Now this is starting to feel more like hurricane season.

Last week produce growers in Baja California and Nova Scotia scrambled to save their fruits and vegetables from Hurricane Kay (in Mexico) and remnants of Hurricane Fiona (in Canada). On a macro scale, Hurricane Kay will significantly affect overall produce prices; however, the local markets that rely on apples and other produce from Nova Scotia will take some time to recoup from the destruction caused by Fiona.

This week, Tropical Storm Ian is forecasted to undergo rapid intensification. The storm will most likely make landfall on the West Coast of Florida on Tuesday, then heading North towards Georgia. Crops subject to damaging wind and rain this week are various, including tomatoes and dry veg, but growers throughout the Southeast should be prepared.

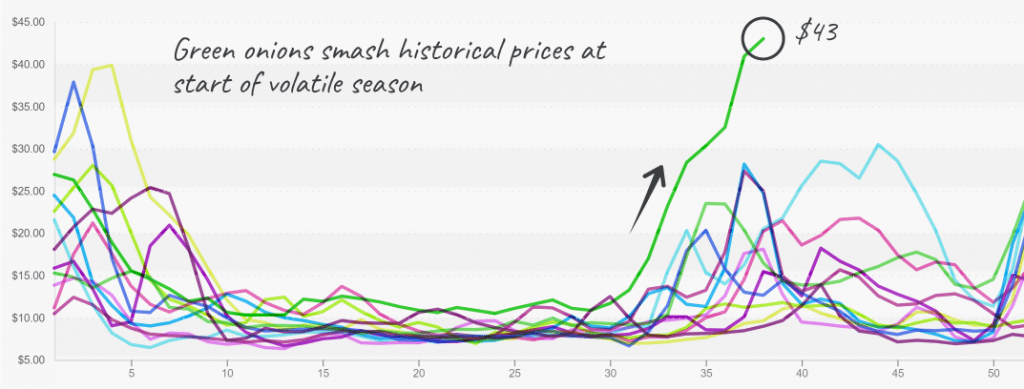

Hurricane Kay recently brought strong winds and heaps of rain to the West coast of Mexico. Green onion supply, just another innocent produce bystander, is suffering the consequences. After months of intense summer heat, the commodity’s supply was already in a precarious position.

ProduceIQ Index: $0.91 /pound, -1.1 percent over prior week

Week #38, ending September 23rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Green Onion prices skyrocket on supply challenges

Now, reported Mexican import volume is in record low territory. Prices and supply should improve over the next few weeks as temperatures cool and Mexico moves into peak production season.

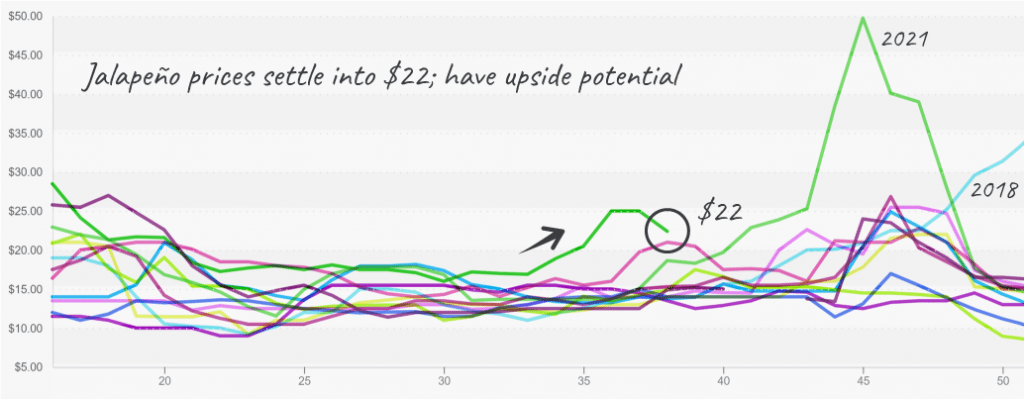

Another victim of Hurricane Kay, Chili peppers, are in extremely short supply in the West. Chili peppers have been in a demand-exceeds-supply situation for some time. But recently, that situation has been worsened by heavy rain and now Hurricane Kay. Georgia and a few Texas chili growers are expected to begin in October, which may provide some relief to elevated prices. That is if the path of Hurricane Ian doesn’t hurt product coming out of Southeast more than the new supply would help.

Jalapeño (1 1/9 through Texas) prices rise before season of volatility begins

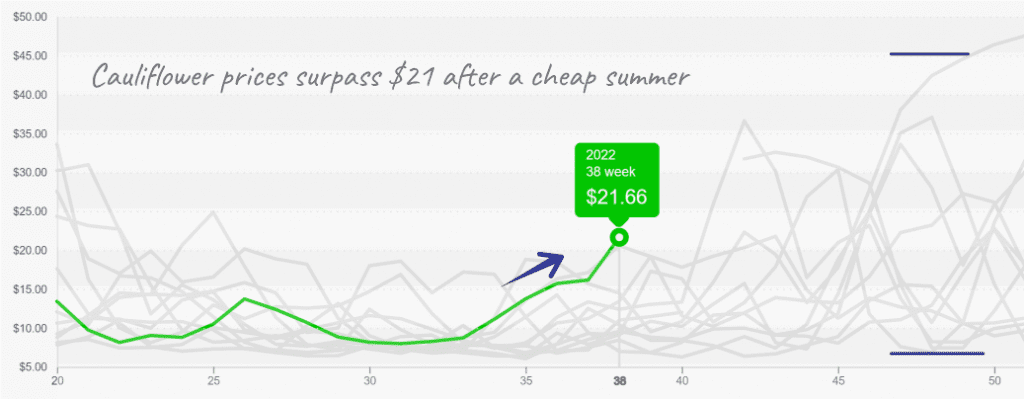

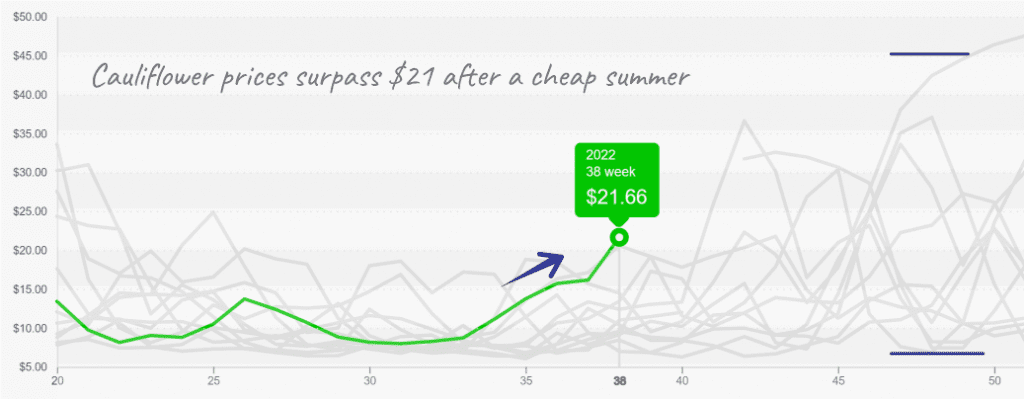

Cauliflower and broccoli markets diverge this week. Broccoli markets have made the fall transition to Mexico, sparing broccoli prices from the fallout of last week’s California heat wave. Unfortunately for buyers, Cauliflower markets weren’t so lucky. Warmer than usual temperatures and rain in Salinas and Santa Maria are spiking cauliflower prices.

Up +36 percent over the previous week, cauliflower prices are at a ten-year high. Cauliflower markets should hold steady; however, that could change over the next couple of weeks if unfavorable weather continues to plague growers.

Cauliflower prices are active heading into the late fall

At $20, cucumber prices are up only slightly this week. Eastern supply is holding prices steady, but markets are vulnerable due to Hurricane Ian. Once the storm lands, Ian’s projected path has it soaking much of the Southeastern growing region, threatening wind and rain to a weak cucumber supply.

Blistering temperatures are setting the cilantro market ablaze. Cilantro prices typically spike over the summer due to high heat and lower yields. This time of year markets are usually on their way down; even so, cilantro prices are at a ten-year high and are expected to climb higher.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.