MADISON, Wis., Nov. 7, 2022 /PRNewswire/ — Fetch, America’s No. 1 rewards app and leading consumer-engagement platform, today released the latest installment of its Fetch Price Index report, finding that average prices for food and consumer goods are up 12.5% compared to last year.

While the rate of inflation slowed in October, so has consumer demand – purchase volume dropped 0.4% year over year. Consumers are buying less, but they’re spending 12.7% more, relatively in line with price increases.

To control spending, consumers are taking fewer trips compared to recent months, shopping in bulk where necessary, and buying fewer items overall. Consumers cutting back on purchasing, another symptom of an ailing economy, indicates they may be saving where they can now in anticipation of the upcoming holidays.

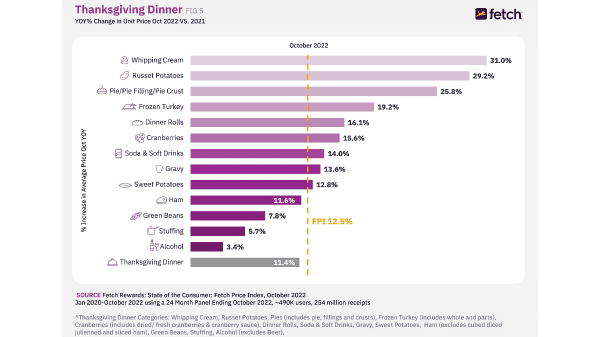

With Thanksgiving approaching, Fetch also analyzed price changes to staple categories to understand how much more the holiday meal will cost this year and how consumers can make strategic adjustments to save money. In addition to the persistent inflation, a major avian flu outbreak in Europe and North America is driving up costs for frozen turkeys by 19.2%.

Across the board, price increases for the majority of Thanksgiving staples are outpacing general inflation – whipping cream is 31% more expensive, russet potatoes are up 29.2%, and pie-making essentials like filling and crusts are up 25.8%.

To save money, shoppers could swap out turkey for ham and/or serve sweet potatoes instead of russets. And, mercifully, alcohol prices are only up 3.4% this year, the lowest price increase of any of the staple Thanksgiving categories.

In an effort to curb inflation, the Federal Reserve last week raised interest rates for the sixth time this year in an attempt to reduce the inflationary pressures while keeping a close eye on the employment index. Hinting at increased risk of an economic slowdown, revised projections for 2022 reflect the weakest growth profile since the global financial crisis.

“With prices remaining stubbornly high, we foresee that consumers will continue looking for ways to make their dollar stretch and pulling back on how much they’re buying. We’ve seen demand decrease as shoppers make fewer trips and buy in bulk, a signal that people are trying to save up for the holidays,” said Wes Schroll, Fetch CEO and founder.

“Consumers are going to continue to search for relief across the board, but especially as they look to put food on tables and celebrate with loved ones later this month and next. We’re committed to helping consumers save on essentials – by partnering with some of the country’s leading grocery, restaurant and retail brands, we’re able to pass savings onto consumers directly.”

About Fetch

Founded in Madison, Wis., Fetch is on a mission to help people have fun and save money on every purchase. The No. 1 rewards app on the market, Fetch has more than 17 million monthly active users who have collectively submitted more than 2 billion receipts and earned more than $475 million in rewards points. A top-ranked app in the App Store and Google Play Store with more than 2 million five-star reviews from happy Fetchers.

Media contact:

Allison Geyer

a.geyer@fetchrewards.com