Howdy, from Viva Fresh in Grapevine, Texas!

Light is at the end of the tunnel for weary, water-logged California growers. April marks the end of the state’s typical rainy season. Ninety percent of San Francisco’s annual precipitation falls between November and April.

But before we can bid adieu to flood-ridden headlines, CA growers are in for at least one more bout of severe weather this week. The storm is forecasted to slam Northern CA Monday afternoon and continue its assault on the rest of the state through Wednesday.

The annual transition northward from areas such as Brawley, CA, back to Salinas, CA, is behind schedule. Growers in the South will attempt to prevent a gap in production by extending the harvest.

ProduceIQ Index: $1.04/pound, up +9.5 percent over prior week

Week #12, ending March 24

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Despite the improving supply of many commodities such as sweet corn, cauliflower, and tomatoes, overall produce prices are up due to substantial increases in the grape and berries category.

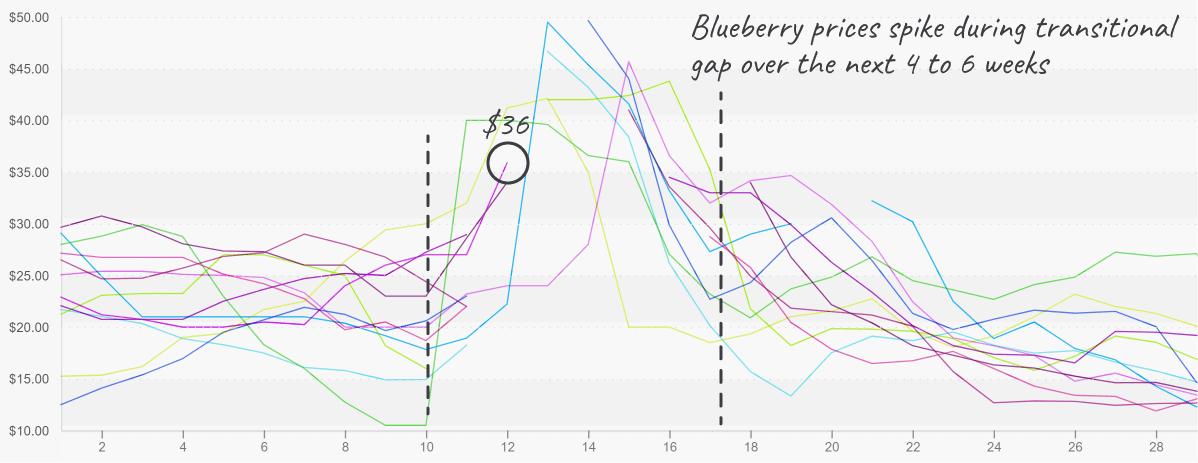

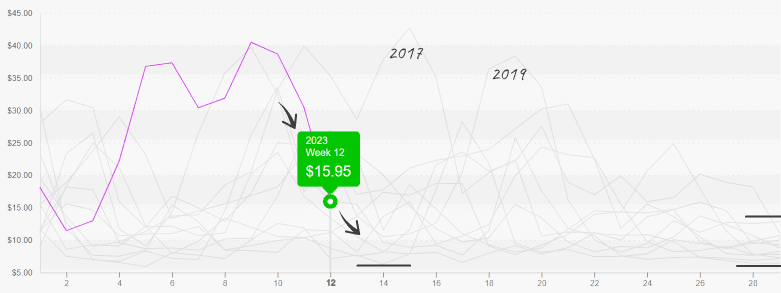

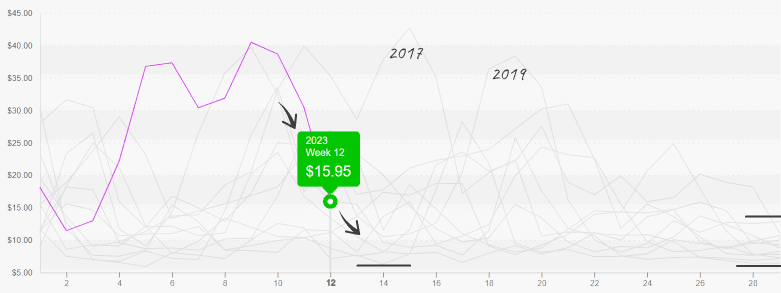

Nearing 2020’s ten-year high, blueberry prices are up +67 percent over the previous week. Prices are spiking due to a temporary gap in supply.

Mexico is supplying the bulk of blueberry volume right now. Chile’s domestic season is on the decline and Georgia and Florida have yet to begin in a significant way. Prices will likely settle within the next three weeks as domestic growers pick up production.

Caused by seasonal supply gap, blueberry prices reach a volatile climax.

Strawberries carve out a ten-year high during a season typically defined by declining prices. FL and Central Mexico are ready to pass off the metaphorical baton to Central CA, but growers are still swimming toward the starting line.

Flooding in California caused by successive powerful storms is tightening a declining strawberry supply. With another storm aimed at the state this week, strawberry prices will almost certainly remain on the higher end of the historical spectrum for the remainder of the growing season.

Warmer weather in Yuma is softening cauliflower and broccoli markets. Cauliflower prices are down -49 percent and broccoli -4 percent over the previous week. Markets may trend lower for the next two weeks before increasing again if production in the Salinas/Watsonville areas is delayed by the weather.

Cauliflower prices crash back towards ‘normal,’ if that were to exist in this market.

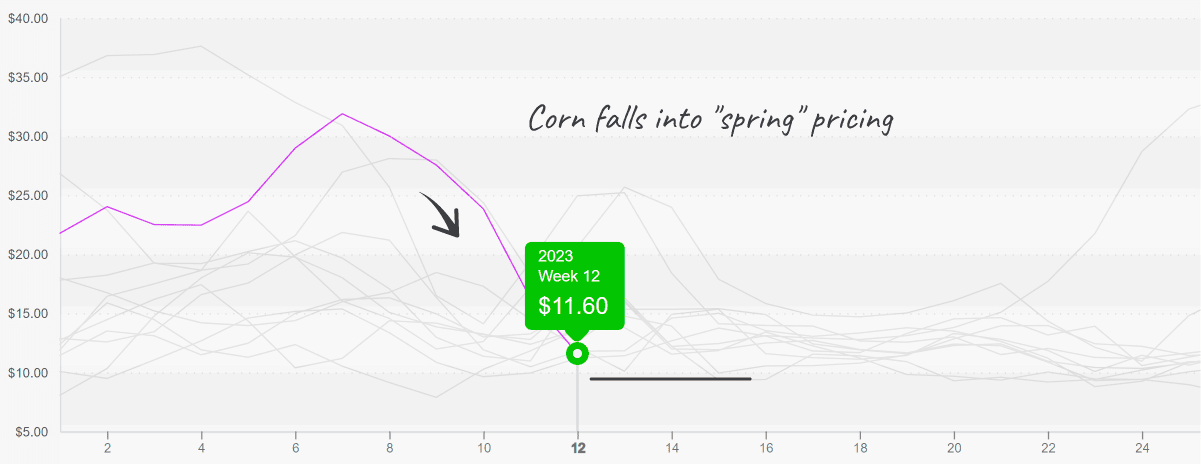

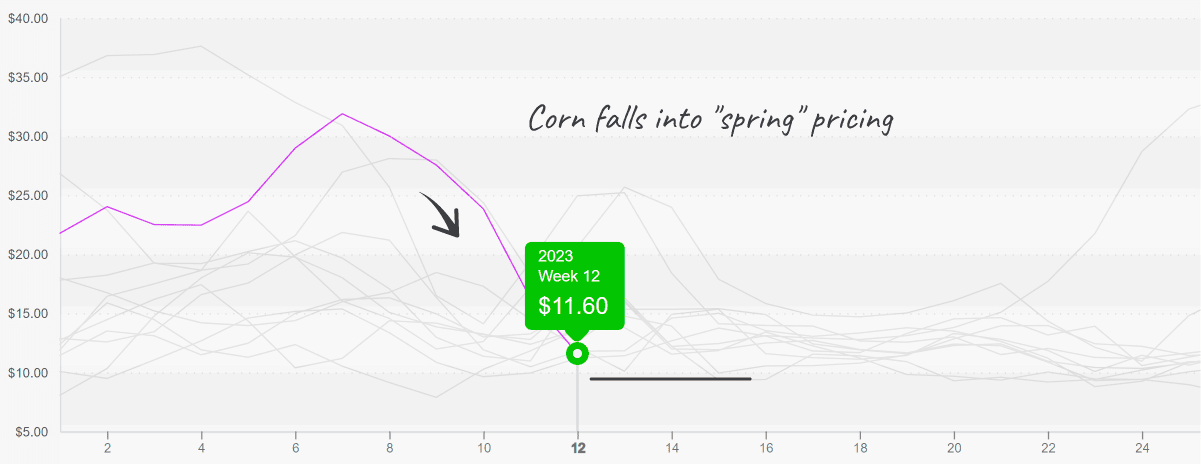

Superb sweet corn supply from East and West coast growers is easing prices to near-historic lows. Expect prices to trend even lower over the next two months as Florida enters a period of peak production and California growers come online.

Corn prices are near historical lows; it’s time to promote!

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.