(Week #42, ending October 22nd)

ProduceIQ Index: $1.02/pound, flat over prior week

Between yet another Mexican hurricane, “Rick,” and Zuckerberg’s Metaverse, things just can’t seem to get any stranger. Here to make some sense out of the chaos, your weekly market highlights:

Hurricane Rick landed as a Category 1 in Southern Mexico (West of Acapulco) on Sunday, October 23rd. The storm is moving northward with rainfall, including to the avocado growing region of Michoacan.

Facebook is employing thousands of software developers to create their version of the matrix. Their bet in virtual reality is to help you live your best life, albeit in a parallel universe. Of course, Metaverse will allow you to share your personal information and shop with gleeful abandon. In this world, all veggies are perfect.

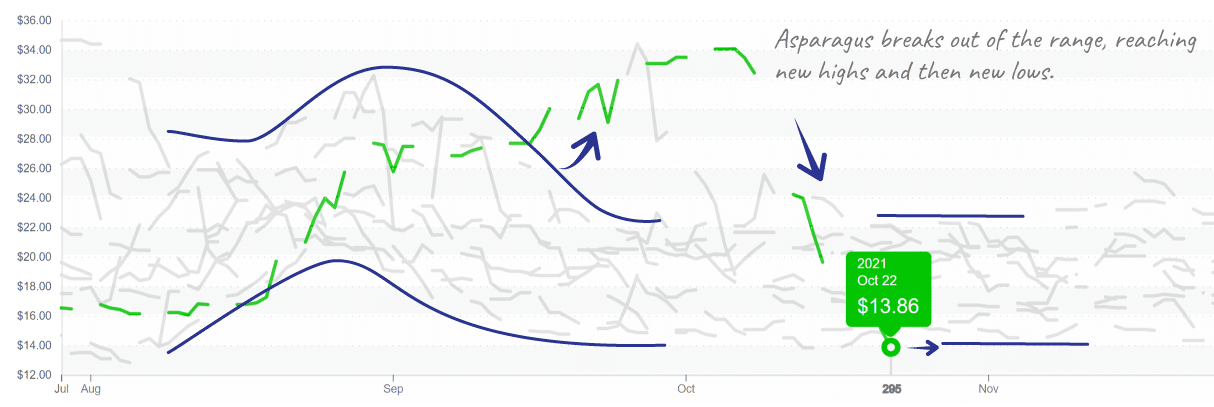

If you find yourself with too many asparagus, don’t fret, the internet is swath with creative recipes that are sure to put your grass to use. Asparagus muffins anyone? Prices are down -32 percent over the previous week and are expected to stay low as Mexican production increases throughout the beginning of November.

Asparagus prices fall from $34 to $14 in 2 weeks.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

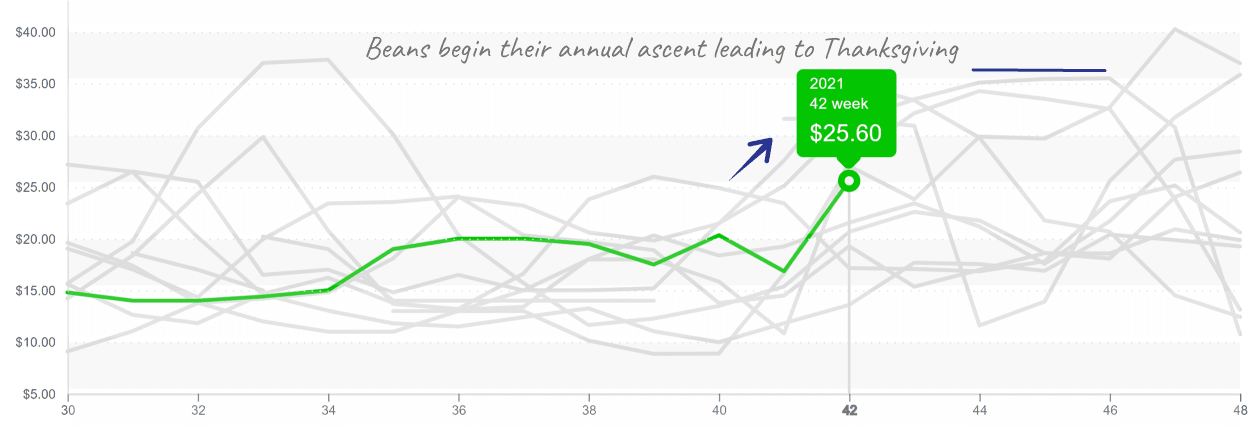

Despite New York’s supply finishing a few weeks early this year and a +50 percent price increase, green bean prices remain mid-range of historical precedent. Eastern and Western markets will stay in flux until Florida and Mexico pick up production throughout the next few weeks. Expect prices to follow typical escalation patterns as fall supplies transition and holiday demand accelerates.

Beans jump past $25 and have further upside potential.

Tomatoverse took a saddening turn of events this week as new allegations of abusive labor conditions prompted the United States Customs and Border Protection to issue a halt against importing tomatoes from Mexican grower, Agropecuarios Tom SA de CV and Horticola SA de CV. Expect customer requirements for evidence of social responsibility to increase in the future.

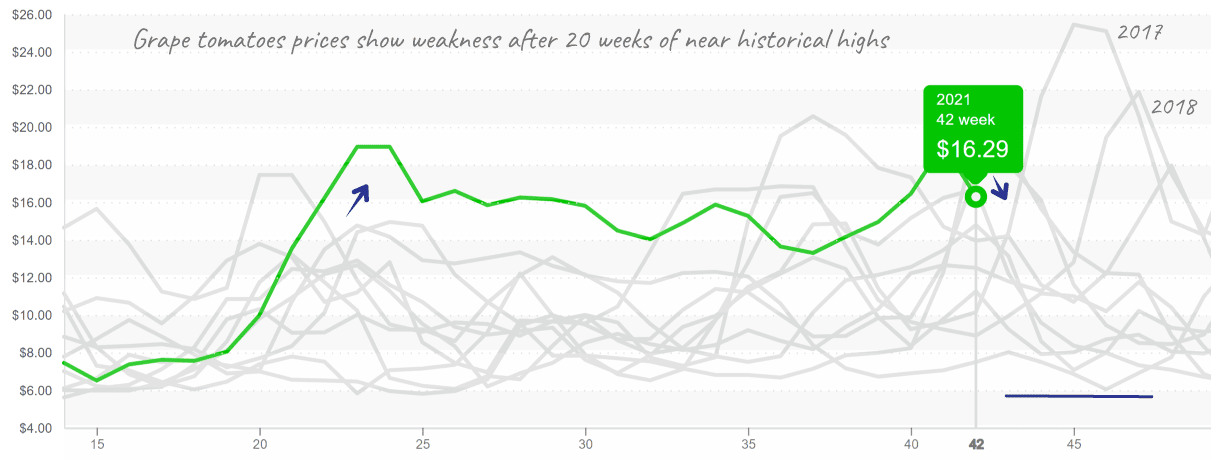

Excluding a slight decrease in the price of grape-type tomatoes, overall tomato prices are tight. Mexican and Californian growers are struggling to fill the widening supply gap. On the bright side, as November nears, so does Florida tomato production near the Tampa region, District 4. Overall shipments from Florida have been significantly declining, from 28 million to 22 million 25-pound case equivalents over the past five years.

Grape tomatoes remain near $16, entering period of historical volatility.

Broccoli prices may be down over the previous week, but we’re skeptical whether the brief reprieve from shocking increases is indicative of downward momentum. Between the heat and wet weather, expect markets to remain unsettled until mid-November.

Blackberry markets took a hit after hurricane Pamela damaged Mexican supply. Prices are up +14 percent over the previous week. Blackberry prices will remain elevated for a few weeks as Mexican growers regain their footing.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.