In a February 2023 Trustee’s Preliminary Administration of the Estate of the debtor report, economic challenges for Lakeside Produce Inc. BB #:158819, beginning in mid-2020 and continuing well into 2022, were cited as the main reason behind the bankruptcy.

Of course, all things associated with Covid and the pandemic are referenced as culprits, including supply chain disruptions, labor restrictions, and foodservice shutdowns.

Another major issue was an outbreak of tomato brown rugose fruit virus discovered in the groups’ greenhouses.

Not only did this result in lost revenue, but there were substantial costs associated with cleaning the facilities, the disposal of infected tomato plants, and replacing them.

Signs of Trouble

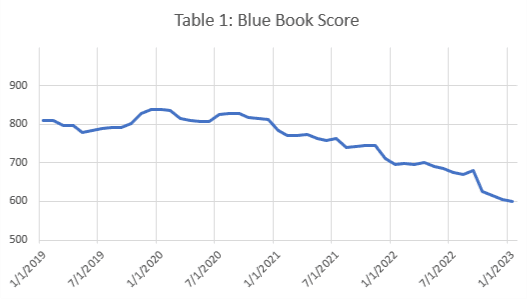

The signs were not immediate, in fact, signs of trouble were subtle when analyzed via the company’s Blue Book score, at least at the beginning of the initial period of concern.

For much of 2019 and 2020, Lakeside’s score traveled in the 800 range and was regarded as “low risk” (see Table 1).

Then, in 2021, the company’s Blue Book score fell approximately 100 points between 1/1/21 and 1/1/22, with its risk moving from “moderately low” to “moderately high.”

Further decline occurred during 2022, with the score dropping approximately another 100 points. The score stopped being tracked after January 1, 2023, when it hit 599, because of the company’s deletion due to its Assignment in Bankruptcy.

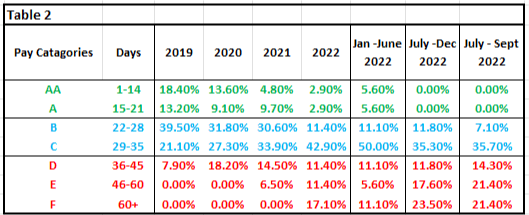

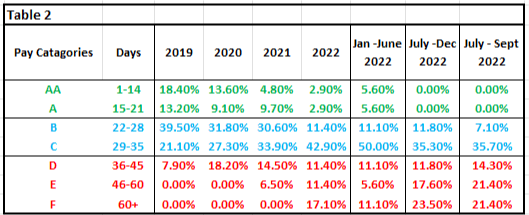

From a ratings perspective, on September 23, 2023, Blue Book removed the assigned rating of 1000M XXX C and replaced it with the rating numeral (76), which means “rating under investigation – rating under review” as a result of an influx of slow pay data received during the month of September (see Table 2).

Despite multiple attempts, Blue Book was not able to speak to the owner or other executives at the time of change.

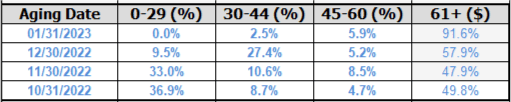

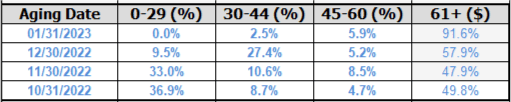

In the final months of 2022, survey data was limited; however, accounts receivable (A/R) aging data shared by industry contributors showed a clear negative trend for all shared files (see Table 3).

Interaction with Lakeside personnel was limited during the final months. Prior to the Assignment in Bankruptcy, Blue Book reported the information numeral (85) on January 16, 2023, meaning “special report available upon request.”

This provided further reference to the reported slow pay and significantly aging vendor receivables.

This rating numeral assignment also referenced that the company’s phone lines were not being answered during normal operating hours, and local sources had suggested personnel were being let go.

The next day, January 17, 2023, the company filed for bankruptcy, publicly announcing its closure.

As a result, Blue Book reported “voluntary assignment in bankruptcy made under the Bankruptcy & Insolvency Act” along with the numeral (113), meaning “reported suspended operations; obligations remain outstanding.”

This is the second of a three-part excerpt from the Credit and Finance department in the January/February 2024 issue of Produce Blueprints Magazine. Click here to read the whole issue.