Month-after-month inflationary pressure is causing consumers to change their buying pattern, and when it comes to food, that means more stops to dollar stores and seeking often-cheaper private labels.

A July survey from InMarket shows shopping shifts to minimize costs.

Nearly one half of respondents (47 percent) said that their shopping habits have changed due to rising inflation. A majority of respondents, 65 percent, said that rising inflation is causing them to spend more money than they used to. To counter higher prices, 58 percent of respondents said that rising inflation is causing them to cut back spending on discretionary purchases.

When asked what they spend now compared to what they normally spend, on everyday needs (including groceries), 55 percent said more, 20 percent said about the same and 25 percent said less. On dining out, 33 percent said more, 21 percent said same, and 46 percent said less.

“To help offset the rising costs of goods, 55% of shoppers are buying more items on sale/clearance, and 46% of shoppers are buying more generic brand products,” the report said. “Just 32% of consumers are buying more products in bulk, suggesting that while bulk purchases may be more cost efficient, the larger expense is not worth it for many shoppers.”

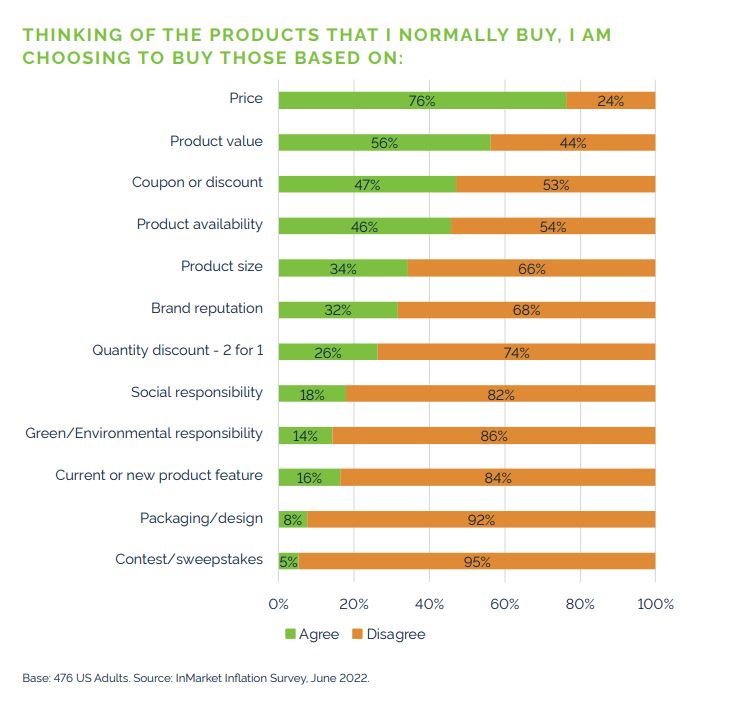

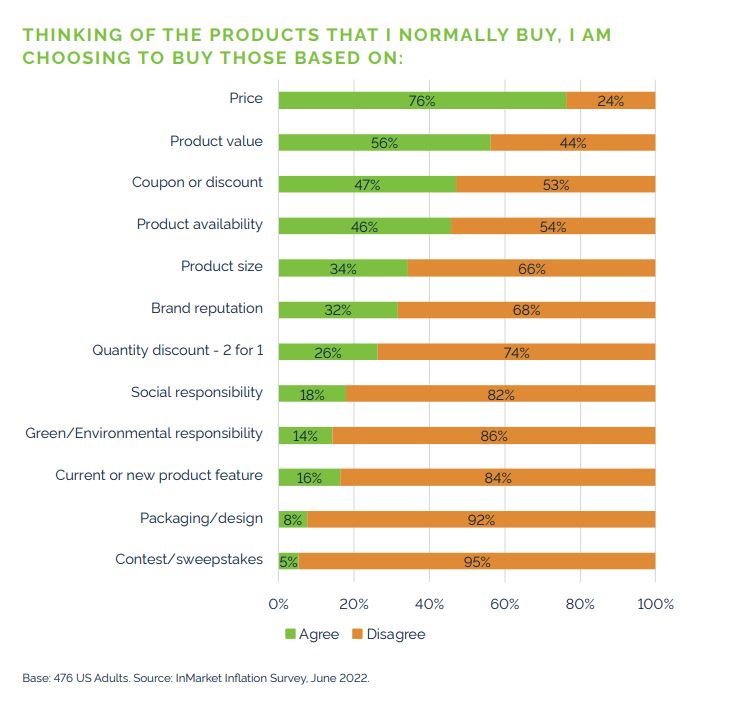

Price has become the dominant motivator for purchases, as a strong majority — 76 percent — of consumers are choosing to purchase items based on price, followed by product value (56 percent). Coupons and discounts are also strong motivators, with 47 percent of shoppers purchasing based on these ways to save.

InMarket says, “35 percent of surveyed consumers said they are shopping significantly more at dollar stores in this era of high inflation. In addition, 39 percent of consumers said they’re shopping less at warehouse clubs — club inventory is typically larger quantities, leading to larger costs (despite being more efficient. These larger bills may turn shoppers away, at least temporarily.”

The company says the behavior changes should not be considered temporary.

“Marketers looking to attract new customers, retain existing customers, and strengthen loyalty must continue to work tremendously hard as consumer priorities shift in favor of value, savings, and quality. Over the next few weeks and months—and perhaps into the next year—marketers should prioritize strategies that enable them to efficiently and effectively engage consumers, especially at key moments throughout their purchase process.”