The pessimists were right.

Fears that the pandemic would dominate the holiday season have turned into reality. Christmas and New Year sales, holidays driven by restaurants, are simply not materializing.

Restrictions on foodservice in the major metropolitan markets, along with retailer cautiousness, tilted holiday prices into the buyers’ favor.

Overall, the industry’s rolling 4-week movement is down 8.2 percent and total sales by -10.1 percent year over year.

Week #50, which is the 2nd week after Thanksgiving, began an even more dramatic decline over last year’s activity. Anecdotally, the lack of orders was widespread last week as well.

ProduceIQ Index: $0.86 /pound, +3.6 percent over prior week

Week #51 ending December 18th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

High freight rates contribute towards lower F.O.B. prices through the holiday shopping season.

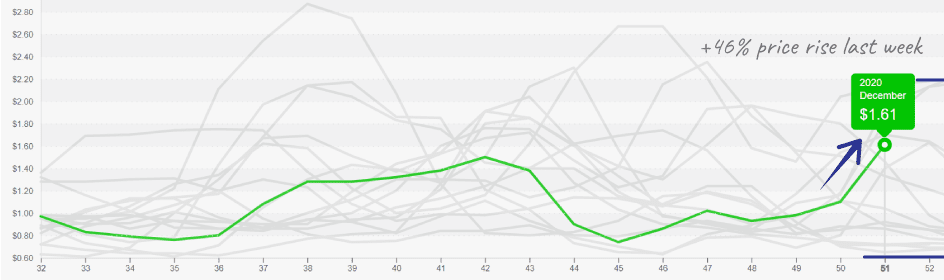

Tomatoes, however, made significant gains. As a silver lining to low grower F.O.B. prices, tomatoes increased 39 percent on light supply.

Grape tomatoes led the category, reaching $1.61/pound. However, these prices may be short-lived as Nogales, AZ, crossings have yet to ramp up. Increases in the Mexican tomato supply is anticipated through the end of the month and into January.

Grape Tomatoes are in a transitional supply gap, causing high prices despite lower-than-usual demand.

Dry vegetables bounced out of their post-Thanksgiving slump. Despite price gains, most commodities remain on the lower end of their trading range.

Corn is an exception to this generalization and remains in scarce supply because of the wet growing season in the muck lands of South Florida. At $0.72/pound, corn is close to its 15-year high and expected to hold through the holidays.

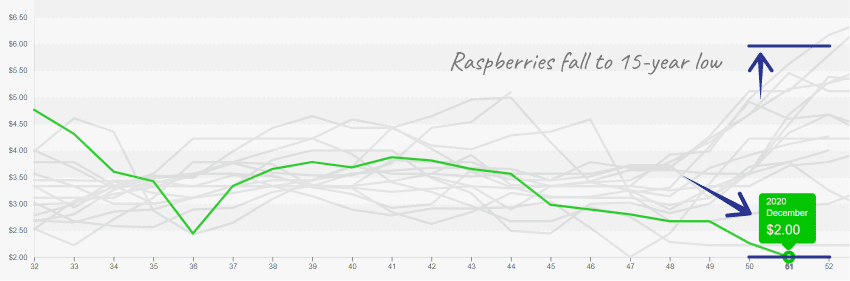

Berry prices fell across the board, causing a -12.4 percent decline for the category. Multiple growing regions are in steady supply, including Mexico, California and Florida. Promotions are encouraged for all types of berries.

Raspberries reach historic lows for this time of season.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.