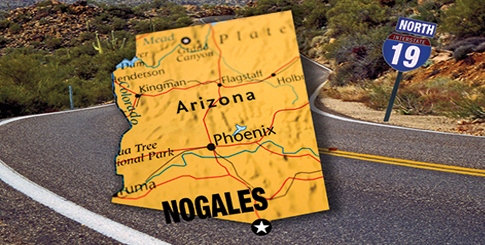

The Nogales ports of entry were once a one-way street down which vast amounts of produce would travel in relative freedom to the waiting plates of hungry Americans. Now they stand at a crossroads.

Faced with an uncertain regulatory environment, major competition from Texas, changing consumer tastes, and salvos from nature itself, Nogales must make major changes in the way it does business to remain the industry powerhouse in the twenty-first century that it was in the twentieth.

What’s New

Nogales has long been America’s ‘old reliable’ in terms of border trade. For decades, it has been the primary point of entry for the U.S.’s ever-growing hunger for fresh produce from Mexico, and could be counted on to make changes incrementally, with business as usual ruling the day and alterations to the system coming slowly but surely.

But in the last few years—and, particularly since the election of Donald Trump and his promises to strengthen border security and construct a wall to prevent illegal crossings—change is on the horizon.

Necessity is the mother of invention

Changes at the border are reflected not just in the raw numbers, as Nogales battles competition from Texas for fresh fruit and vegetable shipments going to the Midwest and East Coast, but from other influences as well.

Economic factors, geographic convenience, and increased demand from the East Coast all played a part in the shift, but so did the Lone Star State’s determination to provide an upgraded infrastructure for shipping.

“The concerned people and companies of this town have brainstormed ways to improve the infrastructure,” comments Roberto Franzone, director of Arizona Sky Produce, of his home in Nogales. “Obviously, necessity is the mother of invention in this case.”

Weather events

Climate factors are also impacting the way business is done in Nogales. The trade value of goods heading into Arizona—preeminently tomatoes, peppers, and other fruits and vegetables from Mexico—dipped to $19.7 billion in 2016, a loss of about $100 million from the previous two years.

This number may fall further for 2017, as Hurricane Katia (one of several furious storms in the fall) dumped between 10 and 15 inches of rainfall onto Mexico’s primary citrus-growing regions. “The key issue affecting us right now is the effect of weather on production and distribution,” confirms Robert Bennen Jr., vice president of Ta-De Distributing Company in Nogales.

Weather implications extended not only from Mexico but to California, Texas, and Florida. Though shipments from the latter two, Texas and Florida, are not a significant part of Nogales’ produce pipeline, their impact continues to be felt throughout the industry.