In the summer of 2019, H. Brooks and Company, LLC BB #:100563 New Brighton, MN, had entered into a definitive agreement to sell its stock and become a wholly owned subsidiary of New Harvest Foods, Inc.

New Harvest Foods, held by an investment group, completed its acquisition of H. Brooks on July 22, 2019. In addition, a new CEO with significant produce experience was appointed to lead the company.

As part of the acquisition, New Harvest Foods, Inc. also acquired J&J Distributors BB #:100664 of St. Paul, MN, with the intent to merge the operations of J&J Distributors with H. Brooks (however, this article’s coverage will only focus on H. Brooks and not J&J Distributors).

Despite the acquisition and change in leadership, vendor trading experiences with H. Brooks continued to tumble. New management shared that vendors were largely understanding, though some had pulled back.

Given the ongoing struggles, a quick turnaround was proving difficult. A lack of bank financing was a contributing factor, but management still expressed a certain degree of optimism and was moderately confident investment capital would be deployed to pay down old supply side obligations.

Just months after being acquired, rating interim numerals (27)(76) were assigned to H. Brooks in March 2020, meaning, respectively, “pay reported as slower” and “rating under investigation,” for further decline in reported trade information.

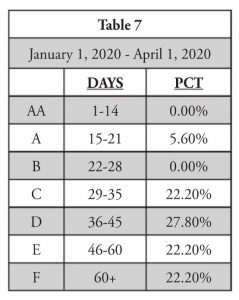

Three weeks later, despite management advising “some” funding had become available, a rating of (144) XX147 (149) was assigned (XX is defined as unsatisfactory trading experiences, while 147 indicates some trading partners report better than XX; Table 7 reflects survey data observed during this change period).

Survey data shows 72.2 percent of accounts reported as delinquent, with 44.4 percent being reported as severely delinquent. Interestingly, for the same period, A/R data shows total delinquency outstanding as 31.3 percent; however, total tradeline delinquencies were 54.1 percent, demonstrating further decline and consistent with survey data as reflected in Table 7.

On June 23, 2020, leadership appointed at the time of New Harvest’s acquisition left. A new president and other executives were announced. Less than a year later, as a result of continued decline in trading performance since early 2019, on February 2, 2021 an (86) F was reported, meaning, “financial considerations and or trade reports prohibit the assignment of a definite rating,” and reported pay experiences were either aging or being handled beyond 60 days.

Multiple federal lawsuits, as well as Blue Book and PACA claims were filed shortly after. An injunction was granted on May 27, 2021, enjoining the company, its affiliates, and certain officers.

The company was reported as having suspended operations with outstanding obligations on July 8, 2021, and its PACA license was suspended for unpaid awards on September 1, 2021.

This is an excerpt from the Credit and Finance department of the January/February 2022 issue of Produce Blueprints Magazine. Click here to read the whole issue.