CORAL GABLES, Fla.–(BUSINESS WIRE)–Fresh Del Monte Produce Inc. BB #:111187 today reported financial results for the first quarter ended March 31, 2023.

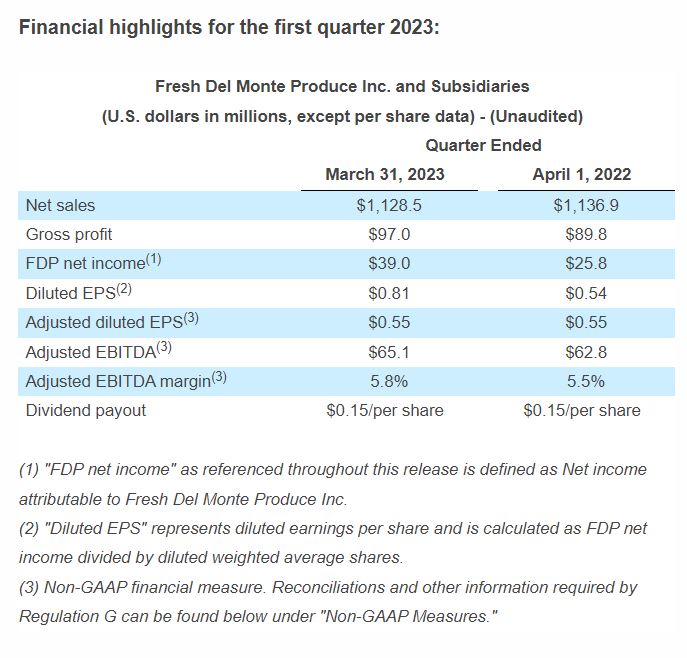

Net sales for the first quarter of 2023 decreased $8.4 million, or 1%, compared with the prior-year period. The decrease in net sales was impacted by lower per unit selling prices of avocados, lower volumes in the fresh and value-added products segment, and negative fluctuations in exchange rates, primarily in Europe and Asia. Partially offsetting the decrease in net sales were higher per unit selling prices across most other products and higher banana sales volume.

Gross profit for the first quarter of 2023 was $97.0 million compared with $89.8 million in the prior-year period driven by higher per unit selling prices across most product categories combined with lower distribution costs.

Partially offsetting the increase in gross profit were higher production and procurement costs across most product categories as well as higher ocean freight costs.

Adjusted gross profit(3) for the first quarter of 2023 was $98.8 million. Adjusted gross profit excludes $1.8 million of other product-related charges primarily due to the sale of two distribution centers in the Middle East. There were no adjustments to gross profit in the first quarter of 2022.

Operating income for the first quarter of 2023 was $74.5 million compared with $39.8 million in the prior-year period, and Adjusted operating income(3) was $51.2 million compared with $40.4 million in the prior-year period. The increase in operating income was primarily due to the gain on sale of underutilized assets and higher gross profit. Adjusted operating income excludes $2.4 million of asset impairment and other charges, net related to a cybersecurity incident in early 2023, and $27.5 million gain on sale of which $20.5 million was related to the sale of two distribution centers in the Middle East and $6.8 million was related to the sale of an idle facility in North America. In the prior-year period, Adjusted operating income excludes asset impairment and other charges of $1.0 million and a gain on sale of $0.4 million.

Other expense, net for the first quarter of 2023 was $9.3 million compared with $4.0 million in the prior-year period. The increase primarily relates to higher foreign currency related losses.

FDP net income(1) for the first quarter of 2023 was $39.0 million compared with $25.8 million in the prior-year period and Adjusted FDP net income(3) was $26.6 million compared with $26.2 million in the prior-year period. Adjusted FDP net income for the first quarter of 2023 excludes the abovementioned other product-related charges, $2.4 million of asset impairment and other charges, gain on sales, as well as $7.6 million of minority interest expense associated with the gain on sale and a $3.3 million tax effect related to all adjustments. In the prior-year period, Adjusted FDP net income primarily excludes the abovementioned asset impairments and other charges and gain on sale.

First Quarter 2023 Business Segment Performance

Fresh and Value-Added Products

Net sales for the first quarter of 2023 decreased by $29.3 million, or 4%, when compared with the prior-year period, primarily due to lower per unit selling prices of avocados combined with a decrease in total sales volume for the segment, mostly of fresh-cut vegetables, prepared foods products and vegetables. The decrease was partially offset by higher per unit selling prices across most other product categories and higher pineapple sales volume.

Gross profit for the first quarter of 2023 was $47.1 million compared with $44.4 million in the prior-year period. Despite lower net sales, gross profit was positively impacted by higher per unit selling prices for most product categories. The segment continued to be negatively impacted by cost pressures for raw materials such as packaging materials and fertilizers as well as higher ocean freight costs. Gross profit for the fresh and value-added products segment included a $1.7 million inventory write-off primarily due to the sale of two distribution centers in the Middle East. There were no other product-related charges during the prior-year period. As a result of these factors, gross margin increased to 7.3% compared with 6.6% in the prior-year period.

Banana

Net sales for the first quarter of 2023 increased by $19.1 million, or 5%, compared with the prior-year period. The increase in net sales was primarily related to higher per unit selling prices in most regions and higher sales volume in North America and Europe.

Gross profit for the first quarter of 2023 was $43.2 million compared with $37.7 million in the prior-year period. The increase in gross profit was primarily driven by higher net sales, partially offset by higher procurement and production costs, such as packaging material and labor, as well as ocean freight costs. As a result of these factors, gross margin increased to 10.2% compared with 9.3% in the prior-year period.

Other Products and Services

Net sales for the first quarter of 2023 increased by $1.8 million, or 3%, compared with the prior-year period, mainly due to higher net sales of third-party freight services.

Gross profit for the first quarter of 2023 decreased by $1.0 million compared with the prior-year period driven by higher costs. Gross margin decreased to 11.2% from 13.1% in the prior-year period.

Cash Flows

Net cash provided by operating activities for the first quarter of 2023 was $15.5 million compared with net cash used in operating activities of $0.3 million in the prior-year period. The increase was primarily attributable to working capital fluctuations, mainly related to levels of accounts receivable and raw materials and packaging supplies inventory.

Total Long Term Debt

Total long-term debt decreased to $472.7 million at the end of the first quarter of 2023 from $554.1 million at the end of the first quarter of 2022.

Quarterly Cash Dividend

On May 2, 2023, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share, payable on June 9, 2023 to shareholders of record on May 17, 2023.

About Fresh Del Monte Produce Inc.

Fresh Del Monte Produce Inc. is one of the world’s leading vertically integrated producers, marketers and distributors of high-quality fresh and fresh-cut fruit and vegetables, as well as a leading producer and distributor of prepared food in Europe, Africa and the Middle East. Fresh Del Monte markets its products worldwide under the Del Monte® brand (under license from Del Monte Foods, Inc.), a symbol of product innovation, quality, freshness and reliability for over 135 years. The Company also markets its products under the Mann™ brand and other related trademarks. Fresh Del Monte Produce Inc. is not affiliated with certain other Del Monte companies around the world, including Del Monte Foods, Inc., the U.S. subsidiary of Del Monte Pacific Limited, Del Monte Canada, or Del Monte Asia Pte. Ltd. Fresh Del Monte is the first global marketer of fruits and vegetables to commit to the “Science Based Targets” initiative. In 2023, for the second consecutive year, Fresh Del Monte Produce was ranked as one of “America’s Most Trusted Companies” by Newsweek based on an independent survey rating companies on three different touchpoints, including customer trust, investor trust, and employee trust. Fresh Del Monte Produce is traded on the NYSE under the symbol FDP.