Hurricane Idalia dropped significant rain in Georgia and throughout the Southeast. Although Idaia made landfall in Florida as a Category 3 storm, by the time the system reached Georgia, maximum wind gusts fell to 73 mph. The storm flooded Valdosta and left 8-12 inches of rain along the Southeastern corridor.

Georgia’s red clay is famous, but not for percolating quickly.

Hurricanes force farmers to delay planting while watching the approaching storm and then more while waiting for their fields to dry out. Ignoring the still undetermined direct impacts, because of planting delays, production gaps will likely be felt later this fall.

Here’s what we know now:

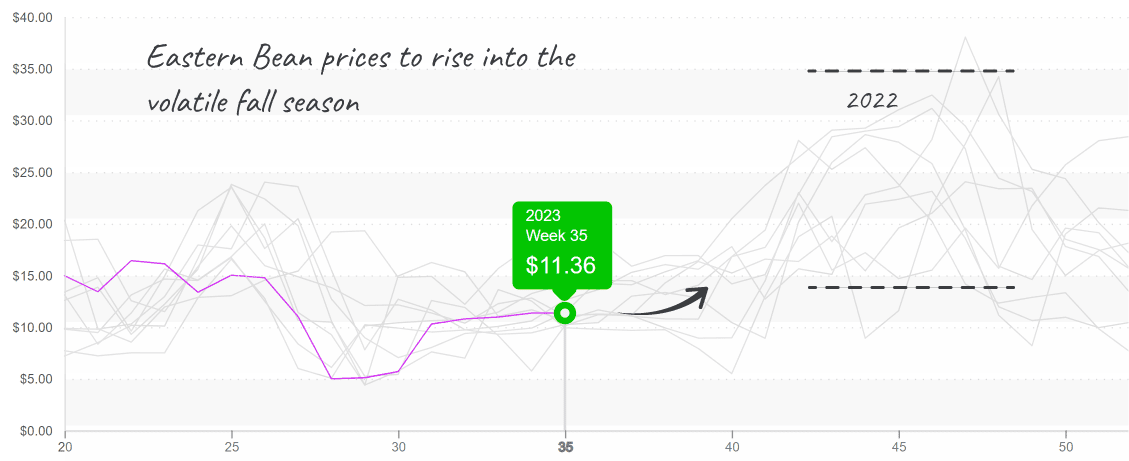

- Early bean plantings are impacted, likely to cause a few-week gap in production.

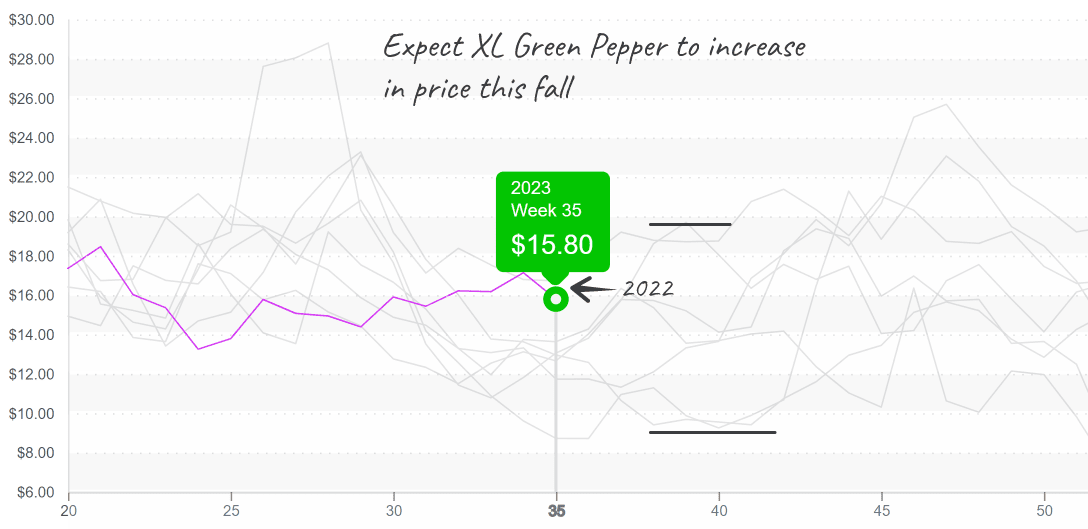

- Some young pepper plants have been damaged, and some plastic on row beds are lost. Expect planting delays and elevated pepper pricing this fall.

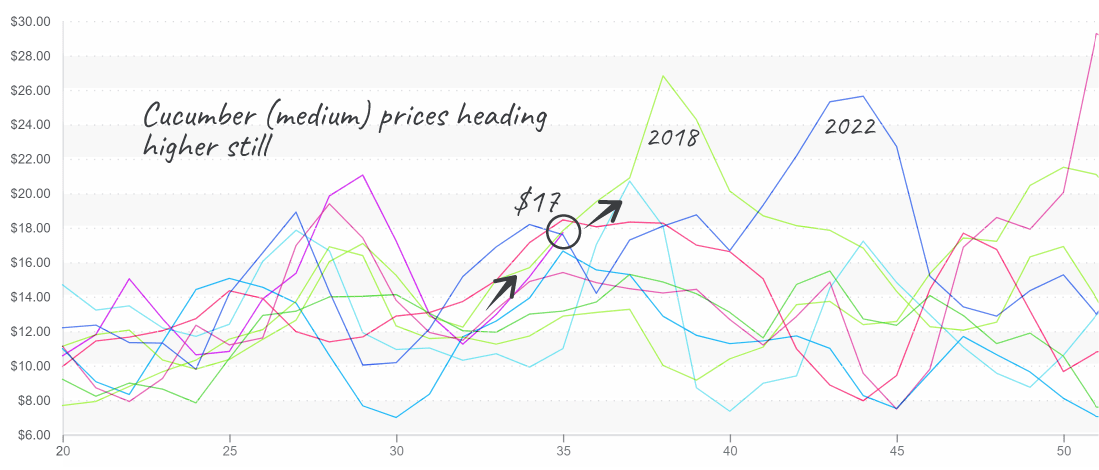

- Wind-sensitive cucumbers may trend higher over the next few weeks, particularly since Hurricane Hilary recently rocked Baja California, Mexico.

- Squash markets are still low and harvesting in multiple regions, but this will slow down soon as Northern growing areas cool off.

- Sweet Corn around Lake Park suffered some wind damage.

- Eggplant that was ready to harvest also has some damage.

On a positive note, some growers not in the direct storm path report little to no losses.

But don’t let go of your hats just yet. Now is when storm activity really picks up in the Atlantic.

ProduceIQ Index: $1.15/pound, down -6.5 percent over prior week

Week #35, ending September 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Here is last week’s story by the charts:

Green Pepper (XL) prices are at a higher range and are expected to increase further.

Cucumber (medium) prices up for three weeks and are expected to continue higher.

Keep an eye on green beans as supply disruptions occur before a volatile time of year.

Please visit Stores to learn more about our qualified group of suppliers and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.