From the USDA’s Foreign Agricultural Service

In 2021, U.S. agricultural and related product exports to Mexico shattered all-time records, helping to close the agricultural trade gap between the two trading partners. Mexico surpassed Canada as the number two market for U.S. agricultural product exports.

The highly integrated and complimentary nature of U.S.–Mexico food and agricultural supply chains ensured that record trade was observed across all product categories. A recovery from 2020 pandemic lockdowns and high global commodity prices helped values, as well as quantity, increase in 2021. This report highlights historical southbound (United States to Mexico) agricultural and related product trade records by value.

Executive Summary

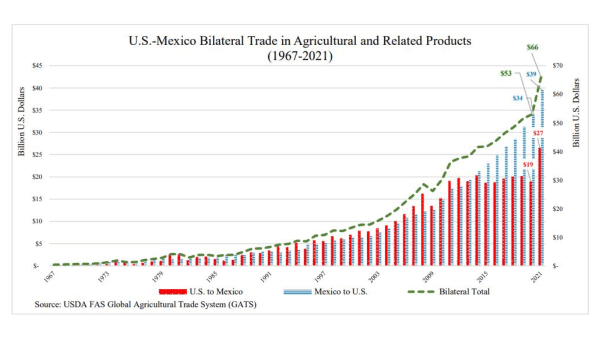

Bilateral Agricultural Trade: U.S.–Mexico bilateral trade in agricultural and related products is more robust than ever, reaching record levels in value and quantity across products and categories. In 2021, bilateral trade totaled $66 billion, with a notable 15 percent trade deficit decline to -$13 billion. U.S. agricultural and related product exports to Mexico increased 42 percent to a record high of $27 billion.

Top Export Market: In 2021, Mexico became the number one market for U.S. dairy products, poultry meat and products, wheat, distillers’ grains, sugar and sweeteners, milled grains and products, animal fats, rice, eggs and products, and pulses. Mexico is the number two market for U.S. corn, soybeans, soybean meal, food preparations, fresh fruit, processed vegetables, “bakery goods, cereals, and pasta”, condiments and sauces, vegetable oils, chocolate and cocoa products, fresh vegetables, planting seeds, non-alcoholic beverages, processed fruit, live animals, dog and cat food, nursery products and cut flowers, and confectionery.

Fresh and Processed Fruits and Vegetables ($1.7 billion): In 2021, U.S. exports of fresh fruit ($748 million) and fresh vegetables ($234 million) to Mexico reached record levels. Record processed vegetable trade was driven by quantity and value increases in frozen potato products ($261 million), reflective of a reopening of the HRI sector after a challenging 2020. Strong U.S. apple ($349 million) exports led growth in the fresh fruit sector. Orange and tangerine exports ($29 million), driven by high demand for products containing vitamin C during the COVID-19 pandemic. Small, but mighty, U.S. cherry ($16 million) exports to Mexico increased an impressive 235 percent from 2020.

Organics ($200 million): Record growth in the category is driven by both retail and HRI demand for fresh organic fruit (apples, grapes, pears, peaches, and others), as well as lettuce and spinach. Baby food and other organic processed products also saw significant growth. Higher-income consumers in Mexico are willing to pay a premium for USDA organic products with the hopes of attaining higher health and food safety benefits – a trend the pandemic has bolstered.