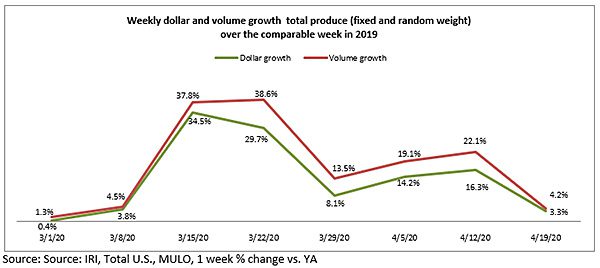

Since the onset of coronavirus in the United States, grocery shopping patterns have been vastly different. Spending has been highly elevated ever since March 8 and much has changed in product and brand choices, trip trends relative to the day of the week and day part, and online engagement. Importantly, the week ending April 19 had to go up against Easter 2019 sales, that fell on April 21 last year. 210 Analytics, IRI and PMA partnered to understand the effect for produce in dollars and volume throughout the pandemic.

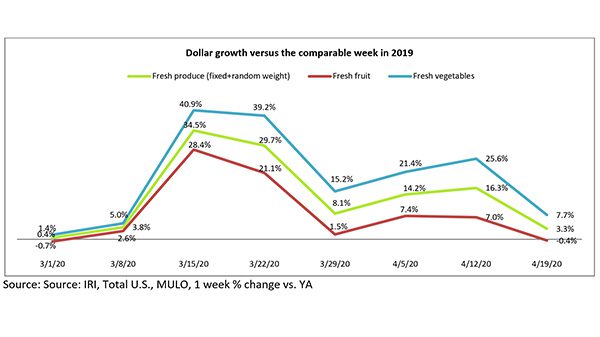

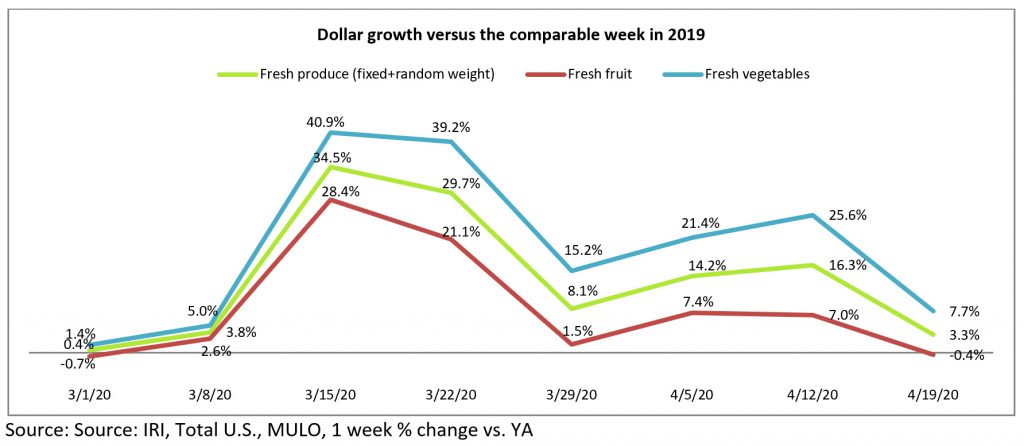

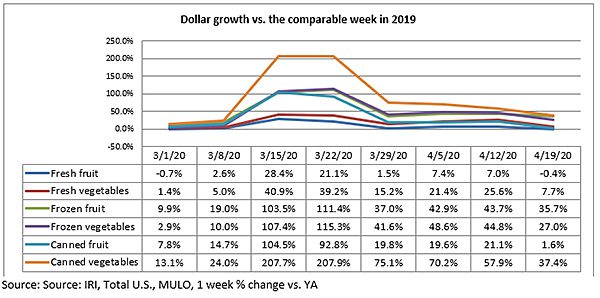

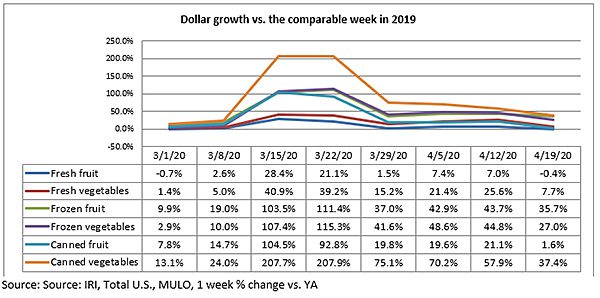

Fresh produce growth for the week of April 19 versus the comparable week in 2019 did increase, but much less so then seen in prior weeks, at +3.3%. Vegetables continued to easily outperform fruit and the three-way split of the produce dollar between fresh, frozen and shelf-stable continued. While fresh produce was down to the lower single-digits in terms of year-over-year growth, frozen and canned produce were still up by double digits.

- Fresh produce increased 3.3% over the comparable week in 2019.

- Frozen, +28.7%

- Shelf-stable, +21.5%

Source: IRI, Total US, MULO, % growth vs. year ago week ending April 19, 2020

“We knew it was going to be hard to beat prior year Easter numbers,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “While no longer showing double-digits, it is encouraging that the elevated everyday demand generated continued gains. Now, going into the summer, it is important to keep the momentum for vegetables going and build strong demand for fruit, despite the vastly different trip and spending patterns. A number of high-impulse summer fruits are around the corner and we have to challenge ourselves to build impulse sales in new ways and within a new reality, including online ordering, trip pressure and a desire among shoppers to minimize time spent in-store.”

Fresh Produce

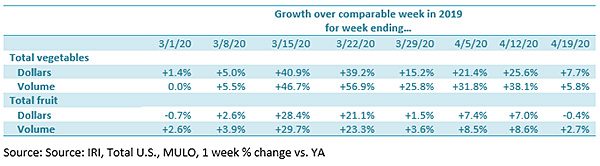

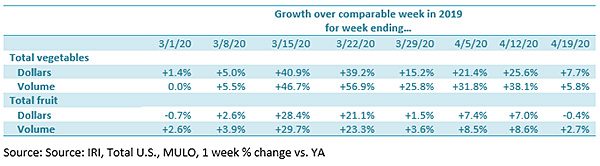

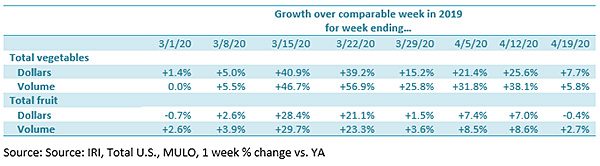

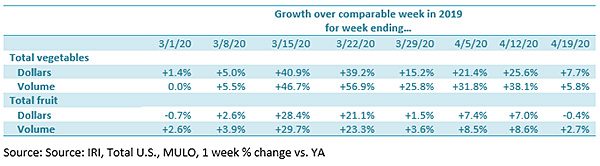

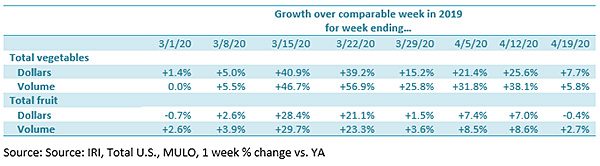

Since the onset of the coronavirus sales patterns, fresh vegetable growth has far exceeded that of fruit, and the week ending April 19 was no exception. Fresh vegetable sales growth (+7.7%) was more than 8 points higher than that of fruit, but it was also the first time that gains fell to single-digits. Compared with the same week in 2019, fresh produce generated an additional $51 million in sales. Meanwhile, fruit sales were off slightly when compared to the same week in 2019, at -0.4%.

Source: Source: IRI, Total U.S., MULO, 1 week % change vs. YA

“I have no doubt about it, in-home consumption is here to stay for the foreseeable future,” said Jonna Parker, Team Lead, Fresh for IRI. “Fresh produce sales numbers this week had multiple headwinds to overcome in terms of going up against Easter 2019, deflation, SKU rationalization, purchase limits, some consumer concern over the safety of bulk fresh items, but also the rise of online ordering. We typically see an initial hesitation to order fresh items online, particularly meat and produce, though shoppers often move past this if they continue to order online. This could also be one of the reasons why we’re seeing frozen and shelf-stable produce sales continue to do so well.”

-

Shopper input certainly seemed to confirm all of these headwinds. For instance, several shoppers commented safety concerns on the Retail Feedback Group’s Constant Customer Feedback (CCF) program this week.

-

“At this time I am not buying fresh produce as I have in the past due to Covid-19.”

-

Another shopper said, “I suggest having a hand sanitizer station available in produce as well so people can de-germ before touching the fresh vegetables.”

-

On the topic of online shopping affecting fresh produce purchases, a shopper noted, “I’m 78 and the kids insist I order groceries online. I normally buy everything fresh, and I don’t like the idea of someone else picking out my fresh produce. So I order frozen fruit and vegetables now.”

-

Shoppers are also noticing the SKU rationalization on certain items, brands or line extensions. One shopper on CCF noted, “The produce section was well below your normal standards. I wanted a green pepper and there were none available.”

-

Another wrote, “Please know that I totally understand why the produce and meat departments had limited stock. My husband and I are a very specific diet due to medical issues. Finding the types of fresh produce we consume is difficult these days. Grape tomatoes and green peppers were scarce today as was 96% ground beef.”

Fresh versus frozen and shelf-stable

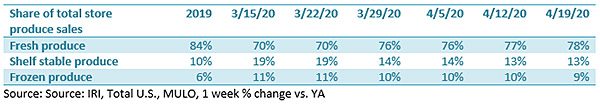

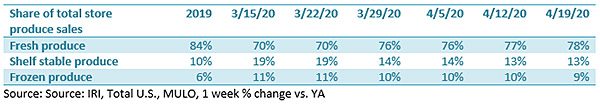

It is also important to point out that percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total produce. For the week ending April 19, fresh produce made up the majority share of total store produce sales, at 78%. “Fresh produce generates the bulk of total produce sales during regular times and it still does today,” said Parker. “Over 2019, 84% of sales was generated by fresh. During the key panic buying weeks ending March 15 and 22, the share of fresh was down to 70% but we’re seeing it climb back up. This week was the highest fresh share since the onset of coronavirus, at 78%. This is still down from typical levels as consumers continue to be highly engaged with frozen and canned, but fresh is making a comeback.”

Dollars versus Volume

As seen in prior weeks, there continues to be a gap between dollar growth and volume growth, though it is much diminished from prior weeks. At the onset of coronavirus in the U.S., dollar and volume sales were relatively close together for total produce, at +0.4% for dollars and +1.3% in volume. For the week of April 12, the volume versus dollar growth gap was largest to date, at 5.8 percentage points, but it is back down to 0.9 points for the latest available week.

Whereas the gap had been driven by vegetables for each of the prior weeks, it was fruit that drove more volume than dollar sales during the week of April 19. For vegetables, dollar sales were two points ahead of volume sales.

Dethroning potatoes, that had been the absolute growth leader since the onset of coronavirus, oranges added the most dollars over the same week in 2019, at $12.6 million. This translated into a percentage gain of 58.8%. Others that gained big in dollars were lettuce (+$11.5 million), tomatoes (+$10.9 million) and potatoes (+$10 million). However, at the category level, big differences between dollars and volume were observed for some fruits and vegetables as well.

“This week, onions and avocados are two big ones that jump out at me,” said Watson. “While onions had a strong 13.4% boost in dollars, volume sales were up 27.1%. That means there is a lot of negative pressure on the average retail price, likely due to the lack of demand from foodservice. On the other hand, we’re seeing some upward pressure as well for other items, particularly potatoes, with dollar sales up 14.9% and volume leveling off at +1.2%. We will have to see what effect the loosened nutritional labeling information will have on the marketplace in the next few weeks.”

Watson referred to the Food and Drug Administration releasing new guidance to provide additional flexibility to the food supply chain, allowing restaurants and food manufacturers to sell excess product without labeled nutrition information directly to consumers in order to help ensure that available food is distributed throughout the country where there is need. Additionally, FDA announced it will work cooperatively with manufacturers for the remainder of the year on the implementation of the updated Nutrition Facts labeling with the understanding that it may take additional time to get products with updated labels into the marketplace.

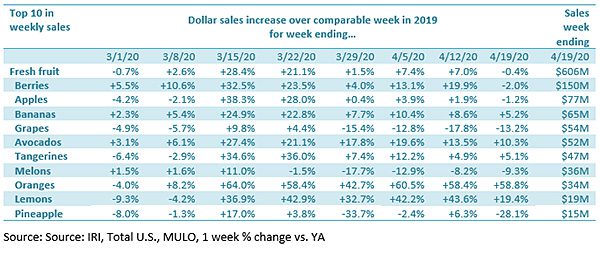

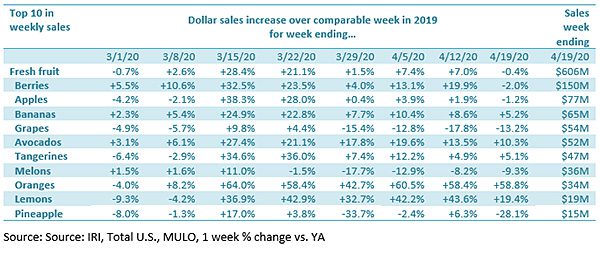

Fresh Fruit

Going up against Easter 2019 resulted in flat sales for fresh fruit. The top 10 items in terms of dollar sales saw sales declines for six items, including powerhouse berries and increased sales for the remaining four items. Oranges, lemons and avocados were the only ones to remain in double-digit territory. “Next week will be an important one to see how much the elevated everyday demand is able to push sales past the 2019 level,” said Parker. “There is so much snacking competition across the store these days. It will be imperative to create demand for fruit through recipes, displays and above all, highlighting the nutritional benefits of fruit. Educating consumers on items for now and items for later to cover them for the entire week will also be an important strategy in the current retail climate.”

Fresh vegetables

Lettuce took over as the top sales category and the top contributor to dollar growth in vegetables, adding $11.5 million in sales versus the comparable week in 2019. Also jumping ahead of the uncontested sales driver to date, potatoes, were tomatoes that added $11 million this week. Other impressive growth categories were potatoes, peppers, onions and mushrooms. Asparagus dropped back out of the top 10 and squash was back in 10th in terms of weekly sales.

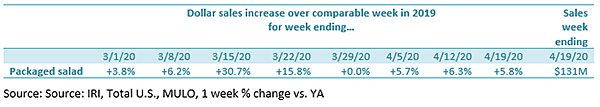

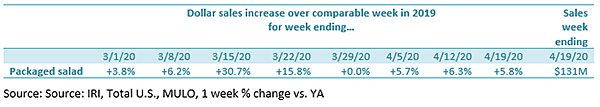

Packaged Salads

Packaged salad sales trends are very similar to that of total produce, with two very strong weeks in the middle of March and growth back in line with the 2019 trends toward the end of March. For the week ending April 19, gains stayed on pace, right around the +6% mark.

Fresh Versus Frozen and Shelf-Stable

Consumers continued to split their produce dollar three ways during the week of April 19. Frozen and canned vegetables had ongoing strong growth during the third week of April. But whereas gains in frozen vegetables had been outpacing gains in frozen fruit since the week of March 15, frozen fruit had a particularly strong week, at +35.7%.

“Many retailers reported increased demand for non-fresh during the onset of the pandemic. Ordering limits had been placed on fresh categories, including produce, from the distribution center to their stores. Retailers are now reporting relaxed guidance on those rules and are moving forward accordingly with increased advertising promotions in advance of the summer months ahead,” said Joe Watson. These and other measures taken by retailers should show up the sales numbers in coming weeks ahead especially as May begins and summer approaches and states begin to relax some of the social distancing protocols which have been in place now nearly two months.

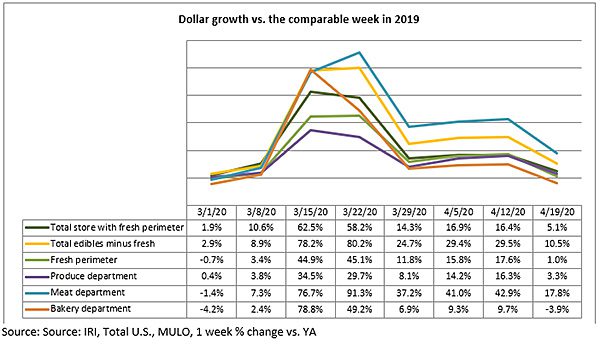

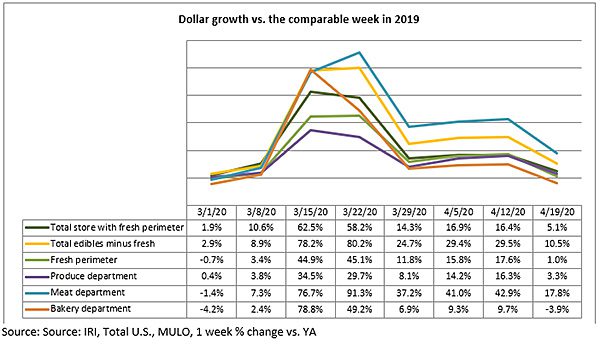

Perimeter performance

Produce was not alone in dropping back down into the single growth digits. Total store sales, including the fresh perimeter, gained a little over 5%, while total edibles excluding fresh were up 10.5% over the week of April 19 versus year ago. While boosted by yet another good week for meat, the total perimeter increased just 1% as sales in deli, seafood and bakery were down significantly.

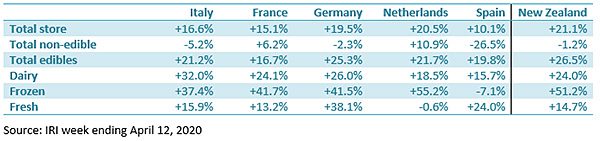

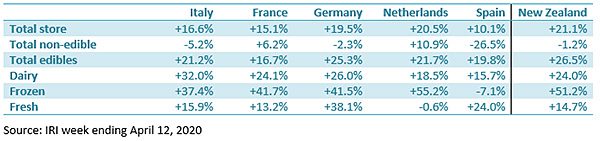

Lessons from Overseas

Overseas sales patterns can help shed some light on what may lie ahead. After very similar weeks of stockpiling as seen in the U.S., most countries seem to have shifted to continued elevated purchasing levels for total edibles, with mixed engagement with fresh (meat, produce, bakery, etc.). For food, the everyday baseline for the week ending April 12 (Easter week) trended about 20% above the comparable week in 2019 for all countries. Non-edible sales have mostly leveled off and declined for some. Frozen food continues to see above-average gains in all countries, but Spain.

What’s next?

As April draws to a close, there is still great uncertainty about the state-by-state decisions on “re-opening” the country. Some states began lifting their executive orders for non-essential businesses whereas others have indefinite shelter-in-place mandates. Only South Dakota remains free of statewide government restrictions that require businesses to close. The reopening of restaurants in some states may provide an indicator of consumers’ mental readiness and economic ability to re-engage with foodservice. For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar. Next week’s sales results will reflect a regular week in both calendar years and may provide some indication of how far the new baseline will lie above the old normal. In addition to many consumption occasions having shifted to at-home, more than 26 million Americans have filed for unemployment in the last four weeks and economic pressure typically translates into more meal preparation at home.

Important changes this week include USDA Supplemental Nutrition Assistance Program (SNAP) program recipients will receive a temporary 40% increase in monthly benefits to provide relief from the pandemic-related economic slowdown. The boost lets families obtaining less than their maximum benefit get the greatest amount per their household size for as long as two months. Additionally, USDA approved Florida and Idaho’s requests to participate in SNAP Online. SNAP Online is now available in Alabama, Iowa, New York, Oregon, Washington, and Nebraska. California and Arizona’s requests to expedite the implementation of online purchasing were approved on April 2.

Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times. #produce #joyoffresh #SupermarketSuperHeroes. 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns.