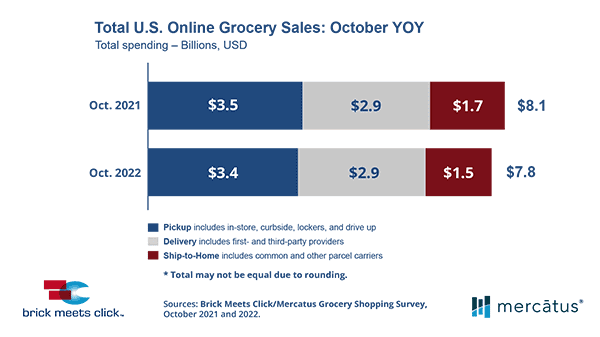

Barrington, Ill. – November 14, 2022 – The U.S. online grocery market finished October with $7.8 billion in total sales, down 3% compared to a year ago and flat versus the prior month, according to the monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded October 28-29, 2022. While October’s year-over-year decline was similar to the prior month, October’s results were driven by different factors, including changes in spending per order, order frequency, and monthly active users (MAUs), that were not evenly distributed across the leading retail formats like Mass and Grocery.

“Beneath the top-line results, the monthly active user base grew much faster for Mass than for Grocery versus last year which may be driven to some degree by inflation’s impact on household spending, but it also reflects the ability of Mass to provide a better shopping experience,” said David Bishop, partner at Brick Meets Click. “Improving the shopping experience is vital for conventional supermarkets’ long-term success as the appeal of shopping online has more to do with convenience than cost.”

During October, and unlike the prior month, all three segments (Pickup, Delivery, and Ship-to-Home) experienced slowdowns in spending per transaction, declining 5% in aggregate versus the same period last year. Ship-to-Home’s average order value (AOV) contracted the most, dropping nearly 11% versus a year ago; Delivery’s AOV slipped more than 7%, and Pickup’s dipped just over 3% during the comparable periods. This broad-based downturn in online grocery spending suggests that customers are either shifting some purchases offline and/or buying fewer items in general due to a challenging economic outlook combined with persistent price inflation.

Order frequency, defined as the number of orders received by MAUs during the period, was another area where October trends differed from those in September. The composite order frequency for October fell nearly 7% as all three segments slipped versus last year. For the specific segments, Ship-to-Home MAUs declined the most, receiving 12% fewer orders in October compared to last year, while Pickup contracted 7%, and Delivery was essentially flat, declining less than one-half of a percent. The softening of this metric indicates a subtle shift in how customers get groceries, with offline purchases gaining from more in-store trips.

The overall eGrocery MAU base, which encompasses users of Pickup, Delivery, and Ship-to-Home, grew by 10% in October on a year-over-year basis but slipped slightly versus last month. Each segment experienced growth in its respective MAU base, driven by a 10% gain for Delivery, followed by an almost 8% lift for Pickup, and a nearly 6% bump in Ship-to-Home users. Although the difference between the MAU base for October and September may reflect the impact of less-frequent customers who cycle in and out of online grocery shopping, the positive trends across the board highlight a larger customer base that retailers can nurture to unlock additional, latent demand.

The effects of persistent price inflation were evident in total grocery spending as the average dollars spent on groceries per household during the last week of October increased 15% versus last year. During that period, online’s share of spending dipped around 50 basis points, accounting for 11.6% of total grocery sales in October of this year. Excluding the Ship-to-Home segment (since it is not offered by most conventional supermarkets), Pickup and Delivery’s combined contribution was 9.4% during the same period.

For October, the cross-shopping rate between Grocery and Mass, which measures the share of Grocery MAUs who also shopped online for groceries with Mass during the same period, remained steady versus last month at nearly 28% and rose two percentage points compared to a year ago. While approximately two-thirds of this group also shopped with Walmart during both 2021 and 2022, the share that shopped with Target has grown, climbing from about one-third of the group last year to nearly one-half this year. This shopping metric highlights for conventional supermarkets that a sizable portion of their MAU base is likely forming their shopping expectations based on experiences with big-box rivals.

The forward-looking repeat intent metric, which indicates the likelihood that an online grocery customer will use the same service again within the next 30 days, softened versus September but improved compared to a year ago. For October 2022, the repeat intent rate came in at just over 58%, a 110-basis point gain compared to October 2021 but a 230-basis point decline versus the prior month. More importantly, the gap between the respective intent rates for Grocery and Mass has widened significantly, as Grocery now trails Mass by over 7 points versus just 2 points a year ago. This gap highlights how customers are encountering different experiences when they shop Grocery and Mass, and that may impact future usage considerations.

“As grocery retailers look to strengthen their share of monthly active online grocery shoppers, they should focus on working smarter, not harder,” said Sylvain Perrier, president and CEO, Mercatus. “This means making sure that your assortment is accurately reflected online, the online ordering process is engaging and streamlined, and there are no unfortunate surprises for customers during the order assembly and receiving process.”

Check out the Brick Meets Click eGrocery Dashboard for October 2022 or visit the eMarket/eShopper page for additional insights and information about the full report.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on October 28-29, 2022, with 1,732 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – Sept. 29-30 (n=1,752), Aug. 29-30 (n=1,743), July 29-30 (n=1,690), June 29-30 (n=1,743), May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.