While the rest of the world is busy rediscovering The Kingdom of Tonga via satellite, fresh produce markets are having yet another expensive week.

Logistics, poor weather and lower-than-expected yields are ongoing problems plaguing suppliers and buyers across the fresh produce industry. But on the bright side, the spectacular volcanic eruption is having zero impact on current produce shortages.

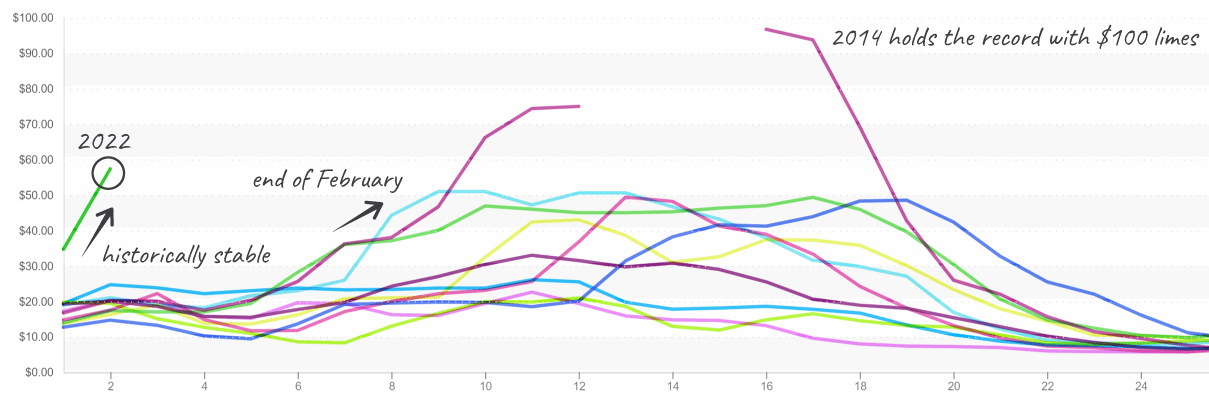

Lime prices shot up from $28 to $61/carton in 7 days. Prices are now more than double any January over the past ten years. This year’s prices are a clear historical outlier due to rain, labor shortages, and increasing freight costs.

Mexican lime import volumes are typically stable until February when prices begin to rise. This year, South American imports will most likely not carry enough weight to halt catapulted prices. Little hope is left for price relief. Our best advice is to substitute when possible, and perhaps a $26/case of lemons isn’t so bad.

Limes are poised to test the price ceiling set in 2014.

ProduceIQ Index: $1.16/pound, -0.9 percent over prior week

Week #2, ending January 14th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

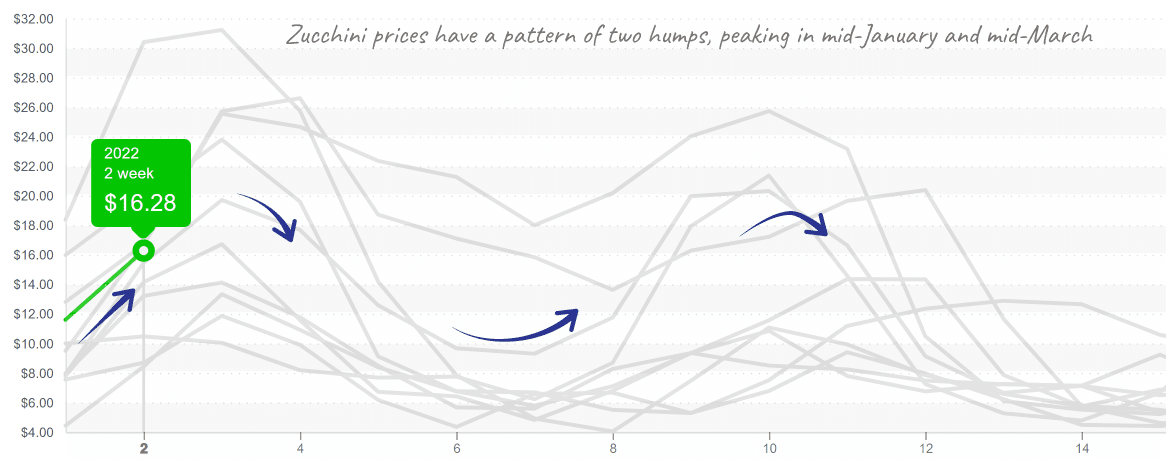

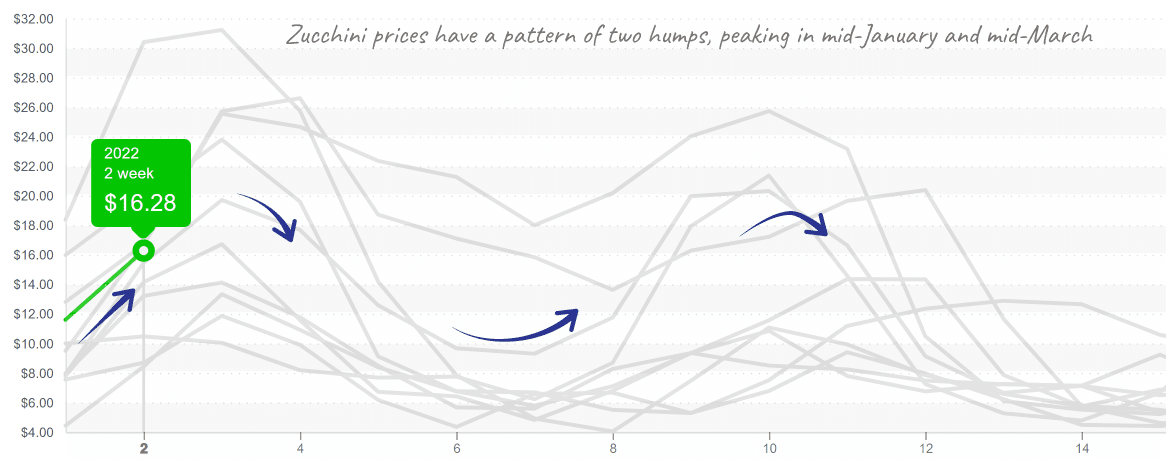

Squash is up as Mexican growing regions shift southward for the mid-winter crop. Historically, squash prices rise the first few weeks of each year and fall into February as Mexican production picks up. The potential for freezing temps in Florida forces squash production South of Lake Okeechobee during the mid-winter.

This year’s production is being slowed down by rain in Mexico and cool weather in Florida. As a result, expect Zucchini prices to rise for at least a few more weeks and yellow squash supply to remain correlated.

Zucchini prices are rising further and now in a rare moment when priced higher than yellow squash.

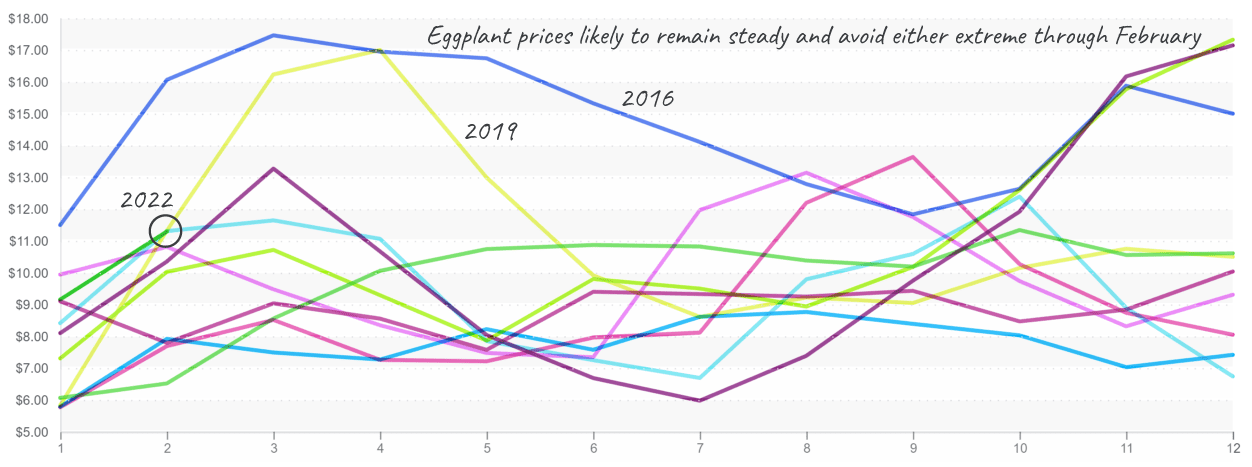

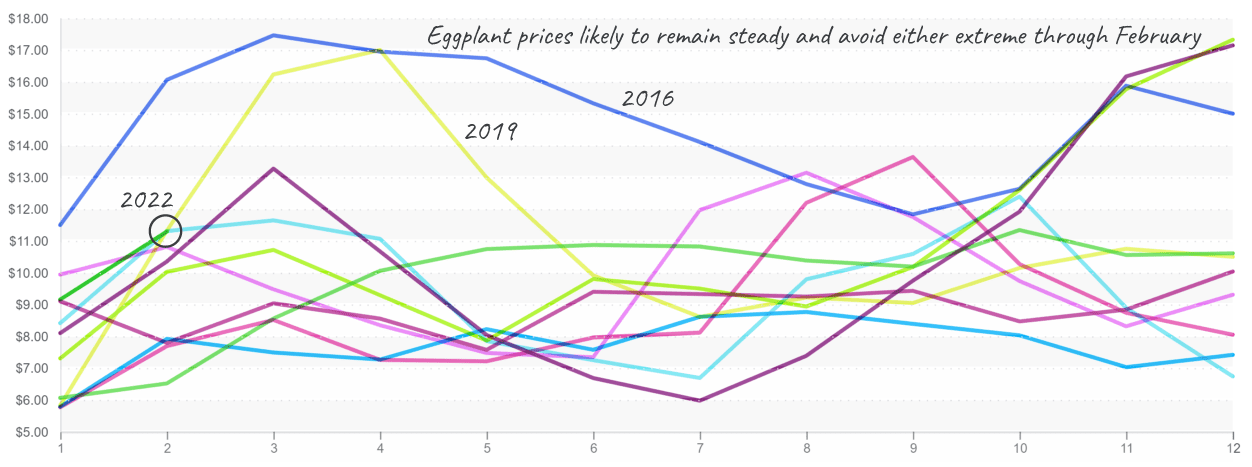

In case your omniscient sales agent didn’t tell you, yes, you should’ve planted more Organic Mini Japanese Albino Eggplant. In all seriousness, ‘eggs’ have warmed up. Varying supply is available out of Florida; however, reported Mexican import volume is meager due to a viral outbreak. Prices are off their floor and should stay elevated for the remainder of this growth cycle.

Eggplant prices lack a pattern during the winter and until Georgia starts in June.

As if lettuce markets don’t have enough going on at the moment, in the Everglades Agricultural Area, lettuce downy mildew, a serious and aggressive foliar disease was discovered this week.

The disease has been known to render the yields of entire fields useless. As a result, South Florida vegetable growers are on high alert to contain the potential to spread and prevent an outbreak.

In the West, cooler weather is causing quality issues and harvest delays. Surprisingly, lettuce prices are relatively stable, although quality and product availability are mixed. Lettuce is the commodity to watch as less-than-ideal conditions are sowing seeds of instability.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.