Q2 results finished 1% higher YOY as eGrocery services and shoppers’ behaviors evolve

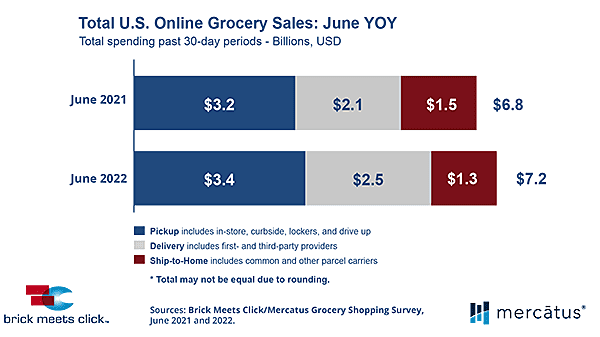

Barrington, Ill. – July 13, 2022 – Total U.S. online grocery sales in June climbed 6% year over year to $7.2 billion, and for the second quarter, eGrocery posted $22.4 billion in sales, a gain of 1% compared to 2Q 2021, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded June 29-30, 2022.

“Inflation and COVID are creating cross-currents in the market as higher prices motivate customers to look for ways to avoid paying more than necessary, and ongoing concerns about contracting the virus motivate shoppers to use online grocery as a way to stay healthy,” said David Bishop, partner at Brick Meets Click. “This is especially true as new variants of the virus triggered surges in infection and rising illness rates during May and June.”

Pickup, the largest segment of eGrocery, performed well; its June and second quarter sales rose 3% respectively versus a year ago. An expanding monthly active user (MAU) base and higher average order values (AOVs) were offset by lower order frequency among its MAUs during both periods. For the second quarter of 2022, Pickup contributed 45.7% of total eGrocery sales, up 80 basis points versus 2021.

Delivery has benefited from a range of new service options and features that have enlarged the size of its addressable market and stimulated more usage occasions. Delivery’s monthly sales jumped over 20%, and it finished the quarter 6% higher than year-ago results. Gains in the MAU base during both periods drove most of the sales lift, although higher AOVs also contributed to the year-over-year gains. Delivery reported mixed results relative to order frequency as frequency increased during June but declined for the quarter. Delivery captured 34.2% of the online grocery dollar share for the second quarter, up 1.7 percentage points from 2021.

Ship-to-Home continues a long-term decline that started at the onset of the pandemic in March 2020 when online grocery shopping began to evolve rapidly to meet new needs. Year over year, Ship-to-Home sales fell over 14% in June and by more than 10% for the second quarter. While the segment’s MAU base grew over both periods, consistently lower AOVs drove the sales decline along with a slight contraction in the number of orders placed each month. Ship-to-Home dollar share for the quarter was 20.0%, down 2.6 percentage points versus last year.

During June, cross-shopping between Grocery and Mass declined to 27%, about 1.5 percentage points lower than last year, which may be attributed to fewer households shopping with Mass during the month. During the second quarter, the share of Grocery’s MAU base that also shopped online with Mass came in at 28%, up slightly more than 1 percentage point compared to the second quarter of 2021.

The likelihood that an online grocery shopper will use the same service again within the next month remained steady at 63% for each month in the second quarter of 2022. As a result, this year’s second quarter average repeat intent rate climbed 7 points versus the same period a year ago. For June 2022, the Grocery rate continued to trail Mass by 8 percentage points, underscoring the gap that grocers still need to close to protect their core customers.

“Despite the current inflationary environment, a significant number of grocery customers continue to shop using online channels,” said Sylvain Perrier, president and CEO, Mercatus. “Customers crave convenience, but they also want to find ways to save money. Encouraging customers to use lower priced pickup services is one opportunity. Elevating and showcasing private label products online is another. Also consider integrating digital coupons into your first-party web and mobile experiences.”

In terms of share of wallet, total eGrocery finished the quarter at 13.6%, up 1.5 percentage points versus last year. Excluding Ship-to-Home (since most conventional grocers don’t offer this service), Delivery and Pickup combined to contribute 10.9% during the second quarter, up from 9.3% last year.

For information about access to the research and monthly eShopper/eMarket reports, go to brickmeetsclick.com.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on June 29-30, 2022, with 1,743 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.