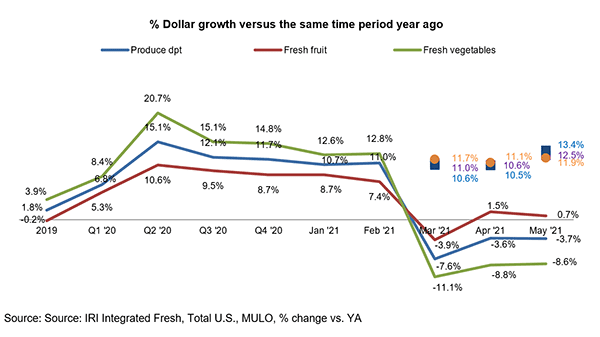

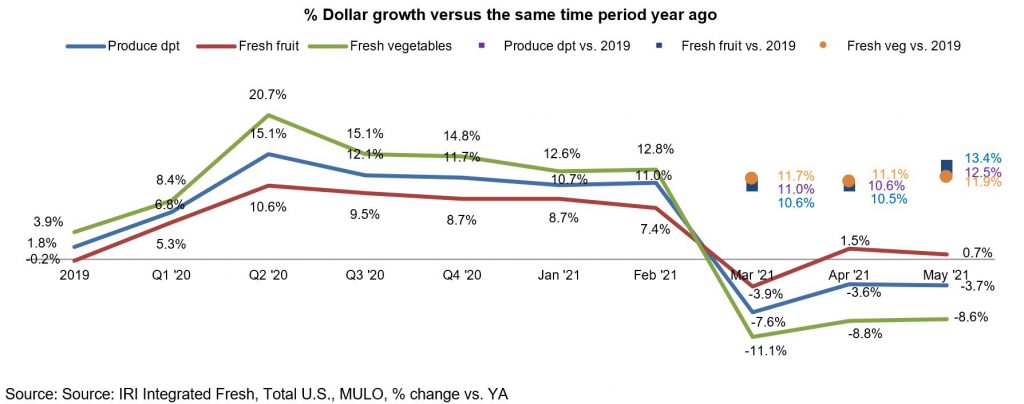

While many aspects of the shopping trip have started to normalize, the weekly consumer demand for fresh fruits and vegetables continues to be robust compared with the 2019 pre-pandemic baseline.

According to the May wave of the IRI primary shopper survey series, shoppers point to a low rate of infection (45%) and broad vaccination (39%) as the top two indicators of what makes them feel comfortable to return to their normal habits without COVID-related precautions. As the number of new COVID-19 cases is down across states and 66% of shoppers have received one or two vaccines according to the May IRI survey, consumer concern is declining rapidly. In May 2021, the IRI primary shopper survey found that the share of consumers who are “extremely concerned” is at its lowest level (35%) since the first wave of the monthly survey conducted in March 2020. Additionally, only 5% say they are more concerned about COVID-19 than they were the week prior — a share that rose as high as 59% in late March 2020.

Many consumers have already started to re-engage with restaurants in the past few weeks. In addition to the 52% who have gotten takeout, 40% have dined inside at a restaurant and 14% have eaten outdoors at a restaurant. 210 Analytics, IRI and the Produce Marketing Association (PMA) partnered to understand how fresh produce performed relative to their 2020 and 2019 performances.

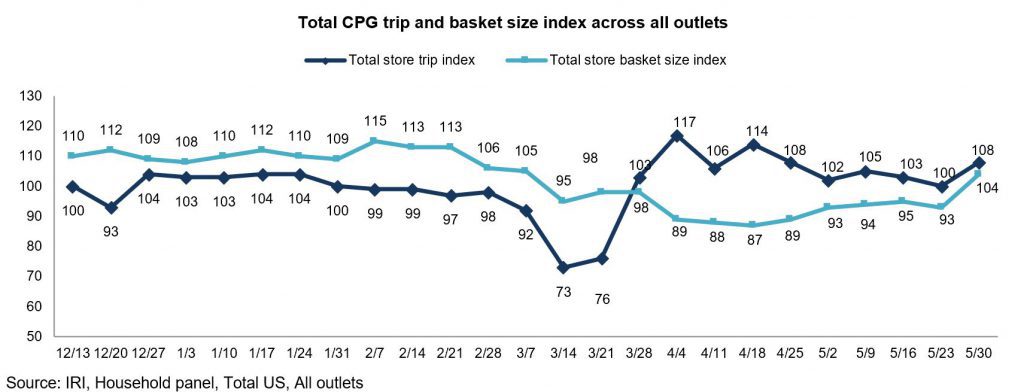

Trips and Basket Size

In May 2020, consumers took significantly fewer trips while spending 10-15% more each visit. A year later, that pattern translates into an increase in total food store visits as shopping patterns are normalizing, while the average spend per trip is below 2020 levels. However, the average spend per trip is starting to track closer to year ago levels than it did in April.

“The return to on-premise dining is likely to affect the high levels of home-centric spending seen in the past 15 months,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “Stronger restaurant sales on top of the continued elevated retail sales are causing some tightness and increased prices in the fresh produce supply chain. While eating out is ramping up, the positive Memorial Day results may at the same time point to a summer with strong backyard barbecue sales as shoppers are returning to larger get-togethers and celebrations.”

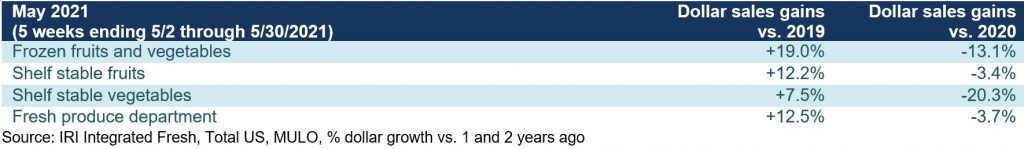

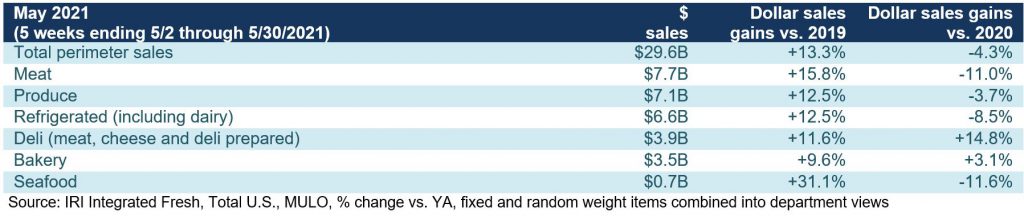

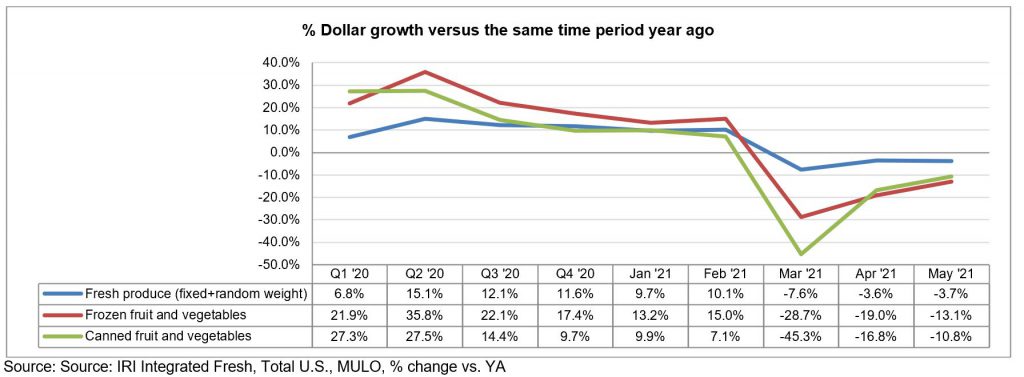

During the five May weeks, frozen fruit and vegetables continued to experience double-digit declines versus 2020 levels. However, frozen produce sales, as well as frozen food in general, continues to be very strong when compared to the 2019 pre-pandemic normal. Shelf-stable fruit sales started to move back to 2020 levels, but canned vegetables remained far below year-ago levels, at -20.3%. Across the three temperature stages, fresh produce came closest to year-ago levels, at -3.7%. This translates into a 12.5% increase versus 2019 levels.

“It is hardly surprising fruit and vegetables across temperature zones were not able to meet the enormous sales spikes of 2020,” said Watson. “However, fresh produce had by far the strongest performance and sales are just a few points below year-ago levels while demand remains robust versus normal. Keeping an eye on the demand versus 2019 will help us understand the at-home versus out-of-home balance, which is imperative for demand forecasting.”

Fresh produce generated $7.1 billion in sales during the five May 2021 weeks. While this is down $276 million from May 2020, it is up $790 million from the 2019 pre-pandemic normal. Importantly, fruit managed a gain over both 2019 and 2020 levels. Vegetables, that had a very strong May 2020, did fall short over year-ago levels, but increased 11.9% versus the pre-pandemic normal.

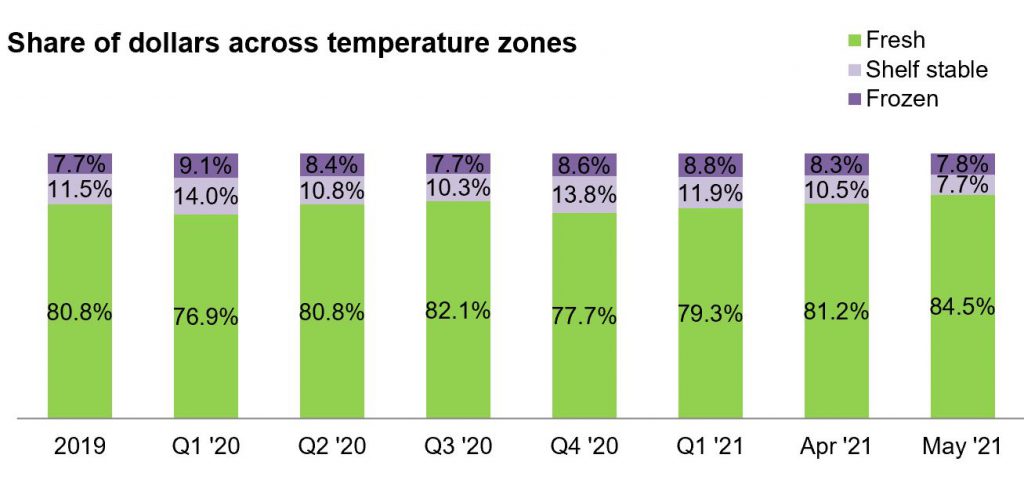

Fresh Share

Fresh fruit and vegetable sales were very strong in May 2021, as consumers were in store more often and celebrated Memorial Day with bigger gatherings. Fresh produce sales reached a high of 84.5% of total sales, with frozen fruit and vegetable sales in particular losing significant share versus prior months and periods.

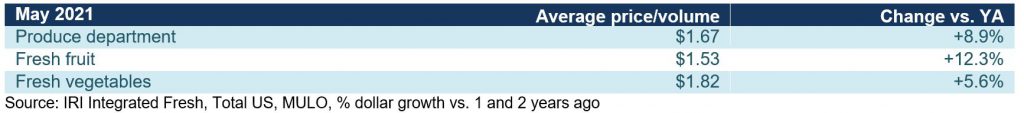

Fresh Produce Dollars versus Volume

Early on in the pandemic, fresh produce experienced deflation with volume outpacing dollar growth, though both experienced record highs. Deflation switched to inflation starting in the third quarter of 2020 and dollar gains have tracked above volume gains ever since. The gap between dollars and volume is growing wider as inflationary pressure is rising in recent months. While dollars are within four percent of last year’s levels in May 2021, volume is still tracking double-digits behind. However, when compared with the pre-pandemic normal of 2019, both dollars and volume are up, signaling continued strong demand.

Watson adds, “Switching to the year-on-year view shows better results for fruit because the spikes in fruit were not as high as those of vegetables in the early pandemic months. Additionally, we switched from a deflationary environment to an inflationary world in fruit.”

As Watson explained, prices for both fresh fruit and vegetables were up around 8% over May 2020 levels. Prices for fresh fruit were up the most, at +12.3%.

Fresh Fruit

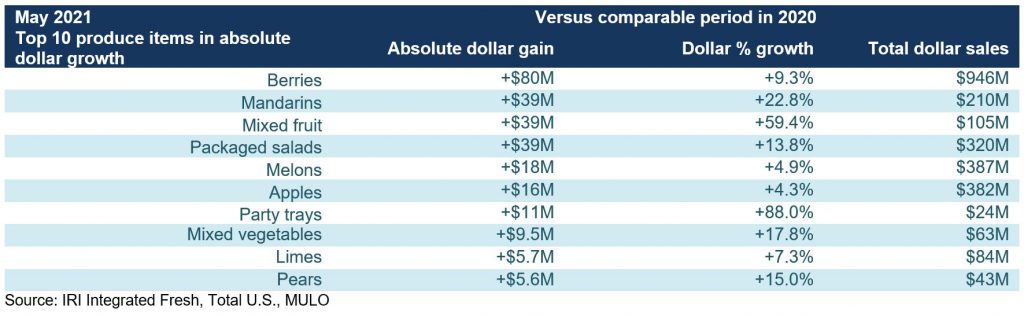

“In fruit, the impact of Memorial Day sales and back yard barbecues are evident,” said Watson. “While berries remain the untouchable number one, melon sales increased both versus 2019 and 2020. Additionally, cherry season has officially arrived and cherries moved right into the top 10 biggest sellers on the fruit side.”

Only five out of the top 10 selling fruits lost ground versus the tremendous sales spikes of 2020, being bananas, grapes, avocados, cherries and oranges. Berries are a notable exception: in addition to being the biggest seller still managed robust sales increases both in the comparison to the 2019 pre-pandemic normal (+28.6%) and the year-on-year view (+9.3%). While oranges were not able to hold on to the very strong May 2020 results, they are certainly still doing very well against normal levels, up 27.1%.

Fresh Vegetables

“Vegetable sales have to compete against the enormous spikes of 2020,” said Watson. “Yet, we see a few areas, including packaged salads and cucumbers, still track ahead of those 2020 peaks.” Watson refers to the 13.8% increase in packaged salads year-over-year, in addition to the 28.2% increase versus the 2019 pre-pandemic levels. In comparison with 2019, all vegetables still saw robust demand in May 2021.

Absolute Dollar Gains

“Berries are the biggest seller in fruit and the biggest contributor to absolute dollar growth across all fruits and vegetables with an increase of $80 million in the five May 2021 weeks versus 2020,” said Watson. “The comeback of entertaining and the greater reliance on convenience also clearly emerges from the Top 10 in absolute dollar growth, with appearances by mixed fruit, mixed vegetables and party trays.”

Perimeter Performance

A look across fresh foods departments for the five weeks ending May 30, 2021 versus year ago shows mixed performance. Departments with strong sales results in 2020 have a much tougher roadmap to stay ahead of prior year sales. This is the case for meat, produce, refrigerated (including dairy) and seafood. On the other hand, departments that struggled during the early pandemic months, including fresh bakery and deli prepared, are now tracking ahead. Importantly, both deli and bakery May 2021 sales results tracked ahead of 2020 and 2019.

Floral

Floral sales saw a dip early in the pandemic as retailers focused on keeping food and beverages in stock. But very soon after, floral started outpacing produce growth and floral sales have remained highly elevated ever since. In May 2021, dollar sales were +9.8% over the prior year. Importantly, floral sales also hold their own against the pre-pandemic 2019 baseline, with an increase of 12.7%.

Fresh versus Frozen and Shelf-Stable Fruits and Vegetables

While fresh fruit and vegetables dollar sales at retail only decreased 3.7% in May 2021, both frozen and shelf-stable saw much greater declines due to going up against very high double-digit increases in May 2020.

What’s Next?

Memorial Day celebrations, and the return of strong sales in produce trays, cut fruit and cut vegetables, signal that consumers are ramping up celebrations and gatherings.

The next report, covering June, will be released in mid-July. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns. Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer. #produce #joyoffresh #SupermarketSuperHeroes.

Date ranges:

2019: 52 weeks ending 12/28/2019

Q1 2020: 13 weeks ending 3/29/2020

Q2 2020: 13 weeks ending 6/28/2020

Q3 2020: 13 weeks ending 9/27/2020

Q4 2020: 13 weeks ending 12/27/2020

Q1 2021: 13 weeks ending 3/28/2021

April: 4 weeks ending 4/25/2021

May: 5 weeks ending 5/30/2021