Fresh produce market prices improved mid-week as expected.

The post-Thanksgiving slowdown lasted the typical ten days, and prices improved after storage coolers were emptied again. Now produce markets are in “pre-Christmas” mode. The industry Index remains at its 9-year low for this week #50.

Cautiousness remains as restaurant shutdowns impact New York and California. Buyers are ordering for known uptake to avoid holding excess inventory if the demand doesn’t accelerate. Gov. Cuomo announced that indoor dining will be closed as of today, Monday, impacting New York City.

Restrictions are also in place for much of California’s population, including controversial bans on outdoor dining.

ProduceIQ Index: $0.83 /pound, -1.2 percent over prior week

(Week ending December 11th)

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

High freight rates continue as a cause for lower F.O.B. prices. Reefer truck rates continue substantially higher than in prior years with expectation for these premium prices to continue through the holidays.

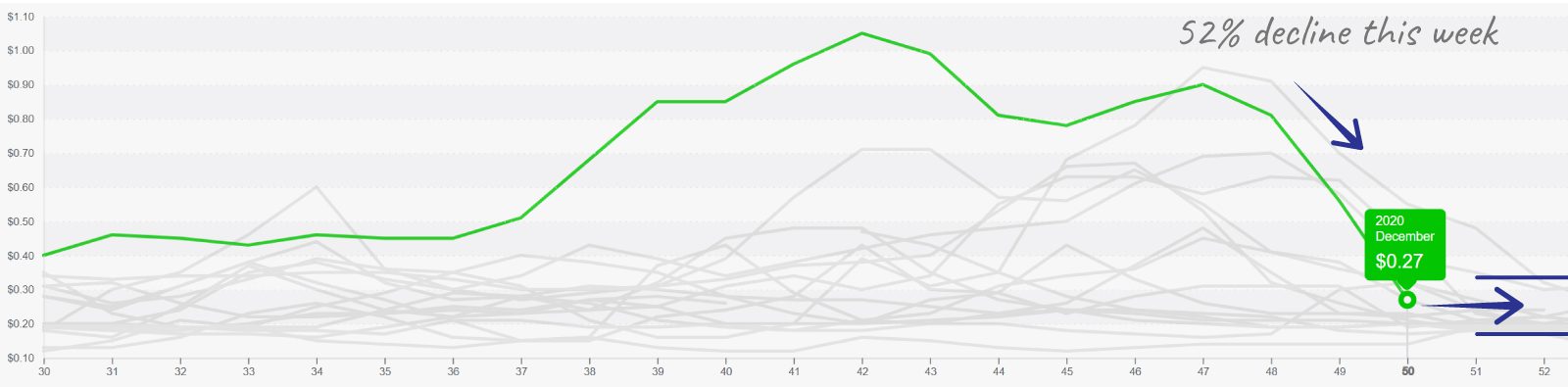

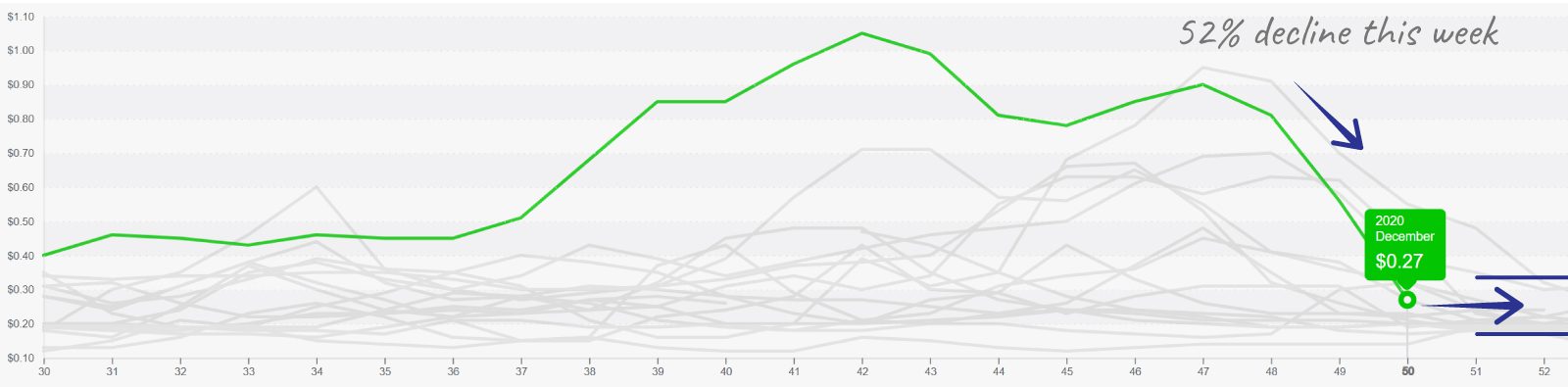

Romaine prices fell from $0.90 to $0.27 /pound in three weeks during the transition to southern growing regions.

Southern California/ Northern Mexico sourced produce was mixed. Cauliflower and celery jumped, +39 percent and +25 respectively, due to cooler temperature nights and slow start in the Yuma desert.

However, the transition from Salinas to Yuma has brought improved quality and supply for lettuce, causing romaine and iceberg prices to plummet, -52 and -33 percent. These markets are active with significant daily price changes.

Other price gains are prevalent in corn (+29 percent), and plum and grape tomatoes (+21 and +12 percent). Corn from Florida remains in short supply after a wetter than normal growing season.

After significant price declines, tomato harvesting has reduced to improve pricing equilibrium and sufficient fruit remains to meet demand.

Asparagus is in quality and promotable supply. Both Peru and Mexico are prepared to fill increased demand for the holidays. Prices are at the lowest in 10 years and are anticipated to remain modest.

Asparagus prices should firm yet remain promotable quality and price for the holidays.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.