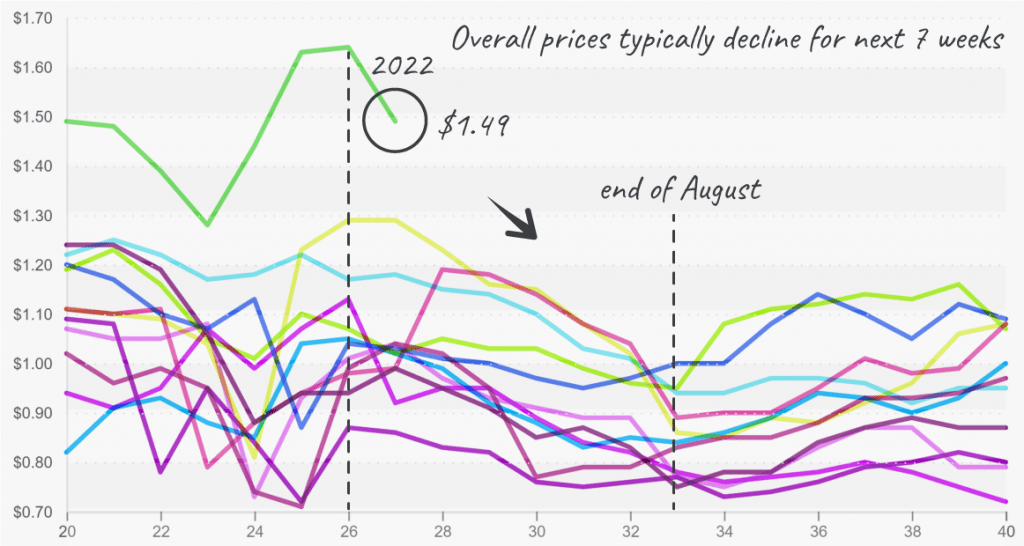

Overall market prices begin descent due to the end of summer holiday season. Independence Day is a key date for the transition to local growers. Heat has brought a wide variety of northern states into early harvest. However, despite a few price declines this week, overall produce markets remain at record highs.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.49 /pound, -9.2 percent over prior week

Week #27, ending July 8th

Overall index remains 15% higher than the 2nd highest year, 2020.

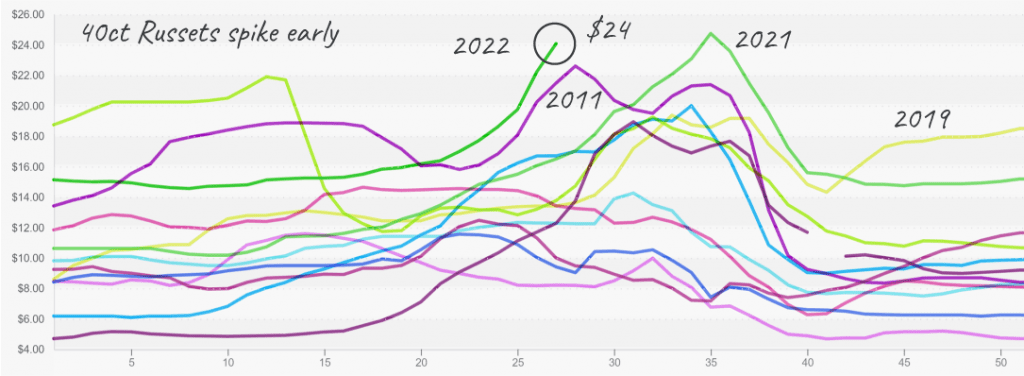

Potato prices are at a ten-year high. This week’s prices are extraordinary for the typically mid-tempered crop. Cold spring weather is delaying the new summer harvest, and storage supplies from last year are quite low. Buyers are clamoring for the last few lonely potatoes in storage. New Russet supply is expected to be at least one week behind schedule. Fingerling potatoes are also short and will probably remain so for another week. Other varieties, like white, red, and yellow, are experiencing elevated but steady prices.

Russet potatoes (50lbs) test new highs as the storage crop winds down before harvesting begins.

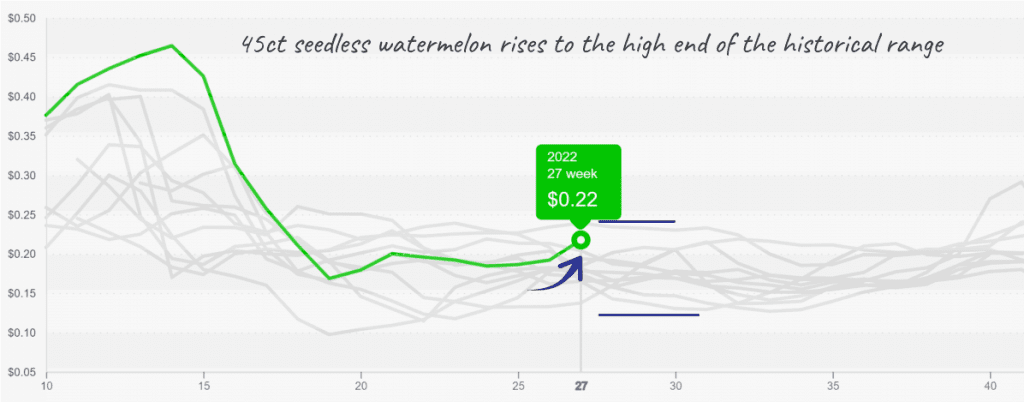

Rarely do watermelon prices continue to increase with such gusto following the 4th of July celebrations. However, this year, strong demand for the melon, less acreage, and erratic weather are keeping markets tight even on post-holiday demand. At $0.22, seedless watermelon prices are nearing 2020’s ten-year record. Still, it is unlikely that next week’s prices will surpass the record as supplies out of San Joaquin and diverse ‘local’ harvesting regions are expected to improve over the next few days.

Watermelon prices rise into July 4th.

Pepper prices are up +21 percent over the previous week. XL green bells surpass $20 on thin supply in the East and only scant amounts in the West. Colored bell supply is even more ghostly and is pulling prices higher. Expect colored pepper supply to remain very tight until Bakersfield picks up in two weeks.

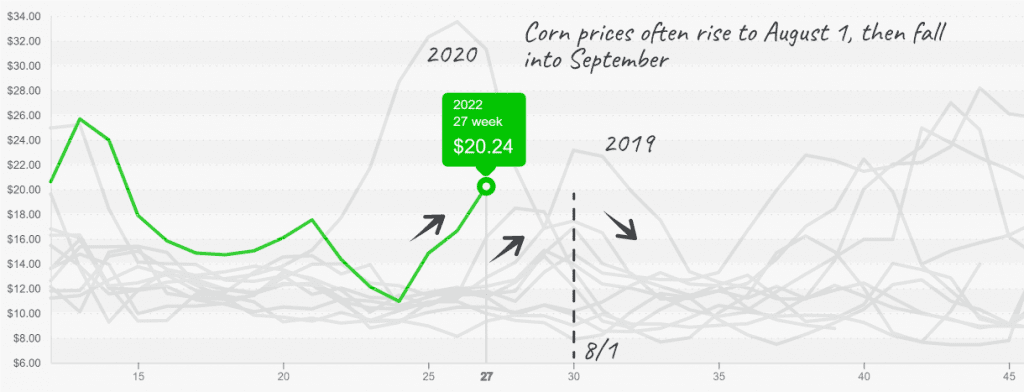

Sweet corn is having a rocky transition out of Georgia. Supplies are minimal on both coasts. The Carolinas and Virginia are just beginning and should provide some relief in the East relatively soon, but Western supply will be slower to ramp up. Expect prices to stabilize somewhat as New York and Michigan growers come online.

Corn prices spike over $20 as summer begins.

Cucumber supply in the East and West is very slender. Surpassing $19 in the East, prices are just shy of a ten-year high. Fortunately for buyers, more local options are expected to come online this week. Quality and demand are both strong, but the increased supply should relieve elevated prices.

By a healthy margin, cabbage prices are at a ten-year high. Supplies out of Mexico and California are limited, and prices are forecasted to remain volatile for at least two-three more weeks when growers out of Western/Central New York come online.

Though obviously not due to the plentiful availability of local product, reported avocado prices are down another -13 percent this week. Remnants of the Mexican Negro crop are still making their way through the newly christened Loca pipeline. Supply is growing and should continue to do so as the Loca season ramps up.

Please visit Stores to learn more about our qualified group of suppliers, or our online marketplace and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.