Working in the produce industry has been a twenty-first century rollercoaster ride. Longtime industry professionals have experienced peaks, rapid drops, and hairpin turns during this era of unprecedented change.

As the Supply Chain Solutions author over much of this time period, I have gained a great appreciation for the strategic transformation efforts of produce supply chain experts. They have minimized product recalls, adapted to the changing tastes of consumers, and interpreted ambiguous government regulations.

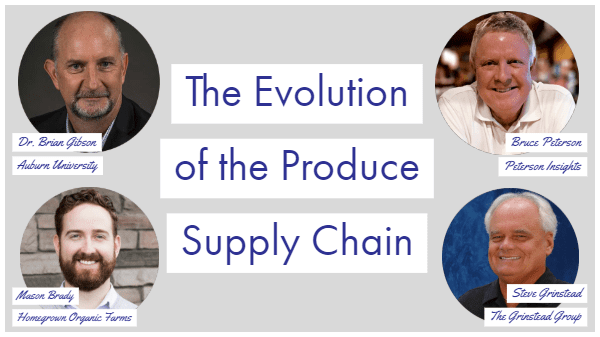

How have they overcome these challenging conditions while vigilantly preparing for the future? We explored this evolution with three experts who share 102 years of collective produce industry experience.

Our roundtable discussion participants are Mason Brady, director of finance and supply chain at Homegrown Organic Farms in Porterville, CA, which grows and markets certified organic blueberries, citrus, stone fruit, and grapes; Steve Grinstead, CEO of the Grinstead Group in Dallas, TX, which provides professional services to the food industry; and Bruce Peterson, president and founder of Peterson Insights in Bentonville, AR, which specializes in food merchandising and procurement consulting services.

Previously, Grinstead was CEO of PRO*ACT USA, a fresh food supply chain network of 70 distribution centers, while Peterson served as senior vice president of perishables for Walmart. The following conversation covers the past, present, and future drivers of fresh produce supply chain processes. We also discuss strategies to ensure uninterrupted field-to-table product flow.

THE PAST TO THE PRESENT

The channel structure and requirements of produce buyers changed considerably over the early part of the decade. To remain viable in this environment, growers, packers, and shippers needed to alter longstanding go-to-market strategies.

Looking across the last 15 to 20 years, how has the industry changed?

Peterson: Going back to the mid-1990s, consolidation and conversion in the retail industry were really cranking up. Retail was moving from a regional privately-held structure into a national and international publicly-held structure. At the same time, the proliferation of the supercenter concept at Walmart and others changed the definition of what grocery shopping meant.

Grinstead: Around the same time, the foodservice side of the produce business began to change. You went from family-owned restaurants to big restaurant groups like Darden and Outback. Private equity groups also got involved. It started to change the dynamics of the supply chain.

How have produce companies responded?

Brady: Suppliers had to go out and build a network, partnerships, and new facilities to efficiently serve retailers and end customers. Providing more consistent service to the big guys across multiple regions was necessary.

Peterson: There was much more systemic interaction in how orders were being placed and how supply chains were managed. Both internal IT networks and external groups began to facilitate the transactional activity that used to take place between the supplier and a seller by phone.

You also started to see a lot more emphasis on data analytics. A foundation was starting to be laid for how decision processes work today with greater examination of what the data analytics recommend we do.

What else changed and what were the responses?

Peterson: From about 2005 on, the consumer demographic was changing pretty quickly. We saw influence shift from the Baby Boomer generation to the millennials and the advent of social media, where millennials validate decisions amongst their peer group.

The reliance on conventional produce expertise and merchandising activities shifted to marketing-driven activities. It really changed what varieties people were selecting, how product was packaged, and how it was prepared.

Grinstead: These shifts opened the door for distributors to offer value-added precut items, packaging options, and services. However, there was a real learning curve in going from a commodity selling focus to a more interactive focus where you had specific packaging products for specific customers. The challenge was to figure out how to manage the new processes and packaging without stressing the supply chain.

Brady: There has been huge growth in demand for organic produce. Retailers told us that suppliers must offer organic produce to continue working with the account. Plus, consumers expect organic produce to have a story about the nature of the product, the farming method, and the systems. We want fast consumer feedback about the eating quality of the product so we can develop and quickly produce new varieties. There’s a lot of data coming down the chain, but it helps us respond faster.