Happy Monday, if you’re feeling worn out after yesterday’s big game festivities, count your blessings. At least you’re not an Eagles fan.

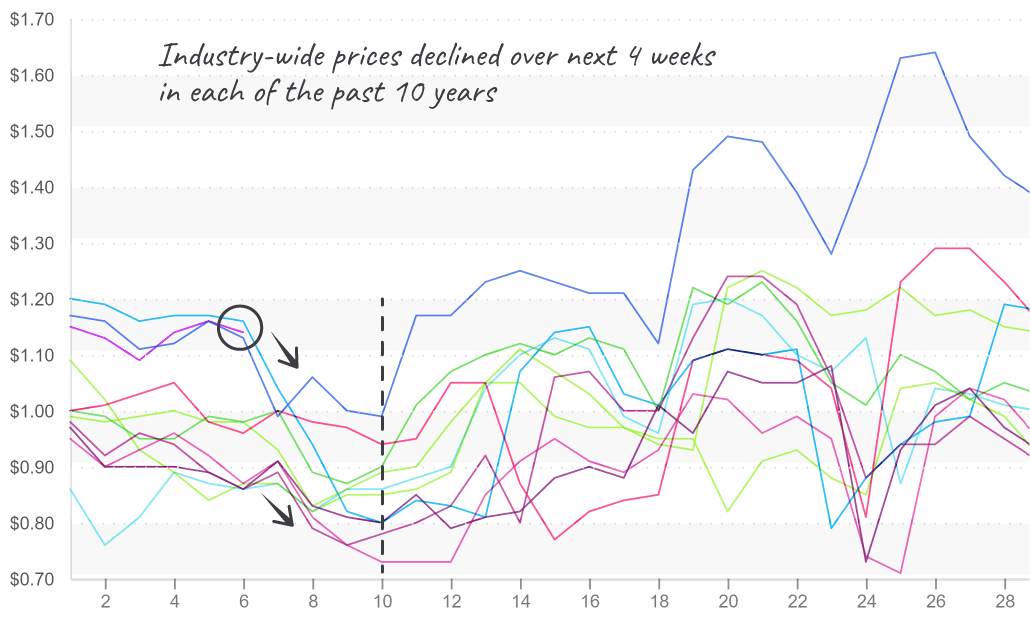

Industry-wide prices continue to decline as Mexican supply peaks during this time of year.

ProduceIQ Index: $1.14/pound, down -1.7 percent over prior week

Week #6, ending February 10th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

However, with some commodities, such as peppers, the increase in supply is unavoidable.

Unlike in the Eastern U.S., which has many successive plantings (each harvested for a short time, e.g., one month), Mexican plant varieties have a longer cycle, are grown much taller, and the same plant is harvested for several months. As a result, this plant will produce less marketable peppers at the beginning and end of the season yet will flush with pepper in mid-season (e.g., February), driving lower prices.

Industry prices fall in mid-February as Mexican supply ramps up.

PSA: Tomorrow IS Valentine’s Day. Let your loved ones know just how much you care for them with some mouthwatering in-season strawberries.

After weeks of record-high prices, strawberry markets are down -18 percent. Prices are down due to improved supply and waning holiday demand. Supply out of California and Mexico has improved significantly, but production in Florida still needs to catch up.

Strawberry prices, at $18.25, continue their decline from record highs.

In other Florida news, corn prices are up to a shocking $28. The cold snap that brought beautiful surfing to South Florida a few weeks ago is causing a significant gap in supply. Reported production volume out of Florida is below average for week #6.

Unfortunately for Florida corn lovers, the supply gap is forecasted to persist through what is usually the sweetest first weeks of the state’s corn season. Florida is cooler now, though it should warm up by the end of the week.

North of $28, corn prices prove midwinter volatility is here to stay.

In a surprising turn of events, lime prices are rising again, up +23 percent over the previous week. Rain and cool weather delay harvest, intensifying the effects of a seasonal decline in supply as Mexican growers transition from the old crop to the new crop.

As is the trend for week #5 through week #15, supply will remain low and prices high through March.

Broccoli prices ease up while cauliflower markets gingerly climb upward. Due to the cool weather in Mexico and Arizona, broccoli supply is slightly lower than usual. However, supply is expected to improve over the next few weeks as production in Watsonville picks up.

With limited supply in the forecast for the next few weeks, a decline in cauliflower prices is farther off than buyers might hope for. Chick-fil-a isn’t helping matters by inconveniently launching the so-called “plant-forward” Cauliflower Sandwich.

Jokes aside, cauliflower prices are still entrenched in record-breaking territory due to cold weather-related challenges. Prices are forecasted to remain high as crops in Yuma and Mexico recover from the repeated bouts of wintery weather.

Cauliflower prices plateau near the high prices of 2017 and 2019

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.