TORONTO–(BUSINESS WIRE) — One of the most important reasons shoppers choose not to use a grocery delivery service is that they want to pay no more than necessary, which was tied with wanting to select their own produce according to new shopper behavior research from Mercatus, fielded June 30 through July 1, 2022.

Specifically, customers’ desire to pay no more than necessary was directed squarely at delivery’s additional service-related costs, not the prices paid for the products online. The research also found that when given the choice, customers are much more likely to select a time slot later the same day, or even the next day, if that meant they could pay a lower delivery fee.

“If you are a grocery delivery customer – especially one using a third-party marketplace – it’s understandable that you may want to find ways to pay less given inflation’s impact on purchasing power,” Mark Fairhurst, VP Marketing at Mercatus mentioned. “These incremental costs, including delivery fees, shopper service charges, fuel surcharges, and even a very modest tip, are some of the last things customers view during the checkout stage, and they can add $20 or more to the bill.”

The new shopper behavior research from Mercatus documented that one in five U.S. households used an online grocery delivery service during the prior month. Among those households that chose not to use a grocery delivery service, the top two reasons tied at 62% respectively between “I like to select my own fruits and vegetables” and “I do not want to pay for the extra charges, fees, and tips.”

The oldest customer group (>60) was significantly more concerned with picking their own produce versus younger shoppers (75% vs. 53%), while the desire to avoid paying the service-related costs was the same across all age cohorts.

Only one in seven households (14%) cited “the products are more expensive online than in the store” as a reason for not using a delivery service.

“These findings reinforce the idea that customers are more sensitive to the added service costs that they can plainly see,” said David Bishop, partner at Brick Meets Click. “This makes sense, because accurately perceiving differences in product pricing online versus in-store, even with known value items, requires more effort on the customer’s part.”

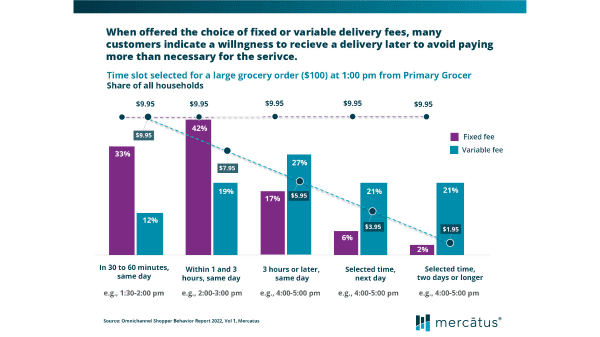

Today most customers only need to choose when they’d like to receive their order as the delivery fee at that point is usually fixed but the research found there is an opportunity for grocers to challenge that practice and consider a variable fee approach based on when a customer would like to receive the order.

When presented with a fixed fee of $9.95 for a large order (>$100), over 30% of customers selected to receive their order within 30 to 60 minutes, and more than 40% of customers selected to receive it within 1 to 3 hours; fewer than 10% opted for the next day or later.

When offered a variable fee that scaled down as the time to delivery was extended, the share of shoppers that selected delivery within the 30-to-60 minute and 1-to-3-hour windows declined by more than half, and over 40% of customers selected to receive the order next day or longer.

“Grocery customers don’t want to pay more than they must, and the explicit fees that come with online delivery are a big speed bump,” said Sylvain Perrier, president and CEO, Mercatus. “Other aspects of this research reinforce that grocery customers shop regional grocers for different reasons than big-box mass retailers like Target or Walmart. Being more convenient is the main reason customers prefer Grocery over a Mass retailer, followed by the quality of the products they want to buy.”

This omnichannel shopper behavior research is the first of a three-volume series. Volume 1 explored other areas of importance for regional grocers, including where households primarily shopped, how the customer demographics varied by retailer type, reasons for selecting a primary grocery store, and more.

The next volume of shopper behavior research from Mercatus will focus on what’s driving shopper behavior towards pickup. For information and to download the full volume 1 report, visit Mercatus.

About this consumer research

The custom shopper research from Mercatus was conducted by Brick Meets Click via an online survey on June 30 through July 1, 2022, with 1,847 U.S. adults, 18 years and older, who participated in the household’s grocery shopping. The sample was weighted to match current population measures related to age and Census region based on the 2020 American Community Survey from the U.S. Census Bureau. The margin of error for the top-line results was +/- 2.6% at the 95% confidence level.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in customer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

Media Inquiries

Mark Fairhurst, VP Marketing

Mercatus

media@mercatus.com