Memorial Day honors all military members who have died while serving in the U.S. forces. We remember those that have sacrificed themselves to preserve the freedoms that all Americans enjoy. Freedom is not free.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.48 /pound, -0.7 percent over prior week

Week #21, ending May 28th

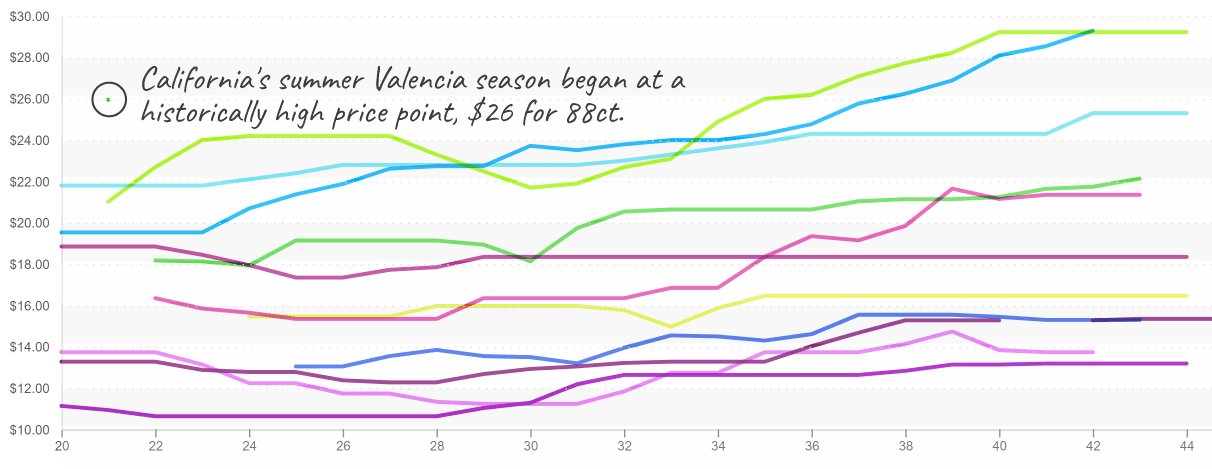

2022 hasn’t been a cheap year for Oranges. Prices have maintained a ten-year high and aren’t showing any signs of letting up.

Early in the year, Citrus greening and poor weather triggered one of Florida’s lowest crop yields in history. In California, growers grappled with an entirely different set of issues. Supply chain problems, specifically labor and truck shortages, prevented California growers from bringing products to market.

Orange prices never normalized. As a seasonal growing region transition and Memorial Day demand add fuel to the fire, prices increase +14 percent over the previous week with the transition from navels to valencias. In addition, summer tends to bring higher orange prices.

Orange prices follow a pattern each year, and we anticipate prices to remain steadily higher than in previous years.

Valencia orange (7/10 bu, 88s) prices typically keep steady and rise moderately through the 24-week season.

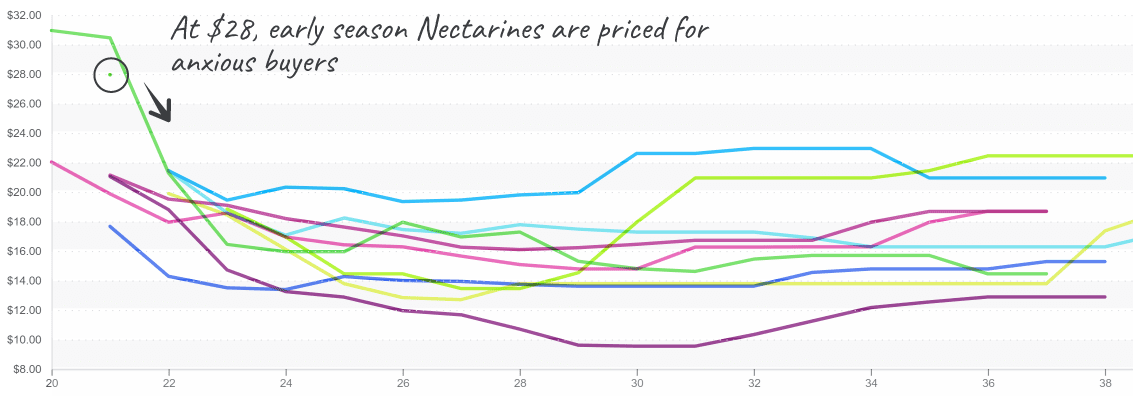

California nectarines and peaches started their spring/summer season at a ten-year high. Markets are expected to cool off over the next few weeks as more supply becomes available from the San Joaquin Valley. Still, it is pretty jarring to see nectarines and peaches in the high $20s.

Nectarines, 25 lb, start on small volume and go to the buyers most hungry for the new crop

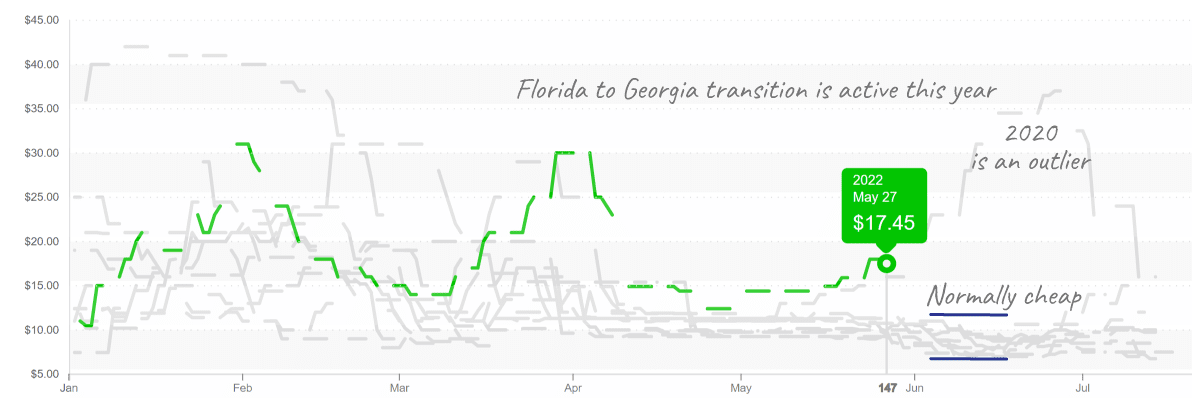

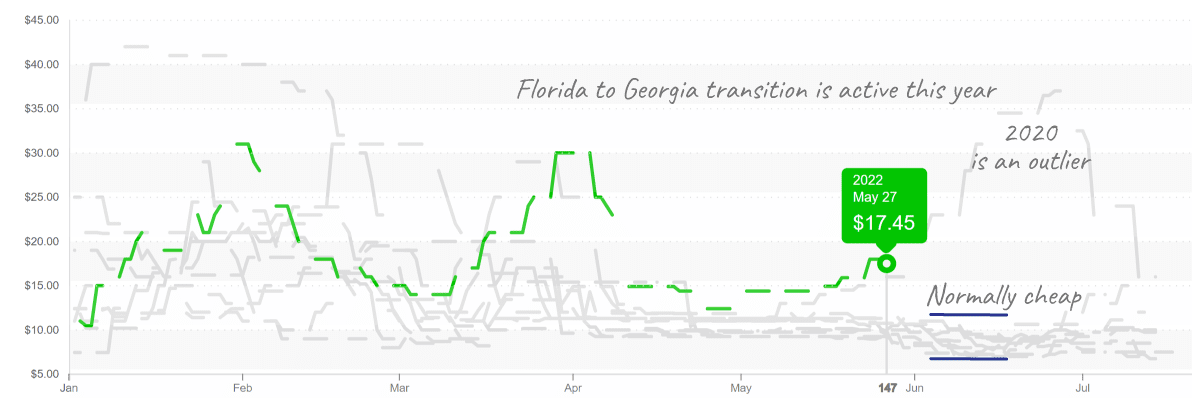

Corn, Memorial Day’s favorite side dish, is a bit pricier. Poor weather caused Florida’s spring season to wind down short on supply. At $17, sweet corn is at a ten-year high and resembles 2020’s prices.

Florida is nearly done on the East Coast, and Georgia is just beginning. On the West Coast, steady supply is available out of Imperial Valley, CA. The post-holiday demand hangover may bring prices down slightly next week, but it largely depends on the availability of sweet corn from Georgia. Markets are expected to be more active through Independence Day than in a “normal” year.

Sweet corn prices are on alert as Georgia had challenging spring weather, and supply is uncertain.

Declining Mexican avocado volume is keeping prices high. However, buyers willing to chance quality can gain a significant discount on Peruvian avocados. More Peruvian product will become available shortly and should provide a bit of relief to the overall market as some buyers substitute.

Strong Memorial Day demand is not enough to keep mixed berry prices from falling. An ample supply of blueberries, blackberries, raspberries, and strawberries is easing overall mixed berry prices. Warmer weather, and subsequently the increasing availability of more local programs, is providing generous options for grocers looking to attract customers with the promise of affordable berries.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.