Growers, too, have been taking note with new organic farms popping up across Quebec. La Belle Province is now home to 1,268 organic farms—more than any other province in Canada, according to Statistics Canada’s 2016 Census of Agriculture.

In all of Canada, total annual retail sales from certified organic products is approximately CAD$3.5 billion, with about 46 percent sold at mainstream supermarkets. Fresh fruit and vegetables account for 39 percent of all domestic organic food and beverage sales in the True North.

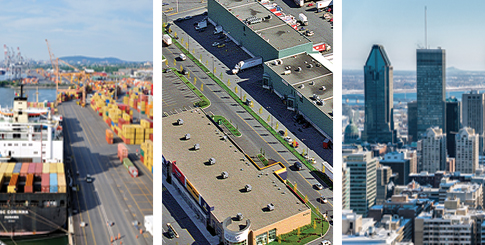

Supermarket Scene: Intense Competition

The competition between food retailers in Montreal, Quebec, and throughout Canada remains fierce. For the time being, it appears the large national chains are continuing to dominate independent stores. “It feels like the big chains are taking over for sure,” reflects Jacques. “It’s hard for the independent retailers to compete with the giant deals they have.”

This is not to say independents and specialty stores aren’t among Montreal’s more popular destinations. Locals seeking a broad range of fresh food choices frequent La Vieille Europe for various European delectables; Milano Fruiterie for Italian fare; Epicerie Latina, Inc. for Latin-themed favorites and prepared foods; Bio Terre and Rachelle-Béry for organics; and a slew of IGA stores for everyday essentials.

The province’s chains—Sobeys, Provigo/Loblaw, and Metro Inc.—may be major competitors in Quebec and across the country, but are struggling to hold their own against U.S. giants Walmart and Costco.

U.S. Invaders

Over the past five years, Walmart has opened more than 50 new “Supercentres” in Quebec, including six stores in Montreal, that offer plenty of produce and other groceries. Costco is also on the rise: there are now 10 wholesale club stores in the Montreal area and a total of 21 across Quebec, with plans to add more locations in the coming years. Across all of Canada, Costco operates 95 warehouses and Walmart runs 410 stores.

Data from Statistics Canada shows Costco and Walmart have gobbled up considerable market share from domestic retailers over the past decade. In the second quarter of 2004, traditional grocery stores sold about CAD$12.3 billion worth of food, accounting for nearly 90 percent of the market, while general merchandisers including Costco and Walmart sold about CAD$1.3 billion or roughly 9.8 percent. By the same quarter of 2016, market share for traditional grocers had plummeted to 79.2 percent, while that of the general merchandisers had more than doubled.

Canadian Favorites Fight Back

Facing pressure from Walmart, Sobeys fought back by slashing prices by 5 to 7 percent on nearly 8,500 items. Yet this risky move ultimately led to lower sales and earnings for the retailer. In the fourth quarter of 2016, Empire Company Ltd., parent company of Sobeys, saw a 47.3 decrease in adjusted net earnings as compared to fourth quarter the year prior.