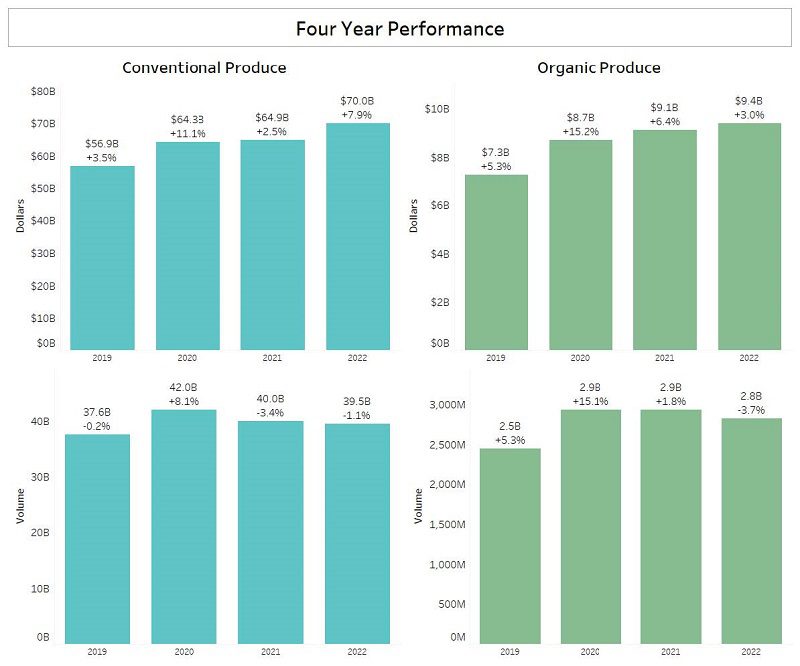

MONTEREY, CA — January 25, 2023 — Organic fresh produce sales grew by 3 percent in 2022, while volume declined by –3.7 percent, as total sales topped $9.4 billion for the year, according to the 2022 Organic Produce Performance Report released today by Organic Produce Network BB #:338018 and Category Partners.

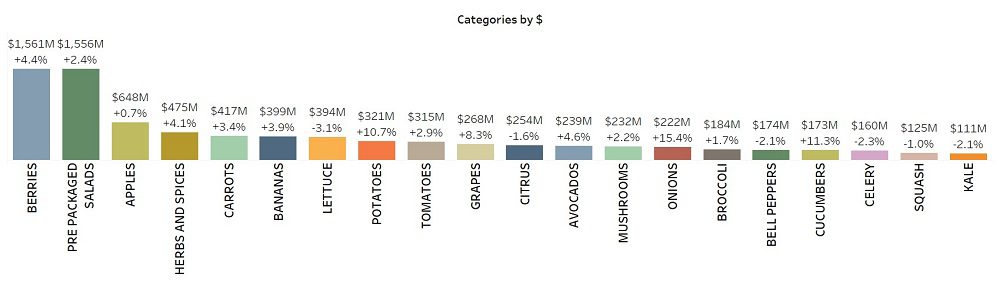

The organic fresh berry category (which includes strawberries, blueberries, raspberries, and blackberries) was the top organic produce category, holding more than 16 percent of organic fresh produce dollars in 2022. Overall fresh berry sales topped 1.6 billion for the year, with organic packaged salads a close second at $1.55 billion.

Total fresh produce sales gained 7.3 percent in dollars for the year but experienced a –1.3 percent decline in volume. Organic fresh produce made up 12 percent of all fresh produce sales and accounted for 7 percent of all fresh produce volume.

“In an inflationary time like this, we expect to see the growth of sales dollars and volume declines repeated for the majority of organic and conventional fresh produce items,” said Tom Barnes, President of Category Partners.

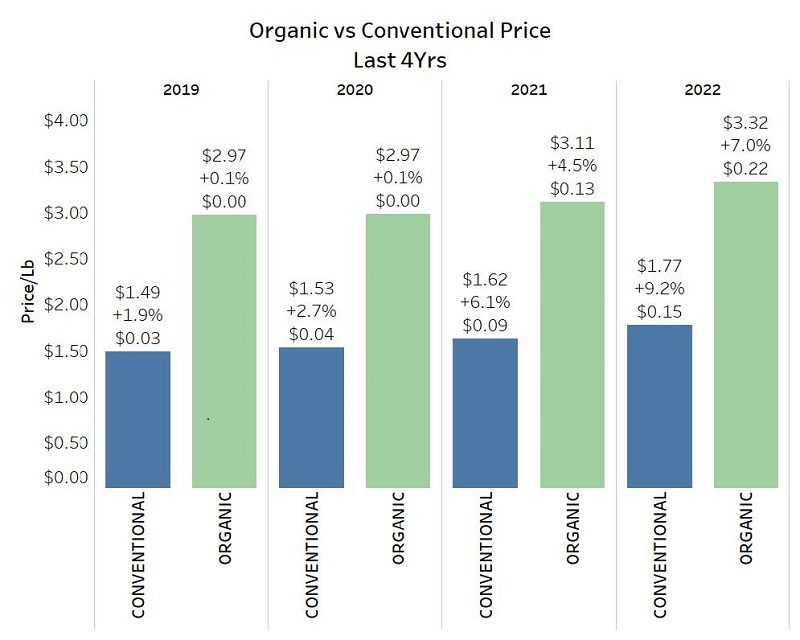

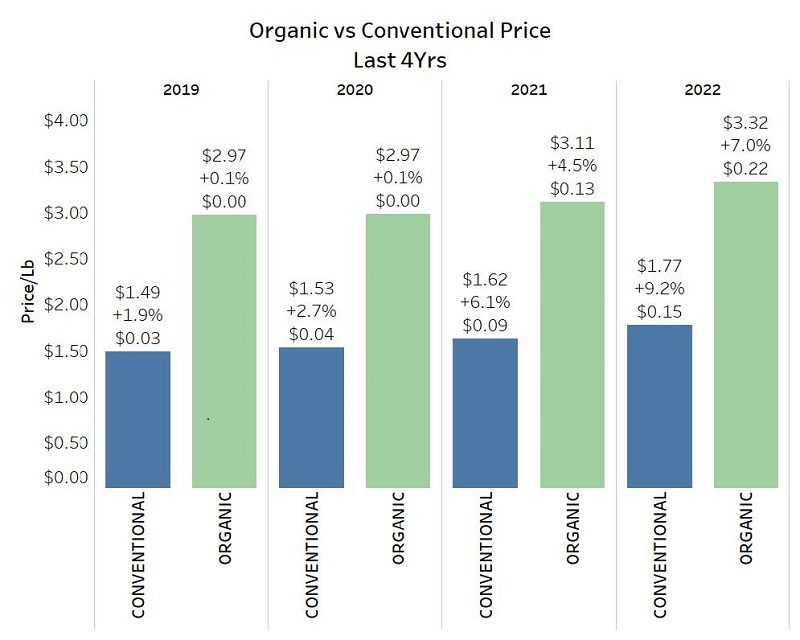

“The average conventional price per pound grew by 9.2 percent compared to 2021 while organic produce price per pound rose by 7 percent. With rising prices, we may see more selective organic shopping from consumers as they substitute higher-priced organic items for conventional ones.”

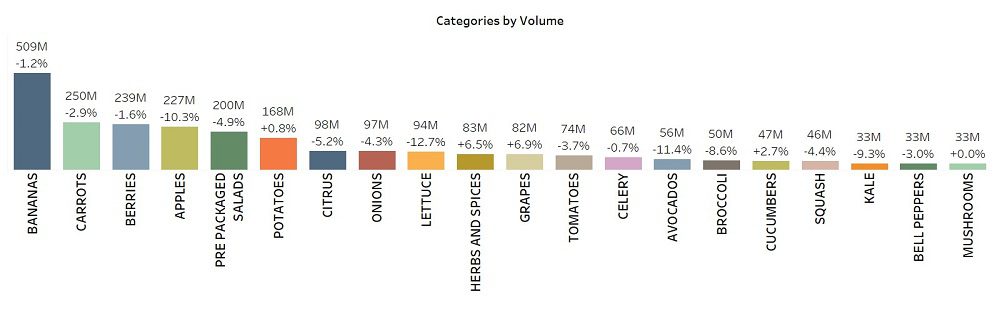

Organic apples were the largest example of substitution as their price per pound increased by more than double the amount of conventional, resulting in a volume decline of –10.3 percent.

For 2022, 13 of the top 20 organic produce categories (by total sales) posted increases in dollars, with organic onions generating the largest increase (15.4 percent), followed by cucumbers, potatoes, and avocados. Conversely, green beans posted the largest drop in dollars (–5 percent), and lettuce and bell peppers also posted noticeable declines in dollars for the year.

Additionally, 14 of the top 20 organic produce sales categories posted declines in volume, with only 10 of those categories showing positive dollar growth. Organic bananas continued to be the biggest volume mover despite a –1.2 percent volume decline in 2022 and showed a modest 3.9 percent increase in sales from the previous year.

Of note, potatoes and cabbage, typically regarded as inflation busters, showed a 10 percent increase in dollar sales and a nominal 1 percent growth in volume. Organic grapes had a stellar year, with a 6.9 percent increase in volume and an 8.3 percent increase in sales.

Organic performance in 2022 was consistent among all regions of the nation—dollars grew and volume declined. The Northeast saw the lowest dollar growth and highest volume decline, while the South continues to show the most year-over-year improvement.

Organic fresh produce prices in aggregate remained substantially higher than conventional, with 2022 showing the price gap between conventional and organics the largest it has been in the past four years at $1.55 per pound.

“In an inflationary time period, it is important for organic producers to understand how their pricing impacts behavior among various consumer segments and to reach those consumers with the health and value benefits associated with organics,” said Barnes.

The fourth quarter of 2022 saw the twelfth consecutive quarter of organic sales growth, with a modest 1.4 percent increase from the same period last year. Organic produce sales for the fourth quarter topped $2.1 billion, with the grape category leading the way in year-over-year dollar and volume growth.

The 2022 Organic Produce Performance Report utilized Nielsen retail scan data covering total food sales and outlets in the US from January through December 2022. A complete version of this report, including information on the top 20 organic fresh produce categories, will be made available on the Organic Produce Network website in mid-February.

OPN is a marketing organization that serves as the go-to resource for the organic fresh produce industry. The company’s mission is to inform and educate through a strong digital presence with an emphasis on original content and complemented by engaging live events that bring together various components of the organic produce community. OPN’s target audience includes organic producers, handlers, distributors, processors, wholesalers, foodservice operators, and retailers. www.organicproducenetwork.com

Media Contact:

Matt Seeley

Matt@organicproducenetwork.com

831-884-5058