A year ago, when I started writing the Focus on Fresh for the 2021 Know Your Commodity Guide, I had no idea we’d still be talking about the COVID-19 pandemic’s effect on consumer spending habits in 2022.

And yet, here we are. Research continues to emerge about the “new” consumer, and new shopping habits, and key reminders that for the most part, retail is a “buy with your eyes” business for most consumers and in-store shopping still dominates most North American households.

I spoke with Anne-Marie Roerink of 210 Analytics about the most recent research she’s conducted and what we can learn going into 2022 and beyond, and we identified five key trends to watch. Roerink’s most recent study was conducted in August 2021 and presented on behalf of the Southeast Produce Council.

Trend #1: Today’s shopper versus tomorrow’s

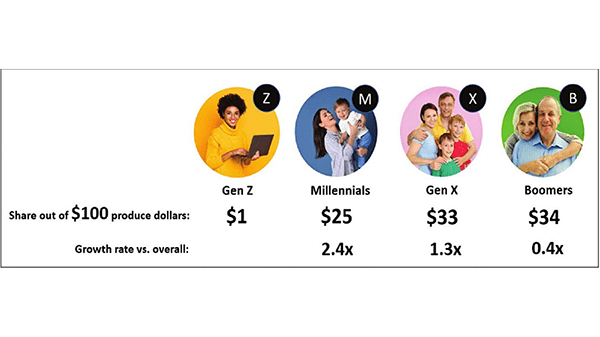

Framing information on today’s consumer (Baby Boomer and Gen X) versus tomorrow’s consumer (Millennial and Gen Z) can paint two very different pictures.

It’s important to remember that while Boomer and Gen X households hold the majority of purchase power, the younger generations will shape how consumers spend going into the next decade.

“Out of every $100 produce dollars, Millennials account for just $24, and Gen Z is only $1, while Gen X and Boomers make up the other $67 split evenly,” Roerink said. “But the growth rate of Millennial shoppers is 2.4 times the overall for Millennials, versus just 1.3 times for Gen X and 0.4 for Boomers. That’s a really important difference.”

This is a big deal when we’re talking about trends like sustainability, which garner a lot of buzz, but not a lot of noticeable action among consumers.

“Oftentimes what I hear when I talk about the importance of sustainability, a lot of people say ‘I don’t really see it in the numbers,’” Roerink said. “That’s right, you don’t, because a lot of the generations that are currently the majority of produce dollars (Boomers and Gen X) are not as engaged with some of these topics.”

But, the wave will come, as Millennials and Gen Z gain spending power, and the industry must be ready.

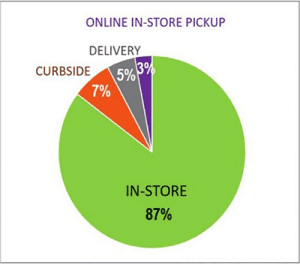

Trend #2: Don’t put all of your eggs in that online basket

It’s no secret that online shopping took a major leap forward over the past two years. It was already trending up before the world shut down, so to speak. At the beginning of 2020, 17 percent of consumers said they bought produce online, according to research by Category Partners LLC.

But, survey after survey suggests consumers still prefer to buy in-store.

“We talk – a lot – about e-commerce, but even at the height of the pandemic only 19% of store trips were online, and by the end of Summer 2021, we’re back down to 13% of store trips being online, so the vast majority of grocery purchase is still happening in-store,” Roerink said.

And consumers still pick their preferred store based on perishables.

“We asked people how do you choose one store over another because let’s be real, all of us have a million stores around us these days,” Roerink said. “It is the combination of produce and meat, so getting produce right is so important, especially if you think about the fact that a lot of the trips are coming back to the store.”

Trend #3: Is direct-to-consumer making a comeback?

While most consumers do prefer to shop in-store, a growing number of them are being drawn to new concepts in direct-to-consumer. It’s not just the gold foil pear in a box of Christmas fruit from Harry and David that are catching a consumer’s eyes.

Consumers are willing to pay exceptionally high amounts of money – compared to their in-store purchase – for these new models.

One example is The Peach Truck, where consumers sign up ahead of time to pick up a box of peaches as they’re unloaded from a semi truck, often in a school or mall parking lot.

“Here’s the kicker: you have to buy 25 pounds of peaches for nearly $50,” Roerink said. “But over a 52 week period, our average spend is only $4.15, so The Peach Truck purchase is 10 times bigger than what people spend on peaches in the store.”

And The Peach Truck sends nearly daily messages to buyers on proper ripening, storage, and recipes to get the most out of their massive purchase – an area that many consumers struggle with when considering purchase in-store.

Trend #4 – Ad strategy shifts

During the height of the pandemic, retailers had to shuffle their promotion strategies with the uncertainty of supply, especially in household goods like paper towels, toilet paper, and cleaning products. Fresh produce was largely unaffected by the supply interruptions, which made it an attractive option for ads and promotions.

“The big shocker, I would say is that 10 years back, it was all about the paper circular that people looked at in-store 75% of the time,” Roerink said. “Two years ago we saw in-store signage jump over the paper circular and this year we saw the paper circular drop even further and retailer apps jump to No. 2 in consumer preference.”

Digital ads, especially retailer apps, offer a lot of exciting opportunities for promotions – and information about shoppers.

“I think apps will continue to grow and really become way more important,” Roerink says.

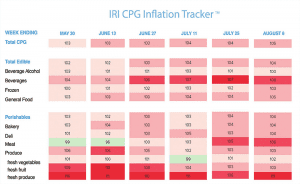

Trend #5: Beware looming inflation

But as much as ads and promotions have been a core strategy for retail and suppliers for decades, high inflation could put the brakes on those based on price.

Inflation, especially in fresh food, picked up in the early summer and continues to rise.

“Typically when we see inflation in fresh fruit, then we see people move into frozen or canned or a different type of fruit that might have lower numbers,” Roerink said. “But right now there’s really no relief across the store. We’re really seeing it in protein where you see the same substitution patterns happening.”

When inflation is high, promotion activity drops – and with it could go fresh produce consumption.

“We see people really being hit from both sides, right at a time where we’re focused on how to get people engaged with fresh fruits and vegetables more, and I think we have to be cognizant of the fact that these price points have opened people’s eyes and they are very aware of what is happening across the store,” she said.