In our March Madness fervor, we neglected to acknowledge a very important annual milestone last week. So, without further ado, happy first day of spring!

Produce markets held steady over the previous week in a surprising hiatus from springtime volatility. Price increases in berries, tomatoes, and corn offset declines in lettuce, celery, and asparagus prices. Still, it wouldn’t be a week in fresh produce without a touch of drama.

ProduceIQ Index: $1.17 /pound, flat over prior week

Week #12, ending March 25th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

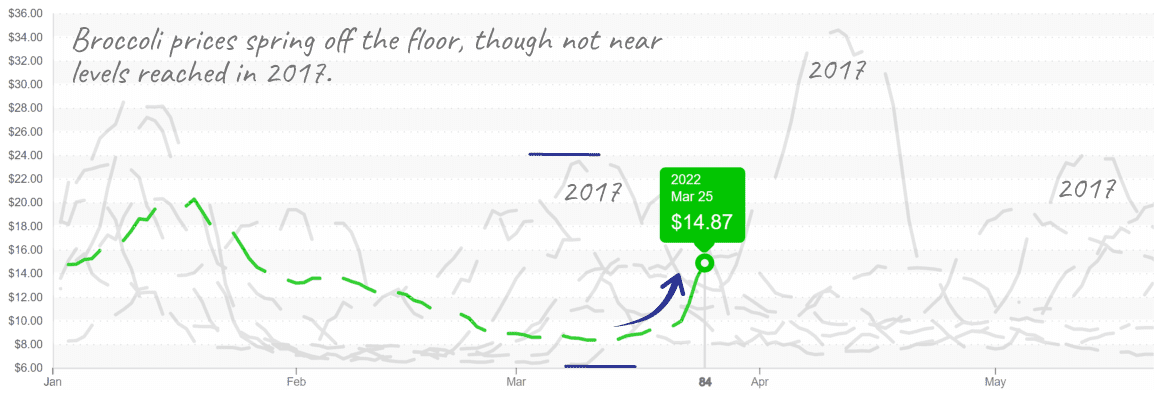

Broccoli markets are tightening up. A bit late, but after a few weeks of low prices, broccoli is finally catching onto our spring transition theme. Moving from $9 to $15, broccoli prices are up +50 percent over the previous week and are expected to climb further.

Mexico’s and Arizona’s broccoli output has decreased sharply over the past three weeks, and California’s production has yet to blossom into all its springtime glory. As a result, expect prices to remain elevated until domestic production in California gets going in mid-April.

Broccoli begins ascent during a season of unpredictable prices.

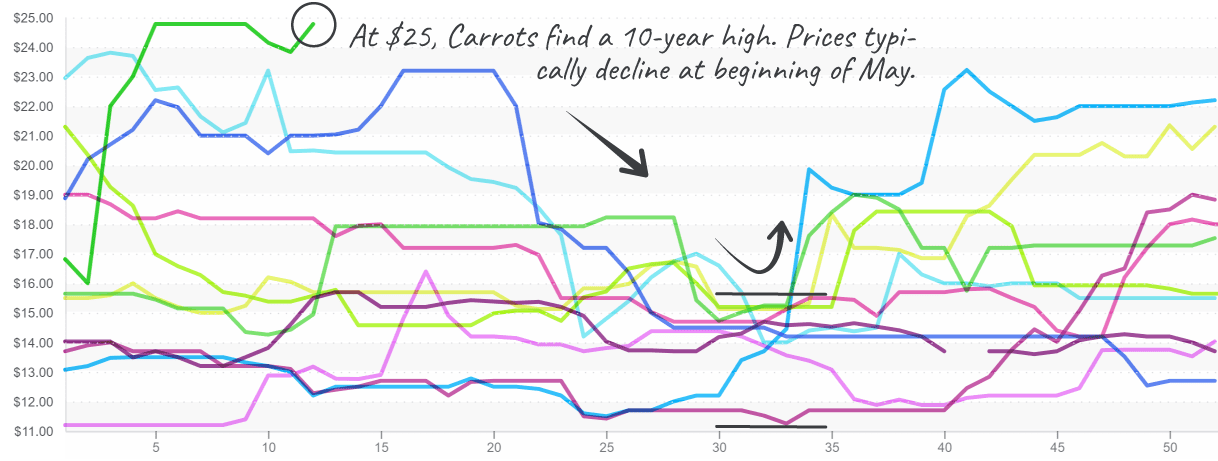

Perhaps the Easter Bunny would like to try another root vegetable this year? Unfortunately, carrots may break the average American’s holiday budget. Carrot yields are lower due to an unusually wet winter. Mexican jumbo carrots crossing Texas are $16, which is high. However, $25 for a comparable 50-lb. sack of carrots from Kern County certainly corroborates the food inflation narrative.

Carrots elevate to prices only reached in the year, 2011.

We may have escaped into glorious spring, but the cold lords of winter are still nipping at our heels. Sweet-corn prices are nearing last year’s record-high prices. In late January, areas as far South as Belle Glade, FL, endured freezing temperatures and frost. Farmers reported a good amount of damage to cornfields, reducing winter yields. Mexican supply is also light.

The good news is Florida’s spring sweet corn crop should provide some relief to overextended markets in the next 2-3 weeks. However, the Florida Exchange and all growers are pushing for higher than “normal” spring prices to help ease rising production costs.

Sweet corn prices continue to climb based on low yields this winter.

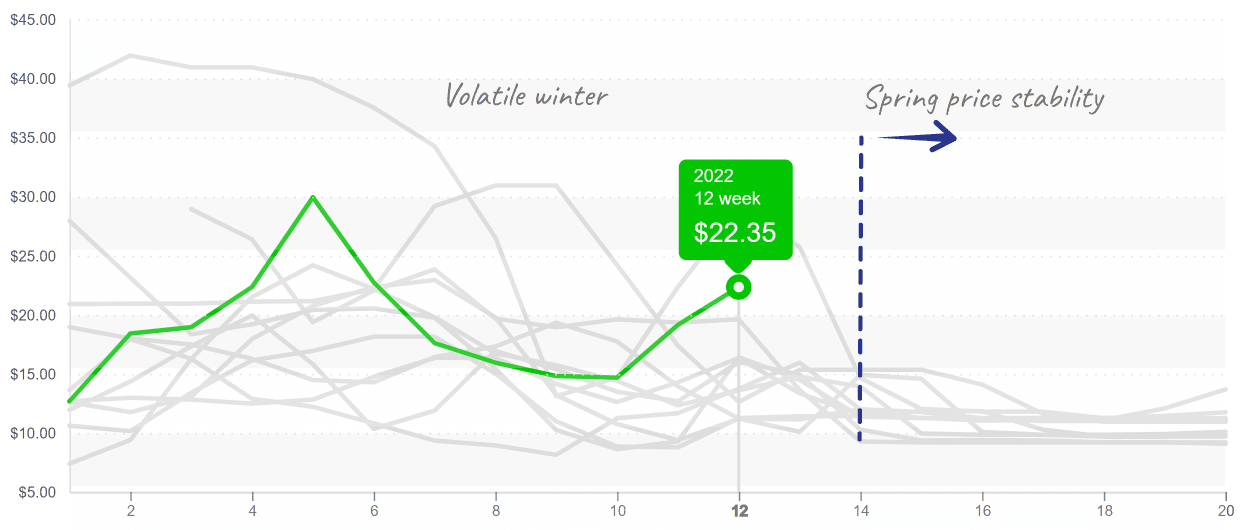

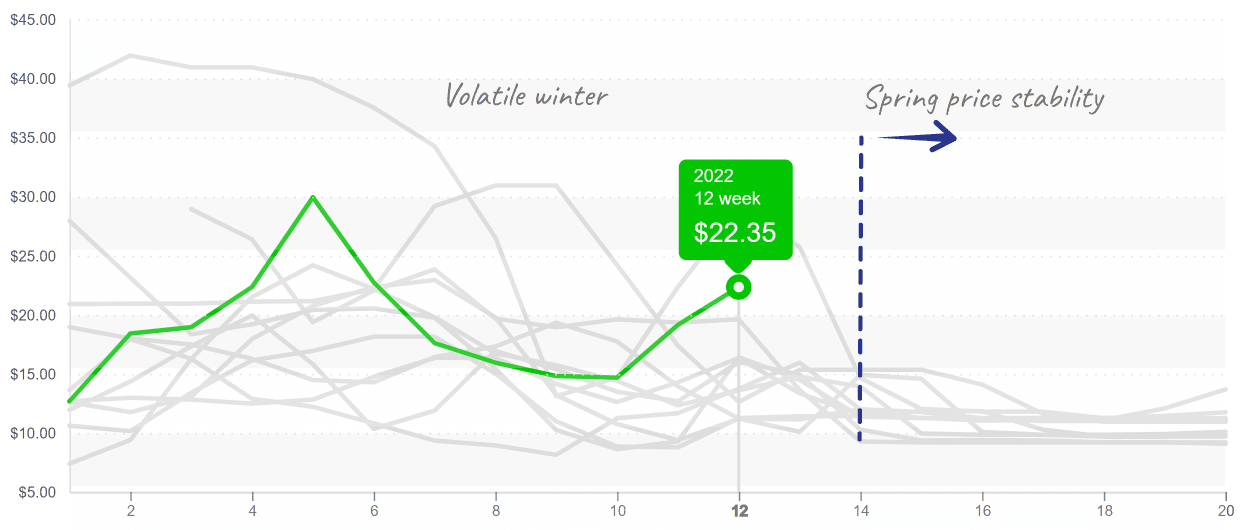

Fertilizer costs, currently in the global headlines because of the war in Ukraine, just reached record-breaking levels.

The Green Markets Weekly North American Fertilizer Price Index began in 2002 with a value of 100. Last week, this Index reached 1,270, implying that fertilizer costs are now more than 12x the price they were 20 years ago. The majority of the increase has happened over the last two years, beginning May 2020. At that time, the Index was at 305. Fertilizer costs rose 4x in two years!

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.