Numerator Projections Indicate a Likely Modest Increase in the Rate of Inflation for Food at Home and Alcoholic Beverages at Home in the Upcoming Consumer Price Index Report

CHICAGO, March 13, 2023 (GLOBE NEWSWIRE) — Numerator projects the Consumer Price Index for food at home and for alcoholic beverages at home both increased 0.5% month-over-month in February.

Numerator, a data and technology company providing insights into consumer behavior, has released its monthly Numerator Inflation Report, an advance projection of the US Bureau of Labor Statistics’ monthly Consumer Price Index (CPI).

The report measures inflation for food at home overall and its subcomponents including cereals and bakery products; meats, poultry, fish, and eggs; dairy and related products; fruits and vegetables; nonalcoholic beverages and beverage materials; and other food at home. This month, Numerator has also added alcoholic beverages at home to its CPI projections.

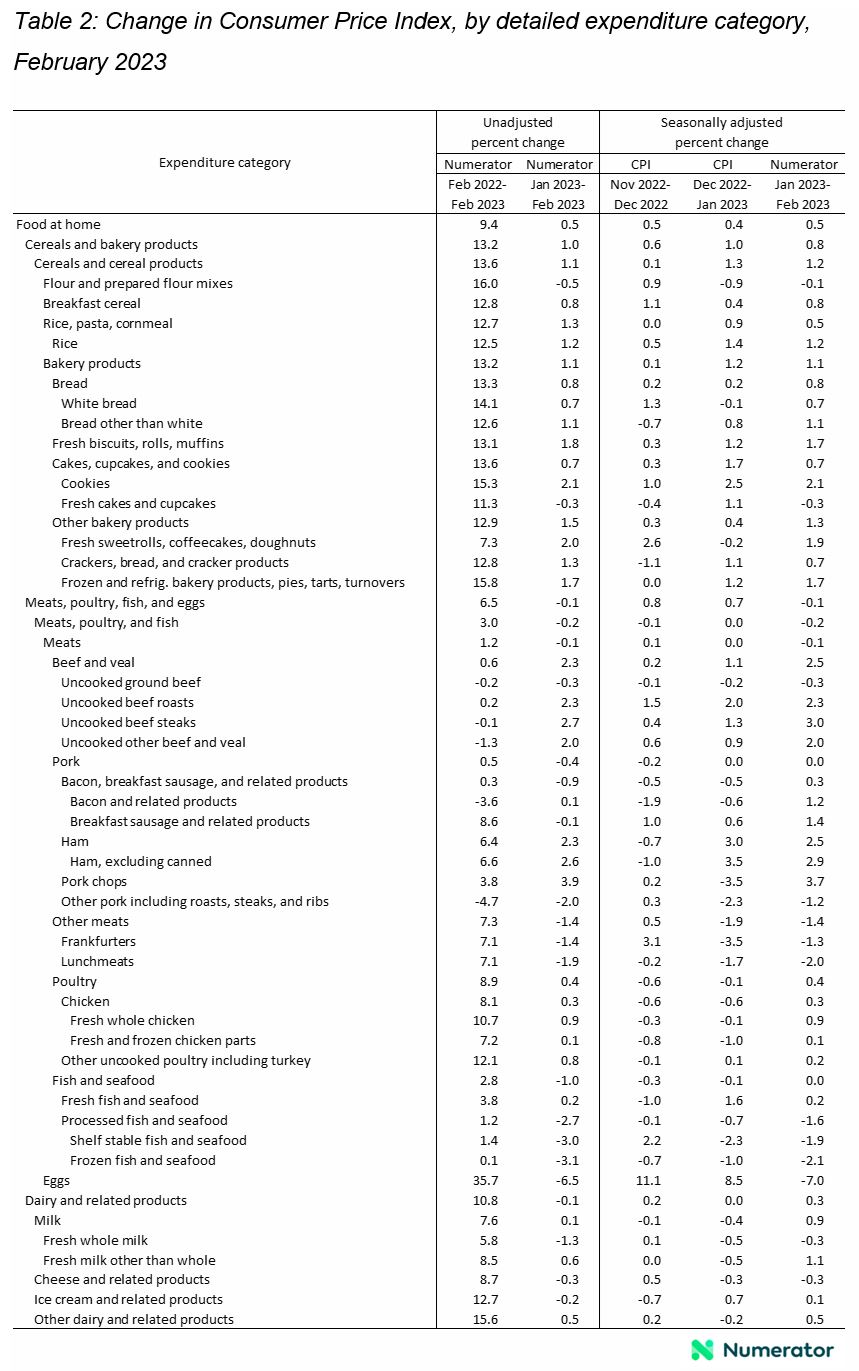

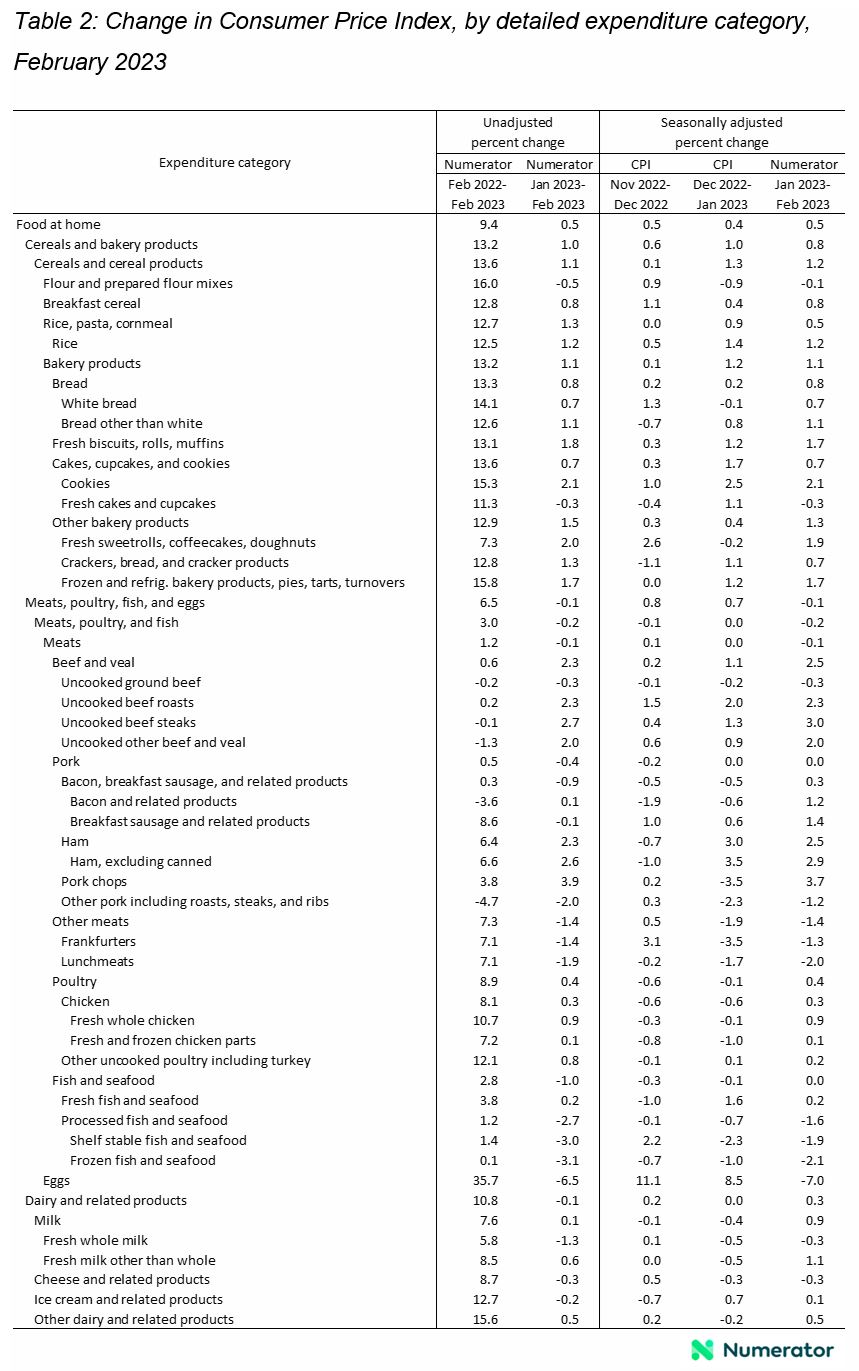

As shown in Table 1, according to Numerator, seasonally adjusted prices for all food at home purchases increased 0.5% month-over-month in February, a modest acceleration from the 0.4% increase in January. In February, seasonally adjusted prices for cereals and bakery products increased 0.8%, prices for meats, poultry, fish, and eggs decreased 0.1%, prices for dairy and related products increased 0.3%, prices for fruits and vegetables decreased 0.8%, prices for nonalcoholic beverage and beverage materials increased 1.0%, and prices for other food at home increased 1.0%. Prices for alcoholic beverages at home increased 0.5% in February on a seasonality adjusted basis, a modest acceleration from the 0.4% increase in January.

On a year-over-year basis, between February 2022 and February 2023, prices for food at home increased 9.4% overall, prices for cereals and bakery products increased 13.2%, prices for meats, poultry, fish, and eggs increased 6.5%, prices for dairy and related products increased 10.8%, prices for fruits and vegetables increased 4.2%, prices for nonalcoholic beverages and beverage materials increased 11.0%, and prices for other food at home increased 11.3%. Between February 2022 and February 2023, prices for alcoholic beverages at home increased 4.5%. (For additional details, please see Table 2 at the end of this report).

The Numerator Inflation Report is produced and published monthly under the leadership of Numerator Chief Economist, Dr. Leo Feler. The report uses Numerator’s first-party and real-time consumer data, aligned with the methodology the US Bureau of Labor Statistics uses to calculate the CPI to produce a projection of the CPI ahead of the CPI’s official monthly release.

METHODOLOGY AND COMPARISON TO CPI

Numerator collects price and quantity data directly from over 1 million US households each month and selects qualifying households to construct a representative panel of 150,000 US consumers. These consumers upload images of paper receipts and link their loyalty and email accounts, providing access to their detailed purchase information on a continuous basis. From this purchase information, Numerator knows the prices consumers pay for over 4 million items purchased throughout the US each month.

In contrast, the US Bureau of Labor Statistics obtains price information for the CPI based on a static survey of 24,000 households regarding their consumption patterns during a prior year and then has government surveyors visit retail establishments to scan items or scrape retailers’ websites to obtain prices on approximately 80,000 items that these 24,000 households tended to buy when they were surveyed.

Numerator data captures the prices a representative panel of 150,000 US consumers pay for items they actually buy in real-time during a given month, whereas the CPI captures prices for a basket of goods selected based on the likelihood that a sample of 24,000 households bought those items in a prior year. The inflation consumers actually experience – which is what Numerator captures – is different than the inflation the CPI reports.

For example, if consumers encounter an item that is out-of-stock and have to substitute to higher-priced items, their “experienced inflation” might be greater than the inflation the CPI reports. Alternatively, if a consumer adapts their shopping behavior by buying in bulk or substituting to lower-priced items, their “experienced inflation” might be lower than the inflation the CPI reports.

For now, Numerator attempts to replicate the methodology the US Bureau of Labor Statistics uses to construct the CPI; however, Numerator also has a more detailed view on how consumers adapt to inflation. Since the US Bureau of Labor Statistics does not observe consumer purchases in real-time, its measure of consumer price inflation cannot account for changes in consumer behavior.

In contrast, Numerator can evaluate how different segments of the population experience inflation, depending, for example, on the density of retailers and competition among retailers in the areas where they live, whether consumers have memberships to certain retailers (e.g., club memberships), and whether consumers have access to broadband and transportation to be able to shop among a broader set of retailers.

Because of the differences in how Numerator and the US Bureau of Labor Statistics collect price data, the Numerator Inflation Report may differ from the US Bureau of Labor Statistics’ monthly CPI release. These differences are attributable to methodology. To have Numerator’s monthly inflation report approximate the CPI, Numerator must control for changes in consumer behavior in an attempt to keep purchasing behavior constant.

Additionally, Numerator collects price data over the course of an entire month, whereas the US Bureau of Labor Statistics collects price data for each product in its sample only at specific points in time during the month. These two methodological differences – the fact that Numerator also captures changes in consumer behavior in response to price changes and the fact that Numerator captures price data over the course of an entire month on a continuous basis – account for the differences in reported inflation between the Numerator Inflation Report and the US Bureau of Labor Statistics’ monthly CPI release.

ABOUT NUMERATOR

Numerator is a data and technology company bringing speed and scale to consumer research. Numerator blends first-party data from over 1 million US households with advanced technology to provide insights into consumer behavior. Headquartered in Chicago, Illinois, Numerator has over 2,000 employees worldwide, and 80 of the top 100 CPG brands are Numerator clients.

DISCLAIMER

The Numerator Inflation Report has been prepared for informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information contained in or provided from or through this report is not intended to provide, and should not be relied upon for, financial advice, investment advice, trading advice, or any other advice. Numerator shall have no liability to any person or entity for any loss or damage resulting from the use of or reliance on the above-mentioned information.