The Honeycrisp apple is maintaining a tight grip on its title as the ‘crop to watch’ in 2020.

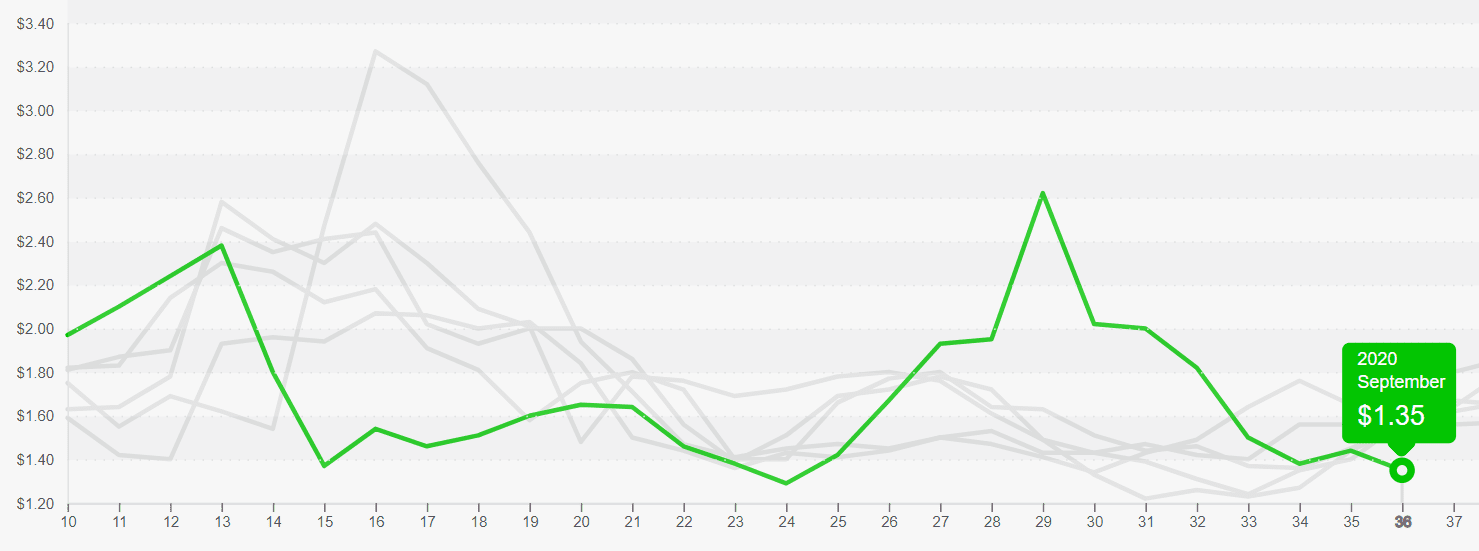

The phenom apple variety experienced a near doubling of prices during August as the 2019 storage crop transitioned to the fresh 2020 harvest. Shipping point prices rose from $1.06 to $1.89 per pound.

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

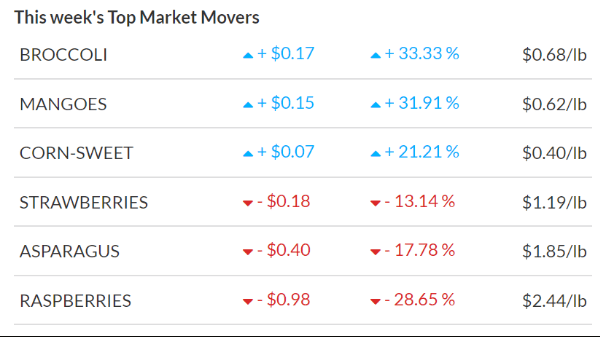

ProduceIQ Index: $0.72 /pound, -1.4 percent over prior week

As is the case with many agricultural operations, high prices don’t necessarily translate to high profits.

The Honeycrisp is notorious for having higher costs in cultivation and picking, and inconsistent yields on-the-tree and a lower packout for the fresh market. Still, consumers are infatuated with the crunch and flavor profile, driving demand at higher price points.

This fall’s U.S. crop was estimated to be 7 percent lower yield than in 2019, and current prices are reflecting that supply concern.

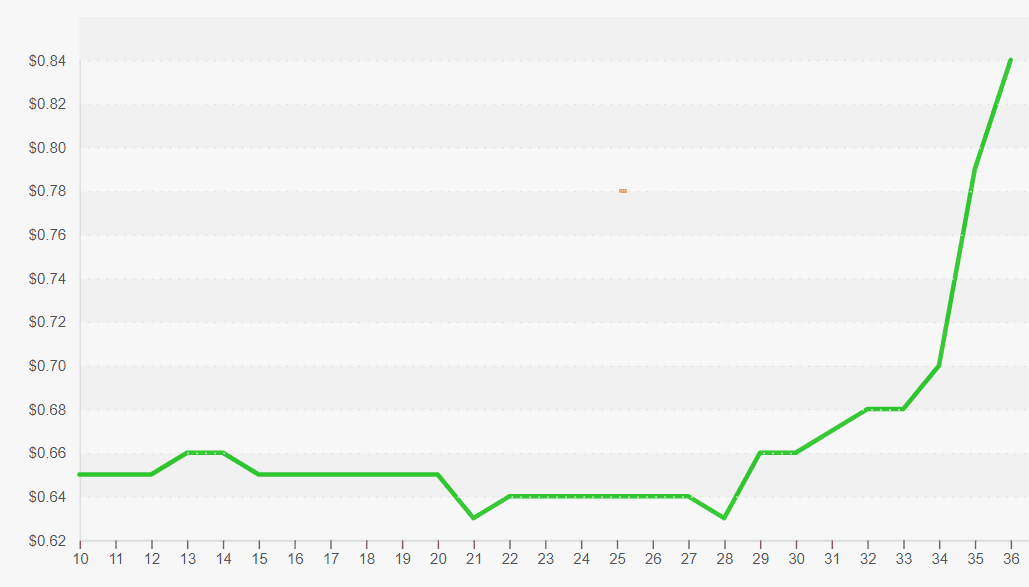

Apple growers had a dismal 2019 and hope to recover with higher prices. The 6.3 percent increase in the Apple price sub-index is important to the industry as it comprises 12.8 percent of our weighted Index for this week 36.

Wet Vegetable category prices bounced off the floor, up 26.3 percent, to continue this year’s roller coaster. Broccoli leads this category with a 33 percent increase, from $0.51 to $0.68 per pound week over week. The rise in this category is due primarily to supply quality issues.

(If you’re curious about the category’s name, wet vegetables may be topped with ice that melts to keep cool on a long journey from California to the East Coast.)

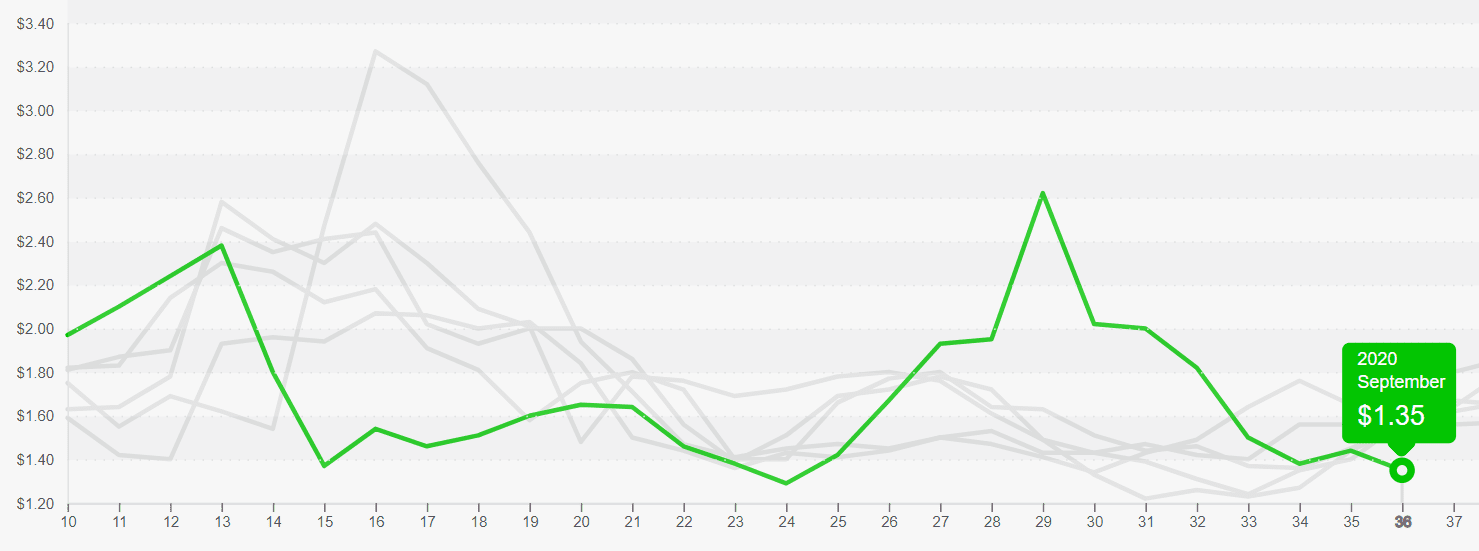

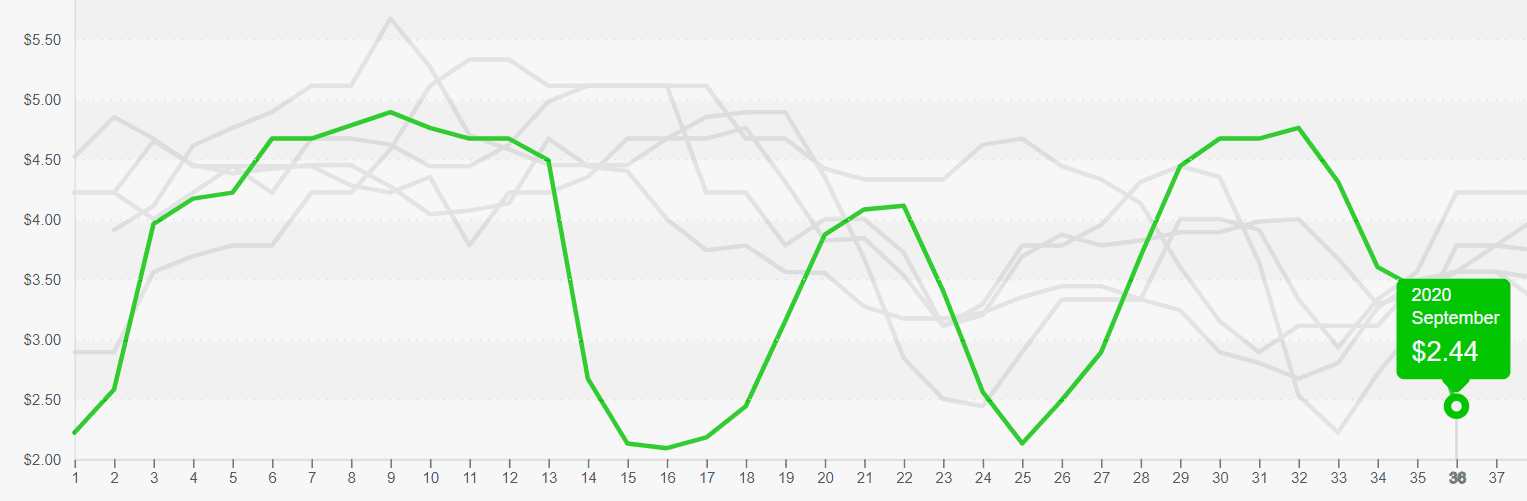

Berries are a buy. Supply from Mexico is abundant on Blackberries and Blueberries, creating a promotable situation that needs consumer lift. Strawberries, on the other hand, are experiencing lower prices due to variable quality. Raspberries continued their steep descent to $2.44 per pound. As the graph below indicates, Raspberries don’t fall below a floor of $2.00 per pound and tend to recover in price quickly.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.