Has e-grocery reached its max?

This question occurs as one looks over the results of a recent survey by Brick Meets Click.

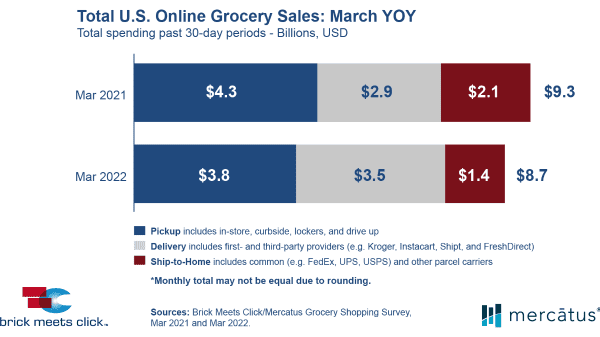

According to the survey, total online grocery sales declined by 6 percent on a year-to-year basis last month. In March, total e-grocery sales amounted to $8.7 billion, down from $9.3 billion in March 2021.

The drop in the ship-to-home category was steepest—30 percent, from 2021’s $2.1 billion to this year’s $1.4 billion. This category includes shipments via common carriers such as USPS, UPS, and FedEx.

Pickup sales fell 11 percent year-over-year, to $3.8 billion from $4.3 billion in 2021.

Delivery sales, however, increased by 20 percent, from 2021’s $2.9 billion to $3.5 billion. Delivery sales includes both first- and third-party shippers, Kroger, InstaCart, FreshDirect.

“Two factors continued to drive Delivery’s strong performance in March,” said David Bishop, partner at Brick Meets Click. “First, the aggressive expansion of third-party providers into grocery is enabling additional ways for people to shop online, and second, newer services focused on faster cycle times are appealing to a broader range of trip missions and usage occasions.”

“A key takeaway from March’s report is that online grocery sales have retained much of the gains from a year ago, proving the resilience of grocery eCommerce,” added Sylvain Perrier, president and CEO, Mercatus. “Even so, conventional grocers need to develop and strengthen their first-party web and mobile channels, leverage third-party solutions to fill in the gaps, and excel at executing the services they offer.”

The figures suggest some other conclusions.

In the first place, the delivery sector is not going away and may still grow. This is at least partly because there is a built-in market for it: the elderly, the disabled, and people who just don’t like going to the store.

On the other hand, pickup sales could continue to diminish. The common-sense explanation: driving to the store and picking up your groceries is only slightly more convenient than going inside and getting them yourself. But in-person purchase has one built-in advantage: you know exactly what you are getting. If you get the wrong thing, it is your fault and yours alone.

We could conclude that pickup sales were heavily motivated by the coronavirus, and that motivation will diminish as the virus fades into the background.

It is very hard to see how online grocery sales are of any great benefit to the produce industry. Produce purchasing is partly impulse-motivated: “The nectarines in the store looked really good today.”

Even when it isn’t, no two fruits or vegetables are identical, and shoppers are likely to want to look at the exact item that they put in the basket. Even with highly reputable providers (such as with strawberries), items vary widely in quality and appeal.

If e-groceries have maxed out, then, it won’t be a tragedy for the produce industry.