The pandemic continues to change how grocery shopping is done and the role that online plays

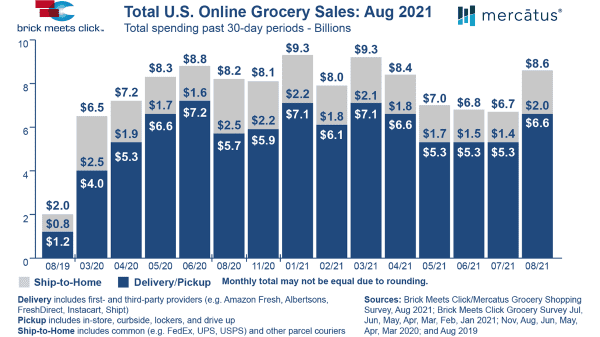

Barrington, Ill. – Sep. 14, 2021 – The U.S. online grocery market generated $8.6 billion in sales during August, a gain of 4.7% versus a year ago, as ship-to-home sales dropped nearly 22% to $2 billion and the combined delivery/pickup segment grew over 16% to $6.6 billion, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded August 29-30, 2021.

The year-over-year sales gain was driven by a strong uptick in the number of Americans going online and using a pickup or delivery service to satisfy their essential grocery needs.

“COVID’s resurgence has clearly contributed to the August sales gain,” said David Bishop, partner, Brick Meets Click. “While retailers don’t control the external market forces, such as the new wave of COVID cases that continued through August, they can choose how effectively their business is positioned to respond to the current circumstances that are disrupting their customers’ lives.”

The ongoing independent research initiative, created and conducted by Brick Meets Click and sponsored by Mercatus, showed that August’s overall sales increase was fueled entirely by an increase in the number of Americans going online to buy groceries, since both monthly order frequency and average spending per order declined versus the prior year.

Compared to one year ago, the number of U.S. households that bought groceries online in August, using any of the three receiving methods, jumped 25% to 69.0 million households. Versus one month ago, the monthly active users (MAUs) for August represented a more modest 4% gain as the rapid rise in COVID cases started at the beginning of July 2021.

“The segment-level results revealed that the size of the ship-to-home MAU base dropped around 10% in August compared to last year, while pickup expanded nearly 50% and delivery grew nearly 30%,” Bishop explained. “So, grocers need to monitor and measure the business at this level in order to get a more accurate picture of the online grocery market.”

Monthly active users placed an average of 2.73 online orders during August 2021, down 3.7% versus the prior year, but to put that into perspective, the current performance was 35% above the pre-COVID level in Aug. 2019.

In addition, ship-to-home’s order share has plummeted by nearly 19 percentage points compared to pre-COVID, illustrating one of many ways that online grocery shopping behaviors continue to evolve.

The weighted average spending per order across all three receiving methods shrank nearly 13% versus last August but was up more than 4% versus the prior month. Despite the double-digit decline in average order value (AOV) on a year-over-year basis, AOVs for each of the receiving methods has remained above pre-COVID AOVs by mid-single to low-double digit percentages.

The likelihood that an MAU will order again in the next month using the same grocery service grew approximately 3.5 points versus July 2021 to 60%.

However, each month’s repeat intent rate since the start of 2021, has consistently lagged August 2020 and 2019 rates by more than 10 points, reflecting in part the circumstances that have attracted customers to shop online, and the challenges associated with the shopping experience.

The share of online customers that used both a grocery service and a mass/discount service to buy groceries during August rebounded slightly from July 2021 to 26%.

The current level of cross-shopping was eight and 11 percentage points higher respectively versus Aug. 2020 and 2019. The ongoing shift in how and where customers shop online for groceries reinforces the need for conventional grocers to manage how well they’re executing compared to the mass discounters.

“While COVID has transformed customer behavior, the fundamentals of acquisition, retention and repeat purchase still apply,” said Sylvain Perrier, president and CEO, Mercatus.

“The more successful grocers continue to dive deeper into their customer data to better understand what’s building and, equally important, what’s hindering stronger engagement. This insight-driven approach is enabling retailers to learn to what degree they need to improve elements of strategy and/or execution.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on August 29-30, 2021, with 1,806 adults, 18 years and older, who participated in the household’s grocery shopping.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted July 29-30, 2021 (n=1,892), June 27-28, 2021 (n=1,789), May 28-30, 2021 (n=1,872), Apr. 26-28, 2021 (n=1,941), Mar. 26-28, 2021 (n=1,811), Feb. 26-28, 2021 (n= 1,812), Jan. 28-31, 2021 (n=1,776); throughout 2020, Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in Aug. 22-24, 2019 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final, Stater Bros. Markets and others. Mercatus is headquartered in Toronto, Canada.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com