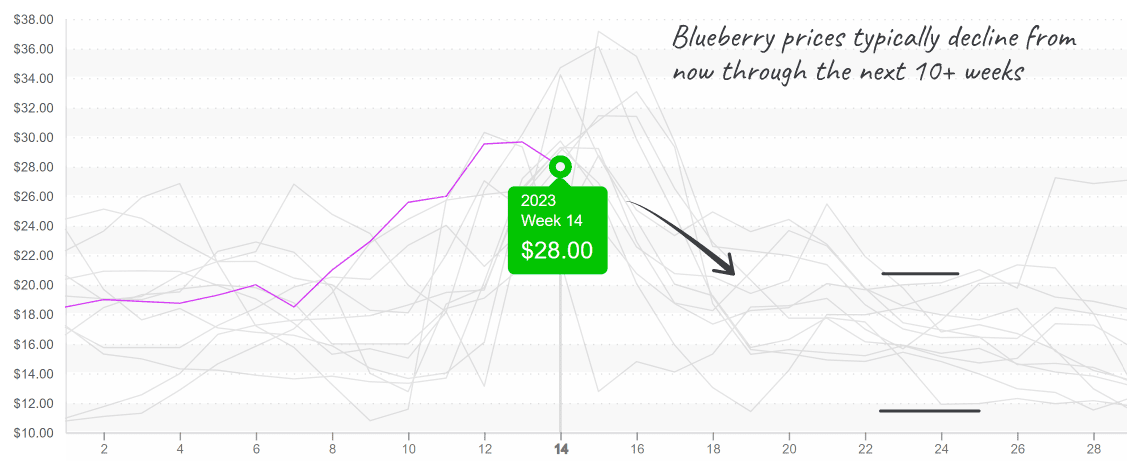

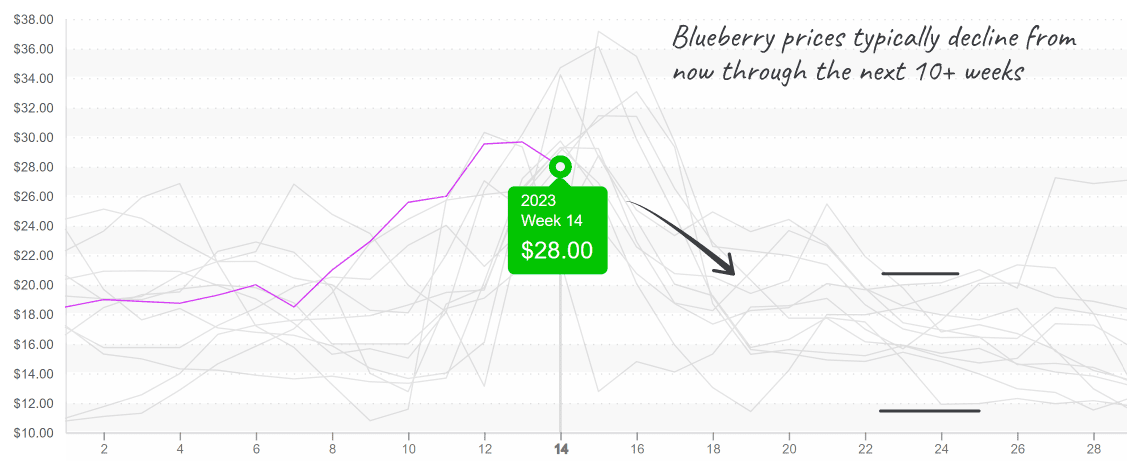

On a sweeter note, the beginning of Florida’s blueberry season provides some relief to elevated berry markets. As more growers in the Southeast and California come online, blueberry prices will likely decline with lots of opportunities for local promotion.

Blueberry prices begin a steady decline after peaking in a supply transition.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.