NEW YORK, Sept. 26, 2022 /PRNewswire/ —

Key takeaways

- Shopping stress jumps due to inflation: nearly half (48%) of consumers find in-store shopping more stressful than last year, up from 40% in 2021. The leading cause of shopping stress is concern over rising food prices (53%).

- With rising inflation, price is the top consideration for consumers purchasing fresh food (92%).

- Actually, it seems consumers are having trouble focusing on much of anything besides price. Preference for sustainable, locally grown, and non-GMO food are all lower than pre-pandemic, down at least 12 percentage points in purchase consideration from 2019.

- Though price overshadows other purchase drivers, health still matters: 84% of consumers consider the health and wellness benefits of fresh food.

- More than half (55%) are still willing to pay a premium for the food that contributes to their health and wellness.

Why this matters

With inflation top of mind, it is difficult for consumers to look beyond price. However, according to Deloitte’s annual report on fresh food, consistent demand for products that foster health and wellness may provide a ray of light for the industry to influence where and how they shop. The report, “Fresh Food as Medicine for the Heartburn of High Prices,” examines the impact of inflation on consumers’ food purchases and how fresh food producers and grocers can adapt to drive new opportunities. The report is based on a survey conducted in July 2022 of 2,054 adults (aged 18 to 70) who influenced fresh food purchases in their households.

Price continues to be the main driver among the three Ps

While three factors drive shifts in what and how consumers purchase fresh food — price, perishability, and preference — price dominates amid inflation. Although anxiety about shopping in-store due to the pandemic declined, shopping stress is on the rise again, up eight percentage points from 2021. The top cause of shopping stress overwhelmingly is concern over rising food prices (53%), followed by a change in personal financial situation (13%).

- Consumers are focused more on food prices: 85% say they prefer food options that are low in price, up five percentage points from 2021.

- More than 9 in 10 consumers (92%) who saw prices rise are making significant changes to adapt. This includes trading down to private labels (38% overall, even more so for consumers in rural areas at 45%). Additionally, nearly 1 in 5 are giving up fresh food items to trade down for cheaper canned or frozen alternatives.

- To cherry-pick the best deals, 1 in 3 consumers is now shopping in multiple stores. Further, 1 in 5 have changed their primary store to a low-cost outlet.

- The perishability of fresh food continues to be an area of concern: More than three-quarters of consumers (78%) consider food waste when making a purchase. This is likely out of a desire to minimize spending, more so than shopping frequency or sustainability factors which played a more significant role in waste concerns in past years.

- Food insecurity raises the importance of price, food waste and convenience: 15% of survey respondents used a food assistance program, this group indicated price (72%), food waste (43%) and convenience (37%) as very important to their fresh food purchases.

Consumers realize the potential benefits of food as medicine

It’s no surprise food matters when it comes to health and wellness. According to the USDA (United States Department of Agriculture), an unhealthy diet is the leading risk factor for death as it exacerbates some chronic health conditions. Putting food to use in preventing and treating specific health needs creates an opportunity for the fresh food industry to further connect with consumers while improving the top and bottom lines. The industry can also help households that face health equity challenges exacerbated by inflation. Food insecurity itself is strongly correlated with adverse health outcomes.

- Overwhelmingly, 84% of consumers consider health and wellness when purchasing fresh food. Another 80% believe fresh food is healthier for them than packaged or processed food marketed as healthy.

- More than half (55%) of consumers are willing to pay a premium for the right foods because they contribute to their health and wellness.

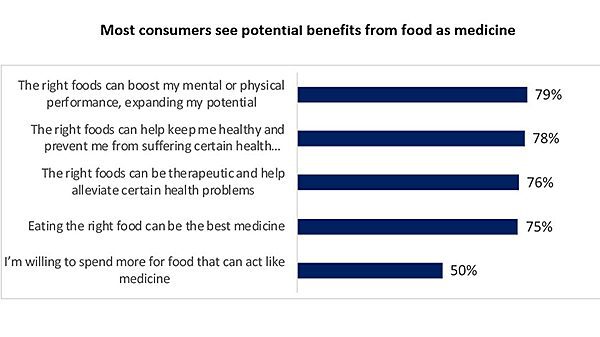

- Consumers believe the right food can improve health and wellness by boosting mental or physical performance (79%), offering preventive (78%) or therapeutic benefits (76%), or being the best medicine (75%).

- When consumers buy fresh food for its health properties, half (52%) do it to feel good or for overall energy (45%). However, many seek therapeutic benefits like weight management (43%) or to manage existing medical conditions (32%), while 39% use fresh food to prevent diseases in the first place and preserve health.

- Further, 3 in 4 actively seek more personalized nutrition, up 13 percentage points from a year ago.

Key quote

“Despite inflation and rising food costs, consumers are willing to pay for fresh food that will positively impact their health and wellness. Amid increasing competition, fresh food producers and retailers have the opportunity to introduce consumers to healthy choices and use food as medicine. Grocers who can close the information gap between fresh food and its health outcomes can be better positioned to win over consumers — and compete on aspects other than price.”

— Daniel Edsall, principal, Deloitte Consulting LLP

Trust in food retailers is key to progress

While consumers want to use food as medicine, 62% cite conflicting information and confusion about the healthfulness of specific foods. Four in 10 consumers do not clearly understand which fresh foods can act like medicine, and a little over half of consumers (52%) say it is essential to get data about food origins, safety, and nutritional properties to use food as medicine confidently. Fortunately, many consumers seem to have a high degree of trust in their favorite food retailers to overcome these barriers.

- More than half of consumers trust their grocer to provide data about the safety, origin and nutritional properties of fresh food items (56%) and correctly use and protect their personal data (54%).

- Nearly half of consumers (48%) would share data on their dietary preferences, and 4 in 10 (42%) would even share some of their medical data, like from an in-store pharmacy.

- Almost half of consumers (48%) would use a digital shopping app or website to get personalized fresh food shopping recommendations from their favorite grocer.

Key quote

“Using food as medicine is one of the ways consumers can be empowered to take control of their health. However, not every household has equal access to or can afford to pay higher prices for fresh, healthy foods which is a factor that contributes to health inequities and poorer health outcomes. We recognize that grocers and other stakeholders have an important role to play in supporting the health and wellness of their communities by helping to ensure their customers benefit from the connection between healthy foods and good health.”

— Jay Bhatt, D.O., MPH, MPA, executive director of the Deloitte Center for Health Solutions and the Deloitte Health Equity Institute

Connect with us on Twitter at @DeloitteCB or on LinkedIn @DannyEdsall.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax, and advisory services to many of the world’s most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people come together for the greater good and work across the industry sectors that drive and shape today’s marketplace—delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthier society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Building on more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte’s more than 415,000 people worldwide connect for impact at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.