So what really happened here? Why did this century-old company close its doors?

In an email shared with The Produce Reporter daily newsletter, the H. Brooks and Company, LLC BB #:100563 former CEO, who had departed in June 2020, noted he had “resigned after it became abundantly clear the new ownership group could not sufficiently capitalize the company.”

There is far more that goes into this case study, including several million dollars still outstanding and owed to produce and transportation firms, as well as litigation now established by plaintiffs representing pension and retirement plan obligations.

But the fundamental reason for this series is not to articulate everything that happened line by line, or even come up with a validated or educated guess as to why it happened. The purpose of this case study is to offer readers the opportunity to evaluate the 30 months of pay behavior in advance of the company’s demise.

The data in the tables in the series shows moderately high to high risk. The trade experience inquiry in January 2019 would not have been a trigger for most creditors, but the XX E report exposed greater concern with added detail and A/R data suggested greater variability.

Blue Book members who contribute A/R data have access to key risk features that identify such emerging trends. To become a contributor, contact a Rating Analyst for more information.

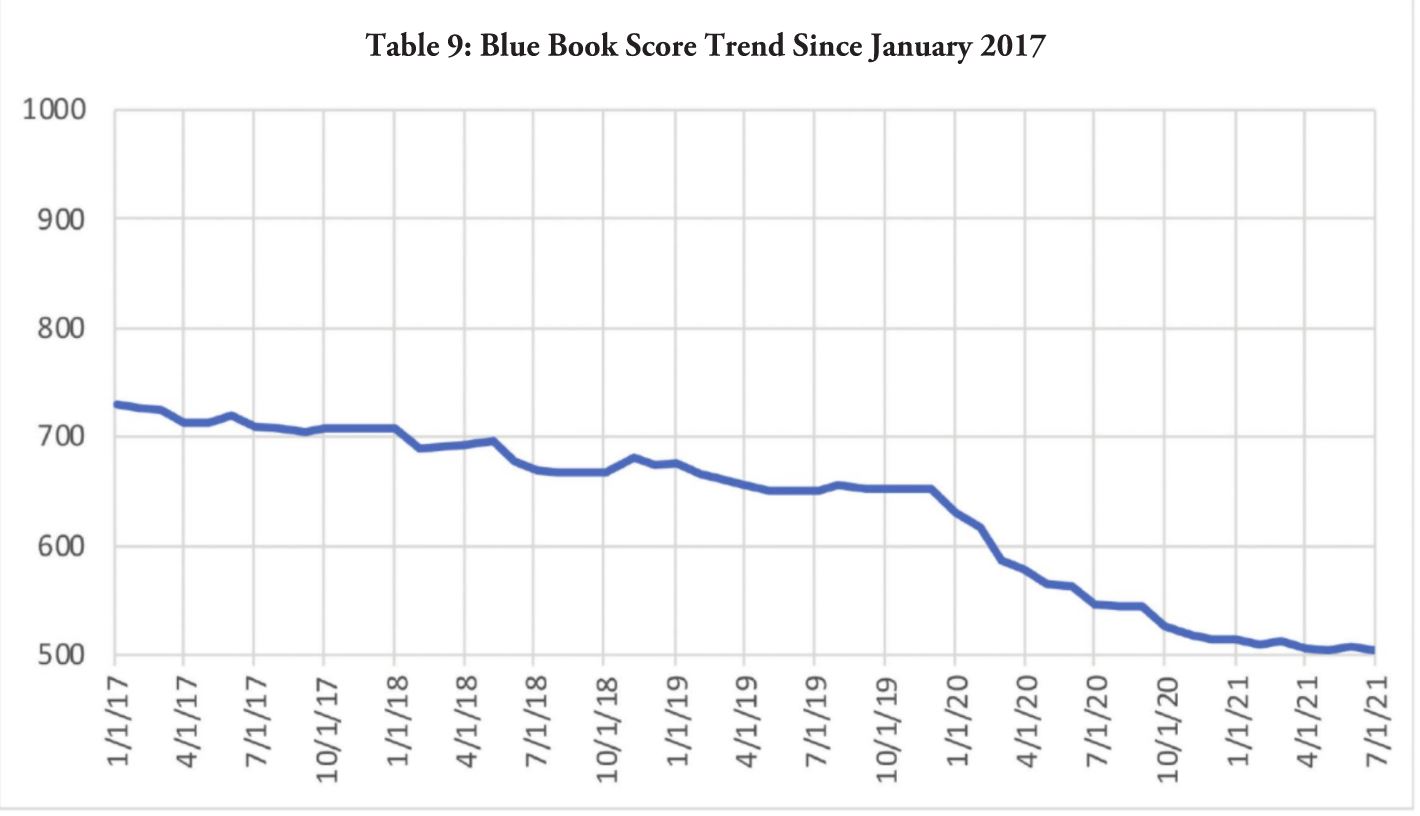

Over the ensuing months, a number of vendors exited their relationships with H. Brooks before being unable to convert receivables to cash, while plenty of others did not—despite the increasingly elevated risk shown in Table 9.

What’s the difference between a business able to hold steady or prosper year after year, while others struggle and/or eventually disappear?

Generally, it’s capitalization; but there are many underlying factors that can lead to failure. Core causes can include weak leadership, an undisciplined business plan, ineffective strategies, poor execution, cash flow mismanagement, an under-diversified customer base, limited market presence, and more—all of which, on their own or combined, can be cause for concern.

One simple way to track the financial strength of a company and monitor its performance is to take advantage of Blue Book’s predictive tools, such as ratings, scores, and real-time A/R aging data.

This in-depth information, along with a company’s own data and credit policies, allows for more informed business decisions.

To read the whole online series, click here.

This is an excerpt from the Credit and Finance department of the January/February 2022 issue of Produce Blueprints Magazine. Click here to read the whole issue.