A calamitous week in fresh produce as the industry faces new supply chain challenges. Border restrictions in Texas, a fire at a major lettuce packing facility in Salinas, and a late snowstorm in the Northwest are all putting the industry on edge.

Border crossing delays caused by Texas Governor Greg Abbott’s decision to add supplementary inspections to all commercial crossings from Mexico this week are the principal extraordinary factor affecting buyer anxiety and produce prices. Avocados, limes, green beans, brussels sprouts, onions, and berries are all experiencing increased market pressure due to the delays.

Lance Jungmeyer, president of the Fresh Produce Association of the Americas, estimated for CNN that $240 million of perishable produce and costs were tragically wasted during the ‘logjam’ as trucks sat in line for days to cross into Texas. Frustrations rose, and Mexican truck drivers retaliated with a further blockade, bringing key border crossings to a complete standstill. Abbott capitulated Friday, April 15th, and the inspection process is normalizing.

Retail and food service are scrambling to readjust produce displays and alter menus to accommodate for the increasing prices of already overblown markets like avocados and limes. But, of course, it is easier for a grocer to expand the apple section for a few weeks than it is for a chef to adjust the fixed menus at your favorite dive.

(Week #15, ending April 15th)

ProduceIQ Index: $1.23 /pound, -1.6 percent over prior week

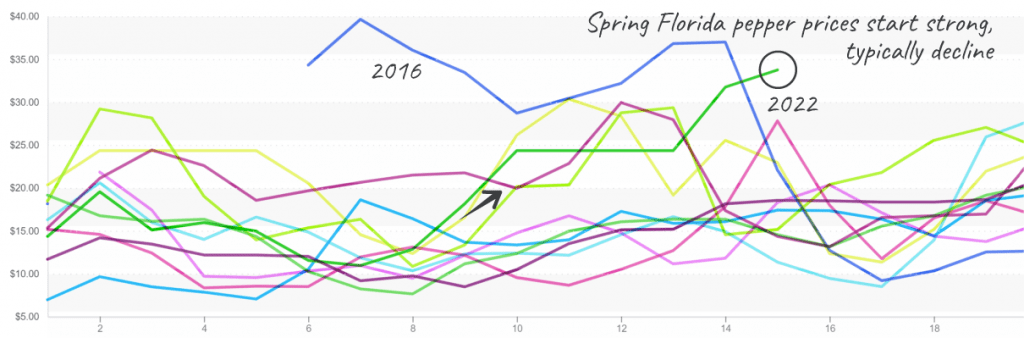

Week #15 green bell pepper prices are at a ten-year high. Mexican green bell production through Nogales is ending, and Coachella California is ramping up. Florida’s spring pepper fields are just starting after a gap from mid-winter production. Expect markets to remain elevated for at least another week.

Florida’s spring Pepper begins with high prices, which typically fall as harvesting ramps up.

Notorious for their short shelf life, mixed berries are innocent bystanders caught in the cross-hairs of Governor Abbott’s political grandstanding. Blackberries, blueberries, and raspberries are all reporting decreased import volumes from Mexico and require an efficient border process to resume full speed. Strawberries markets are benefiting from significant domestic supply out of California to bolster reserves.

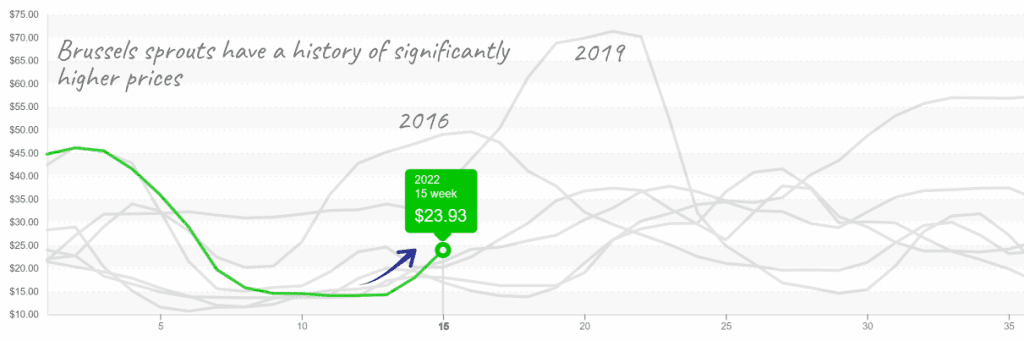

Brussels sprouts markets are stretching thin. Warm weather in Mexico and logistical challenges at the Mexican border are taxing an already weak supply. FOB prices are up to $24 from $18 last week. This time of year, buyers are nearly entirely reliant on Mexican growers to meet demand. Watch markets carefully as prices could quickly accelerate.

Brussels sprouts get off the floor and have upside potential.

Any week is the wrong week to back up traffic at the Mexican border, but choosing holy week is certainly not doing avocado markets any favors. Prices are up +6 percent over the previous week and exceed $70 per case, unprecedented territory for this time of year. If prices decline soon, Jesus’ resurrection won’t be the only miracle worth celebrating this April.

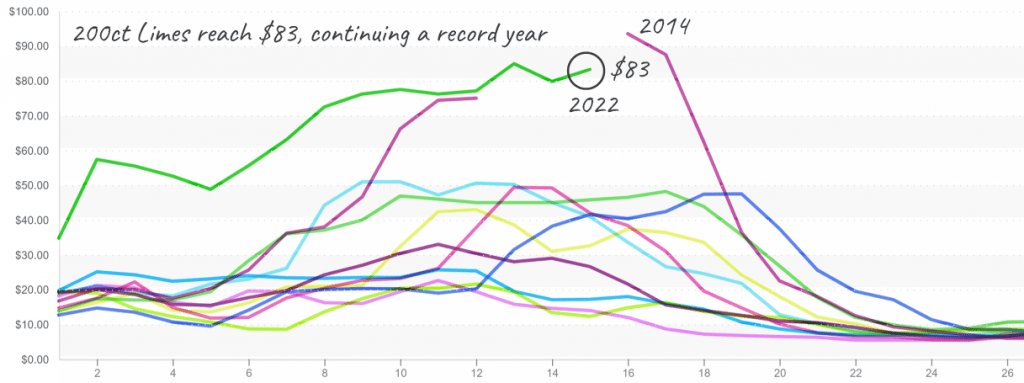

Similar to avocados, Mexican lime import volumes are down due to delays at the border. Larger fruit is especially tight, forcing prices up another +5 percent this week. As delivered to the restaurant, Lime prices are reaching the psychological $100/case barrier. That exorbitant price may cause reduced demand from prudent chefs. Key lime supply is a bit more plentiful and is providing some opportunity to substitute.

Limes almost reach price levels from the 2014 anomaly.

If major logistics delays weren’t enough news, there was a massive fire at a Taylor Farms food processing facility in Salinas this week. The facility was preparing for its annual transition from Yuma to open Salinas. Though it is uncertain how Taylor Farms will replace the facility’s processing capacity, expect increased use of trucks and the need for logistical flexibility.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.