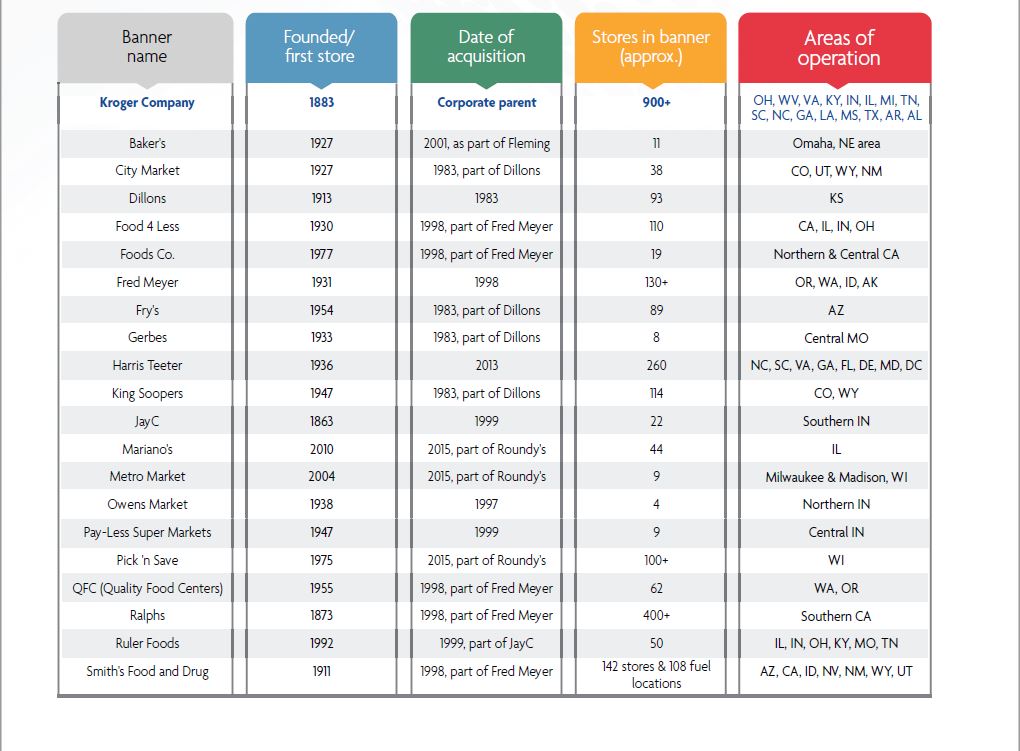

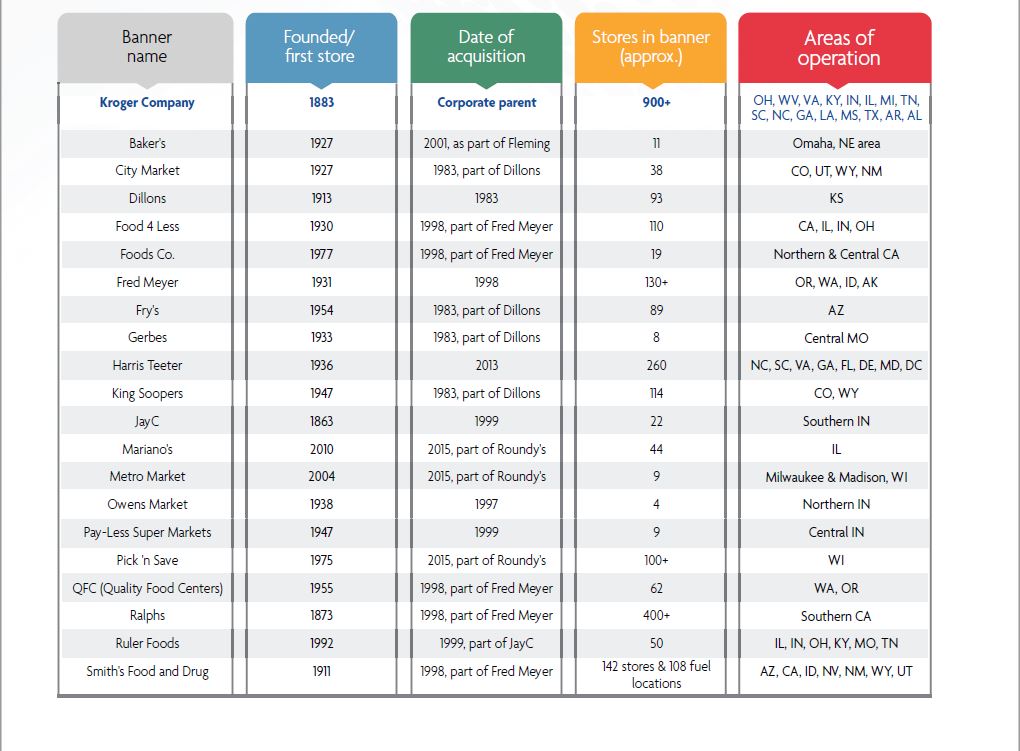

Kroger Co., BB #:100073 Cincinnati, OH, has 2,760 stores across more than 20 nameplates, many of which have come to the company through acquisition.

It has met with criticism in some quarters for the “Krogerization” of the chains it has acquired, notably the upscale Chicagoland retailer Mariano’s.

But Mark Hayes, president of Twin Garden Sales BB #:119080 in Harvard, IL, which has been selling sweet corn to Kroger for more than 30 years, believes Kroger’s policy of keeping the original nameplates and their basic business models is a positive differentiator.

“The Walmarts and Costcos of the world open their own stores and live and die by their name on those stores. Their mission is to build more across the country under that name,” Hayes says.

What’s different with Kroger, he believes, is keeping individual banners and their identities alive.

“They’re all over the country,” Hayes notes, but Kroger isn’t “messing with the recipe—it’s a smart strategy. The brand on the store remains the one consumers trust, whether it’s King Soopers, Fred Meyer, or Pick ’n Save.”

“When a company buys another company, it’s a very tricky process,” says Bruce Peterson, president and founder of Peterson Insights Inc., in Bentonville, AR. “On the one hand, you want to leverage economies of scale. On the other hand, many of the regional supermarket chains had a significant imprint on the hearts of the people who shopped there for generations.”

Peterson agrees that Kroger has done a better job in this regard than some of its competitors, such as Safeway.

“Kroger has been well positioned in the marketplace for some time; its own locations, as well as those from the acquired companies, have put the company in a position to be ‘relevant’ to customers in the markets served.”

Peterson adds that Kroger’s fresh produce departments have always been solid when compared to the competition. “They’re not best in class, but then again, they haven’t had to be,” he says. “They offer solid value to consumers.”

This is a multi-part feature adapted from the cover story of the March/April 2020 issue of Produce Blueprints.