‘It ain’t over till it’s over.’ We are in the final stretch of the Atlantic Hurricane Season, but surprisingly, there is still activity threatening Florida.

A tropical disturbance close to Puerto Rico has an 80 percent chance of turning into a tropical storm in the next 48 hours. As of now, the Eastern coast of Florida is in the storm’s projected path.

Regardless of the storm’s status, Florida will receive rain this week and a lot of it, which is unhappy news for growers still recovering from Ian.

ProduceIQ Index: $1.11 /pound, up +2.8 percent over prior week

Week #44, ending November 4th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

In other tropical news, the U.S. is suspending Haitian mango imports to protect government employees from possible endangerment.

Mercifully, this won’t have the same impact as last year’s Mexican Avocado situation; Haitian mangoes account for less than 3 percent of mango production, and buyers have until January to find new suppliers.

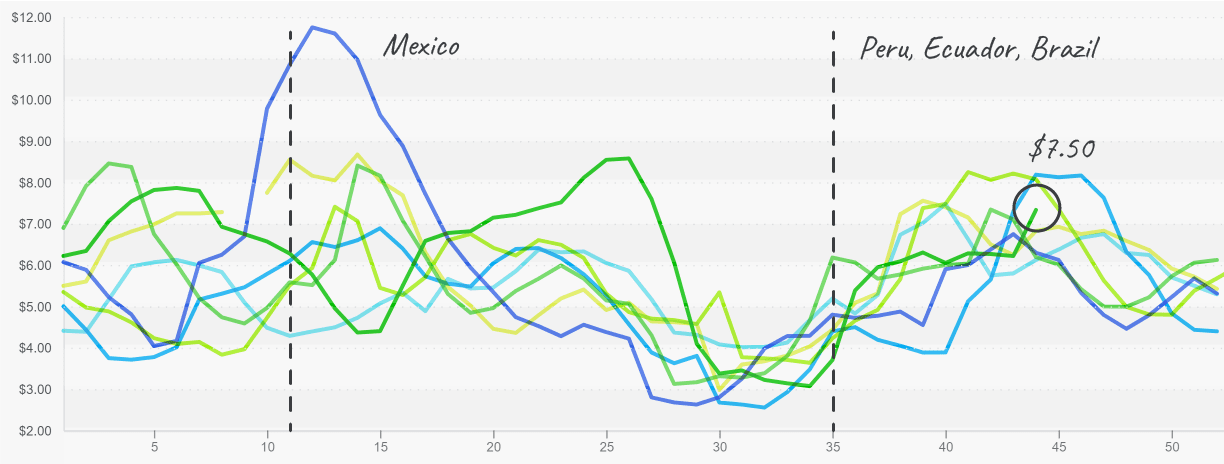

Mango prices are up 24 percent over the previous week due to a dwindling Mexican supply. However, prices should ease as we get closer to the peak Peruvian export season in December. Expect tight supply and elevated prices as Brazil, Ecuador, and Peru increase shipments.

Mango prices rise without Mexican production

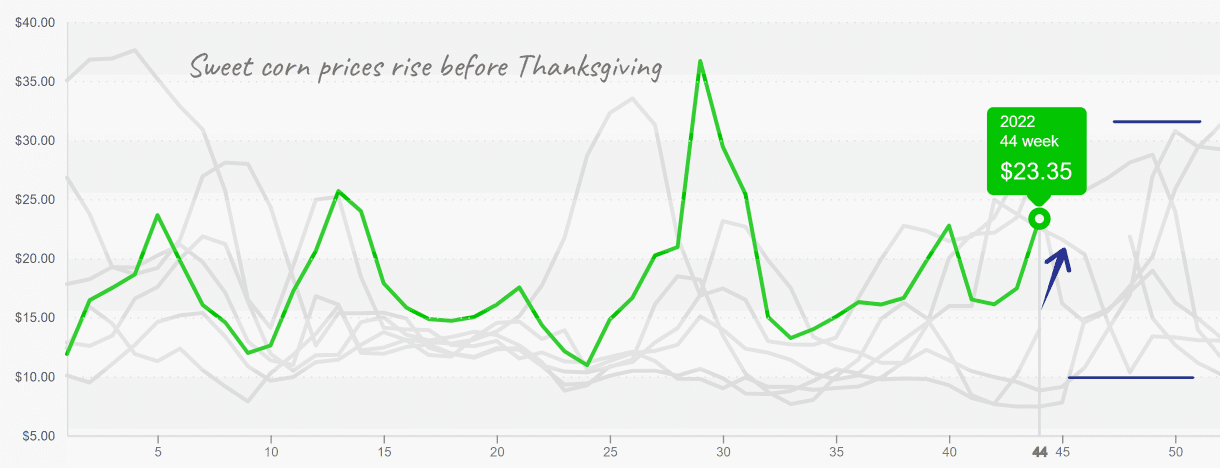

A series of cold fronts has frozen out the last bit of Georgia sweet corn. As a result, Eastern supply is very tight, and prices are responding, up +28 percent over the previous week. Warmer than usual weather in the West has diminished quality, although overall supply is fairly steady.

Barring weather-related damage from a late-season tropical system, Florida will pick up production slowly over the next few weeks and relieve elevated sweet corn prices.

Sweet corn prices rise ahead of transitions

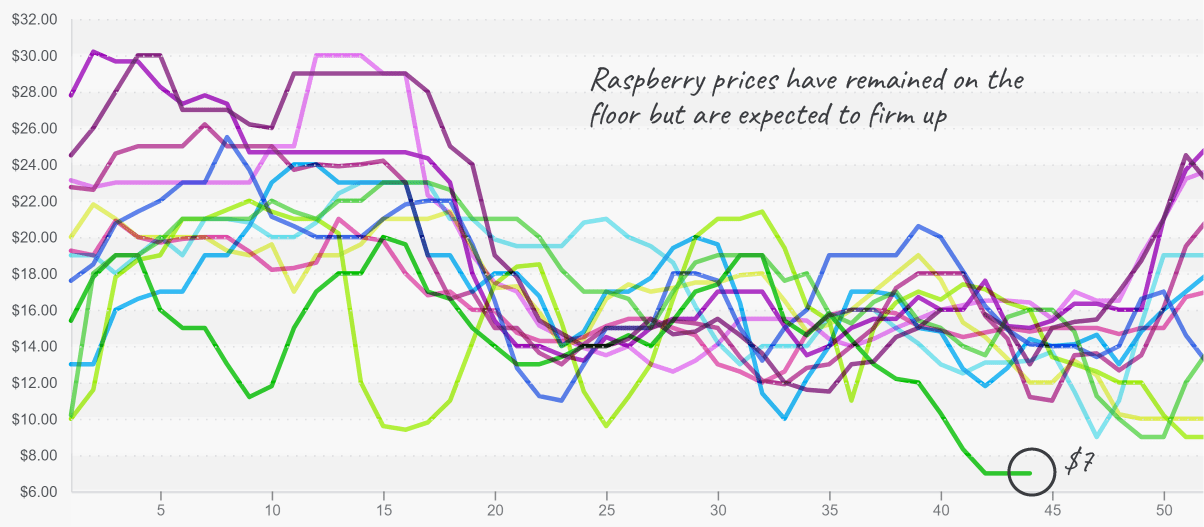

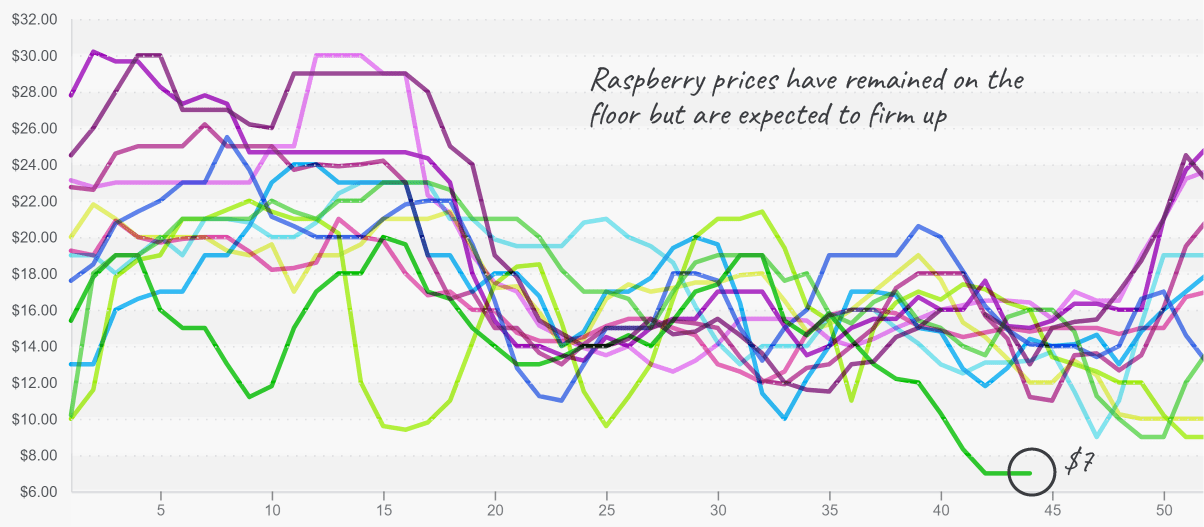

Raspberries have finally found the bottom of the price well. But a silver lining for growers is there is nowhere to go but up from here. Raspberries are still absurdly cheap; however, markets should firm up within the next week or two in response to a steadily decreasing supply.

Raspberry prices remain at 10-year lows

On the opposite end of the price spectrum, record-high cucumber prices are finally catching a glimpse of the light at the end of the tunnel. Cucumber prices exploded over the past few weeks in response to exceptionally limited supply. Florida’s first harvest is expected imminently, and the transition to Southern Sinaloa in Mexico is nearly complete. Expect prices to begin their descent accordingly over the next two weeks.

Florida tomato growers can’t seem to catch a break. Just when growers are beginning to salvage what was left in the wake of Hurricane Ian, another tropical system is on the horizon. Large fluctuations in the amount of water given to tomatoes, e.g., a slow-moving storm system, causes fruit on the plant to crack.

Growers in the East and West are recovering what they can from fields that have suffered heavy hurricane and tropical storm damage. Prices will likely stay elevated through the holidays as suppliers endeavor to meet demand.

I’d be remiss if I didn’t mention that lettuce prices are so high that restaurants are now paying over $100 per case, a significant psychological hurdle.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.