So far in 2022, avocados have been as popular in the U.S. as ever, despite several supply problems.

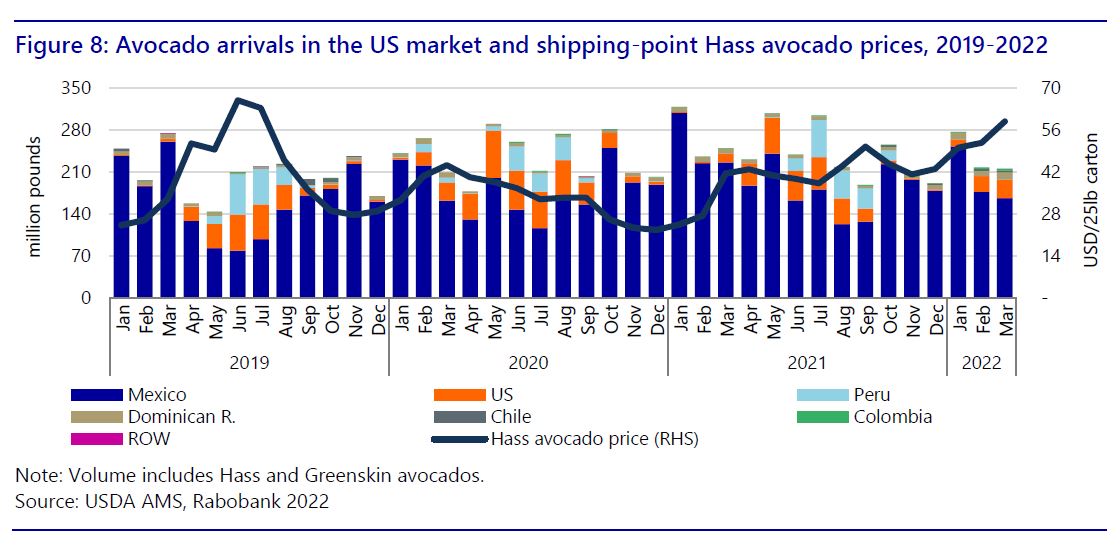

RaboResearch released a report on the avocado market that estimates that shipping-point prices will decline gradually now that Cinco de Mayo buying has finished. The holiday is the second largest driver of avocado consumption in the U.S.

“Nevertheless, we estimate that from May to mid-summer, prices will remain higher on average than in 2020 and 2021,” writes lead author David Magana, fresh produce analyst with Rabo AgriFinance, the part of the global Rabobank Group that serves U.S. agricultural producers.

“Starting from late summer, prices are likely to decline below the prices observed in 2021 but remain higher than those of 2020.”

The report says the second half of 2022 should see increased volume from Mexico, both from the main supplying state of Michoacan, but also new exports from Jalisco. Volume from South America should also increase.

This summer, California is expected to harvest higher volume than last year. Shipments from Peru to the U.S. will also likely rise considering the disruptions in Europe with the conflicts.

The report gives historical perspective, showing how availability has risen in the U.S. from 1 billion pounds in 2005-06 to 3 billion in 2020-21, and per capita consumption has grown to more than 9 pounds, more than three times of that in Europe, which has changed the strategies of supplying nations.

So far in 2022, avocados have been as popular in the U.S. as ever, despite several supply problems.

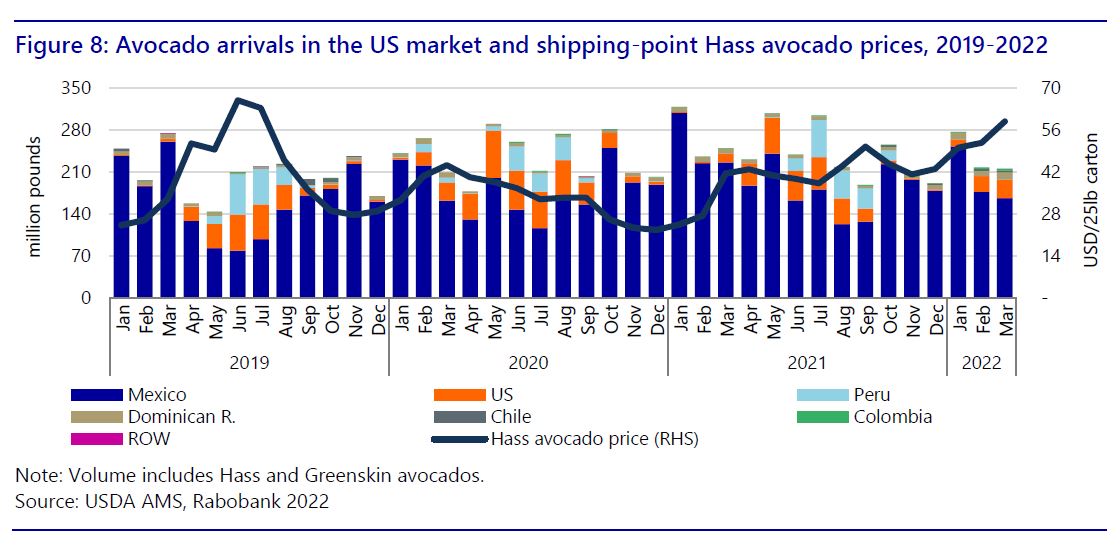

RaboResearch released a report on the avocado market that estimates that shipping-point prices will decline gradually now that Cinco de Mayo buying has finished. The holiday is the second largest driver of avocado consumption in the U.S.

“Nevertheless, we estimate that from May to mid-summer, prices will remain higher on average than in 2020 and 2021,” writes lead author David Magana, fresh produce analyst with Rabo AgriFinance, the part of the global Rabobank Group that serves U.S. agricultural producers.

“Starting from late summer, prices are likely to decline below the prices observed in 2021 but remain higher than those of 2020.”

The report says the second half of 2022 should see increased volume from Mexico, both from the main supplying state of Michoacan, but also new exports from Jalisco. Volume from South America should also increase.

This summer, California is expected to harvest higher volume than last year. Shipments from Peru to the U.S. will also likely rise considering the disruptions in Europe with the conflicts.

The report gives historical perspective, showing how availability has risen in the U.S. from 1 billion pounds in 2005-06 to 3 billion in 2020-21, and per capita consumption has grown to more than 9 pounds, more than three times of that in Europe, which has changed the strategies of supplying nations.

Greg Johnson is Director of Media Development for Blue Book Services